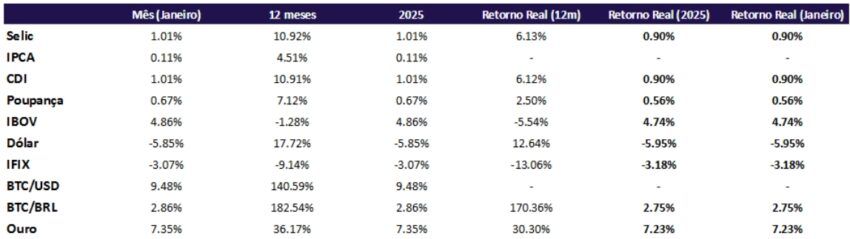

The beginning of 2025 brought significant movements to the financial market. Gold, Ibovespa and Bitcoin were the positive highlights, while the dollar and iFix recorded the largest falls.

The survey of the Studio Group’s real gain index (IGRGS) pointed out that, adjusted by inflation, fixed income assets had more modest returns.

Gold leads real gain from January 2025, followed by Ibov and Bitcoin

Among the assets that were valued in January 2025, gold led the ranking, with a real gain of 7.23%. Ibovespa occupied the second position, rising 4.74%, followed by Bitcoin, which advanced 2.75%. On the opposite side, the dollar had a negative performance of – 5.95%, while IFIX, a real estate funds rate, retreated – 3.18%.

Gold: refuge in times of uncertainty

The appreciation of gold is directly linked to the increase of global uncertainties. Geopolitical tension and interest rates in the main markets of the main markets led investors to seek protection in assets considered safe.

According to Carlos Braga Monteiro, CEO of the Studio Group, Gold maintains its historical relevance as rESERVA VALUE.

In times of economic instability, it is natural for the market to seek safety in assets with less correlation with traditional volatility. Gold remains a safe haven, explains Monteiro.

Bitcoin surprises and maintains appreciation

Bitcoin, despite high volatility, managed to maintain a positive return of 2.75% in the period. The growing institutional adoption and a favorable macroeconomic environment helped boost cryptocurrency. Many investors have come to see him as an alternative for portfolio diversification, seeking discoring assets from traditional markets.

Monteiro points out that although Bitcoin still faces regulatory and large -scale adoption challenges, appreciation reinforces its role as a digital reserve asset.

In 2024, Bitcoin became the most profitable asset, according to IGRGS.

Conservative investments continue to attract investors

While higher risk assets had varied performances, more conservative investments kept stable income. Selic and CDI closed the month with real gains of 0.90%, ensuring return above inflation. Savings, on the other hand, delivered only 0.56%, but continued to be an option for more cautious profiles.

Monteiro points out that, even in a volatility scenario, traditional investments continue to play an important role.

Selic and CDI continue to be references for those seeking security. With variations in the basic interest rate, these assets remain stable for the investor who prioritizes predictability, points out Monteiro.

Dollar and iFix suffer losses

The dollar, which is traditionally a hedge option for moments of uncertainty, performed weakly in January, with a fall of – 5.95%. The devaluation may be linked to changes in US monetary policy, as well as the most favorable global economic scenario for emerging.

IFIX, an index that brings together the main real estate funds, fell – 3.18%, impacted by the sector’s volatility and the caution of investors in relation to the real estate market.

Lessons for 2025: Diversification is essential

The January scenario reinforces the importance of wallet diversification and economic environment analysis. With traditional assets facing difficulties, gold and bitcoin emerge mainly as alternatives for protection and appreciation.

Monteiro concludes that strategic financial planning needs to balance security and opportunity. “The results show that a well -structured strategy, combining actives from different classes, can protect against losses and enjoy the best performances on the market,” he concludes.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.