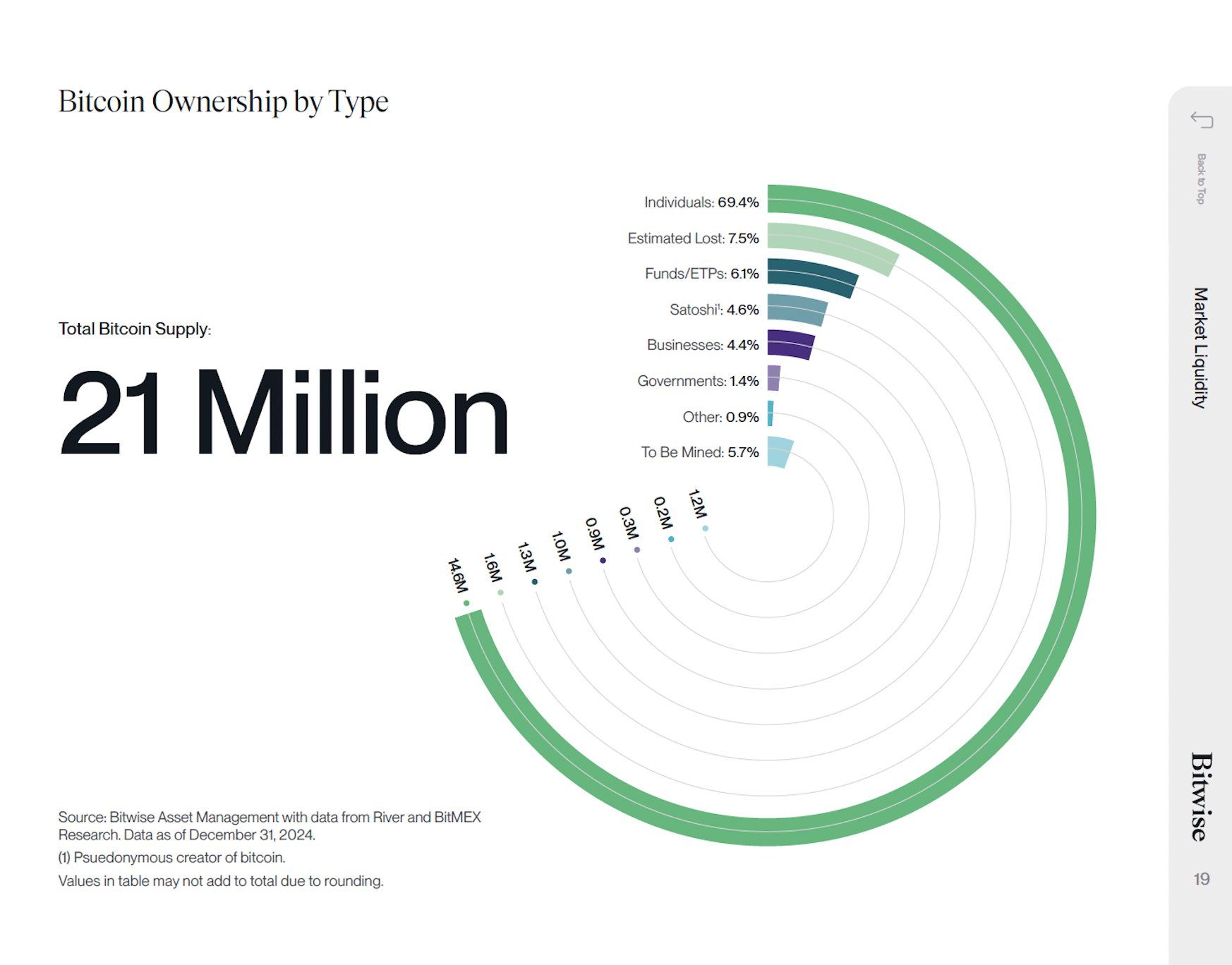

According to Bitwise Asset Management, individual holders control most of the total bitcoin supply (BTC). According to a survey by the company, 69.4% of the 21 million BTC in circulation belong to private investors.

Therefore, large institutions and governments seeking to acquire Bitcoin may face challenges.

In a recent post in X, Bitwise has outlined the distribution of the total supply of bitcoin. In addition to individual holders, approximately 7.5% of the asset is considered lost. Funds and products traded on the Stock Exchange (ETFS) control 6.1%.

The portfolio associated with Satoshi Nakamoto, Bitcoin’s pseudonym creator, has 4.6%. In addition, governments and companies collectively have only 5.8% of Bitcoin.

In addition, the asset manager pointed out that if companies and governments wish to acquire bitcoin, they will need to buy it mainly from individuals willing to sell.

… This market dynamics between buyers and salespeople can become very interesting, the post said.

Hunter Horsley, CEO of Bitwise, also pointed out that despite consistent purchases of companies and ETFs, the price of Bitcoin still faces falling pressure. He also emphasized that most of the value of bitcoin remains in the hands of individual holders.

… Each new buyer must find a seller. Obvious, but important as always, added Horsley.

Is a bitcoin supply shock coming?

Meanwhile, only 5.7% of Bitcoin remains to be mined. In addition, OTC (over-the-the-country) markets are little bitcoin. A cryptian analyst pointed out that only 140,000 BTC remain in the OTC market.

… There is almost no bitcoin left, even to institutions, he stated.

The analyst explained that ETFs collectively bought 50,000 BTC last month. However, price movements remained contained. This suggested that institutions get Bitcoin from OTC markets instead of exchanges to avoid firing price increases.

However, this strategy may no longer be viable with the exhaustion of the OTC supply.

… Each billion dollars invested in BTC increases its price by 3-5%. That’s why OTC’s exhaustion is so insane, the analyst commented.

He added that if Microstrategy (now Strategy) continues their aggressive acquisitions or ETFs maintain their January accumulation level, Bitcoin OTC may run out. A similar scenario would occur if the US and states started buying Bitcoin as part of their reserves.

Strategy has maintained a consistent Bitcoin acquisition plan. On February 10, the company bought 7,633 BTC for approximately $ 742.4 million. This marked its fifth purchase of bitcoin only in 2025. According to the Saylor Trackerthe company now holds 478,740 BTC, valued at US $ 47.12 billion.

Institutions like Blackrock are also pressuring the offer. The asset manager allegedly acquired $ 1 billion in BTC in January.

However, as the offer is tightened, institutions can soon be forced to buy directly from Exchanges, which significantly increasing the price of Bitcoin.

This threat of shock of supply hangs as Bitcoin’s adoption accelerates. In one report Previous, Blackrock noted that cryptocurrency has reached 300 million users faster than the internet and mobile phones.

Brian Armstrong, CEO of Coinbase, also commented on the comparison of the adoption schedule.

… Bitcoin’s adoption should reach several billion people by 2030 at current rates, PREVENTED Armstrong.

He added that the comparison depends on how official starting points are defined for Bitcoin, the Internet and mobile phones. However, Armstrong acknowledged that the general trend is still accurate, despite these variables.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.