Bitcoin tried significant price fluctuations in 24 hours, briefly surpassing the $ 100,000 mark before retreating. The sudden fall reflects continuous market uncertainty, with traders reacting to short -term volatility.

However, long -term stability can be consolidated mainly with the support of mature investors that maintain their positions.

Bitcoin adopts different approach

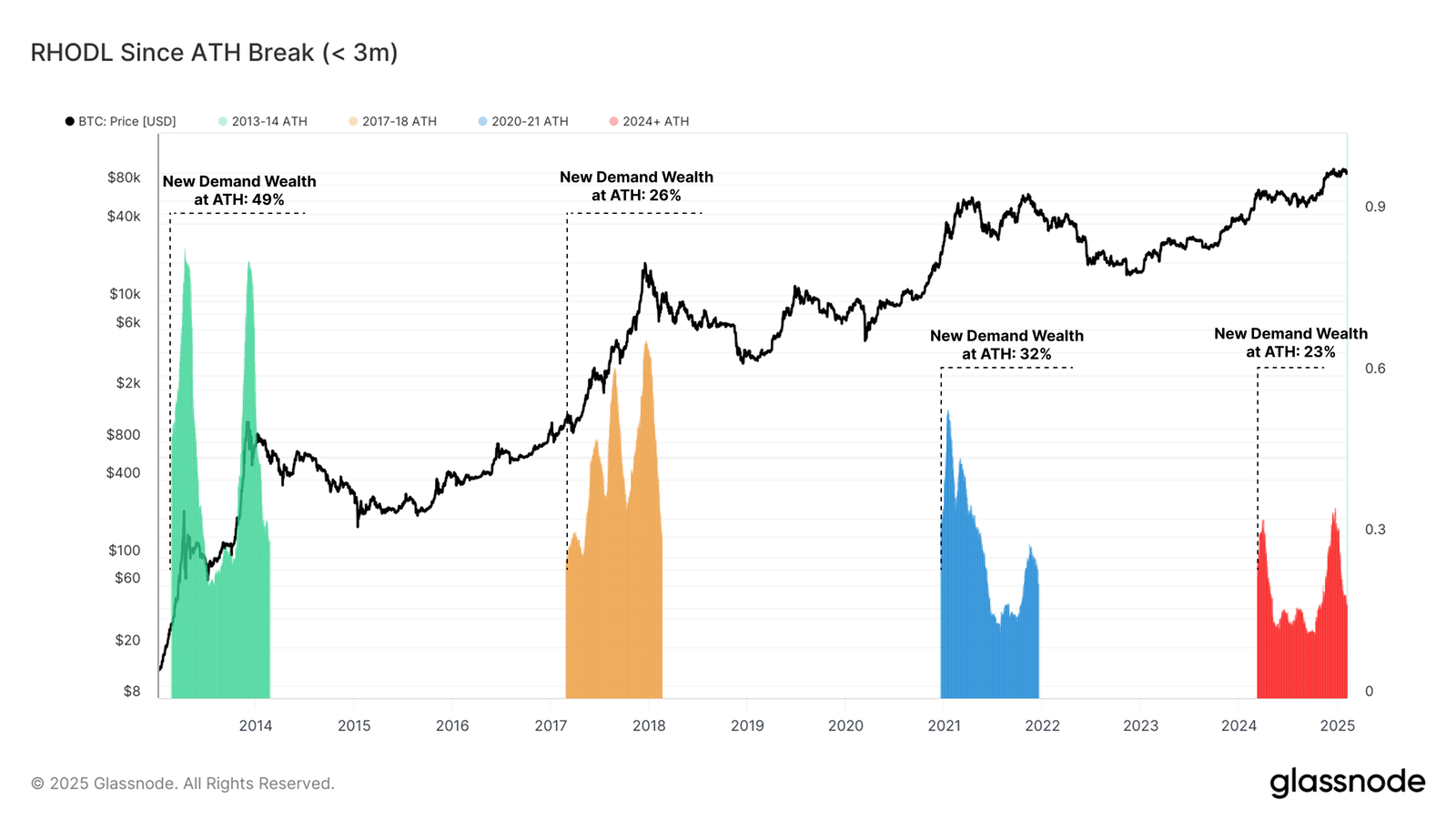

The Rhodl (Realized Hodl) ratio since Bitcoin’s recent record (ATH) is 23%. Although the new demand remains significant in this cycle, wealth kept in coins over three months is much smaller than in previous cycles. This suggests that new demand inputs have occurred sharply rather than a sustained standard.

Unlike previous cycles, which usually completed a year after the first break of ATH, the current cycle took an atypical trajectory. This is because Bitcoin reached a new ATH in March 2024, but the demand does not yet correspond to the levels observed at previous highs. This difference raises questions about how the rest of the cycle will unfold.

Volatility performed in a three -month mobile window remains below 50% in this cycle. In contrast, high -past races became levels of volatility exceeding 80% to 100%. This reduction in oscillation suggests that Bitcoin’s price action is more structured, with mature investors contributing to a more stable market environment.

The 2023-25 cycle followed a staircase pattern, with price rallies followed by periods of consolidation. Unlike previous cycles characterized by extreme oscillations, the current trajectory of Bitcoin displays signs of gradual price increases. This trend supports a more controlled high market, reducing the risk of extreme falls.

BTC needs to stay above support

Although Bitcoin’s long -term perspective remains uncertain due to increased short -term volatility, immediate forecast suggests vulnerability to correction. Cryptocurrency is being negotiated near key support levels, and new falls can lead to deeper retreat.

If Bitcoin loses the support level of $ 95,869, it may fall towards $ 93,625. While BTC holders have been abstained from making significant profits, new losses can trigger a wave of sales. This scenario would put additional pressure on the price, extending Bitcoin correction.

On the other hand, a $ 95,869 jump could allow Bitcoin to recover the level of $ 100,000. Successfully break this psychological barrier would invalidate the perspective of low, potentially preparing the terrain for a new high trend.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.