Since the beginning of February, Bitcoin has faced difficulties to stabilize above the $ 100,000 mark. Donald Trump’s tariff wars triggered a significant volatility in the market, keeping traders on alert.

However, despite these obstacles, a key group of coin holders – those without a history of sale – intensified their accumulation. This signals a strong conviction in the long -term perspectives of the asset.

D resilienceBitcoin long -term ethics

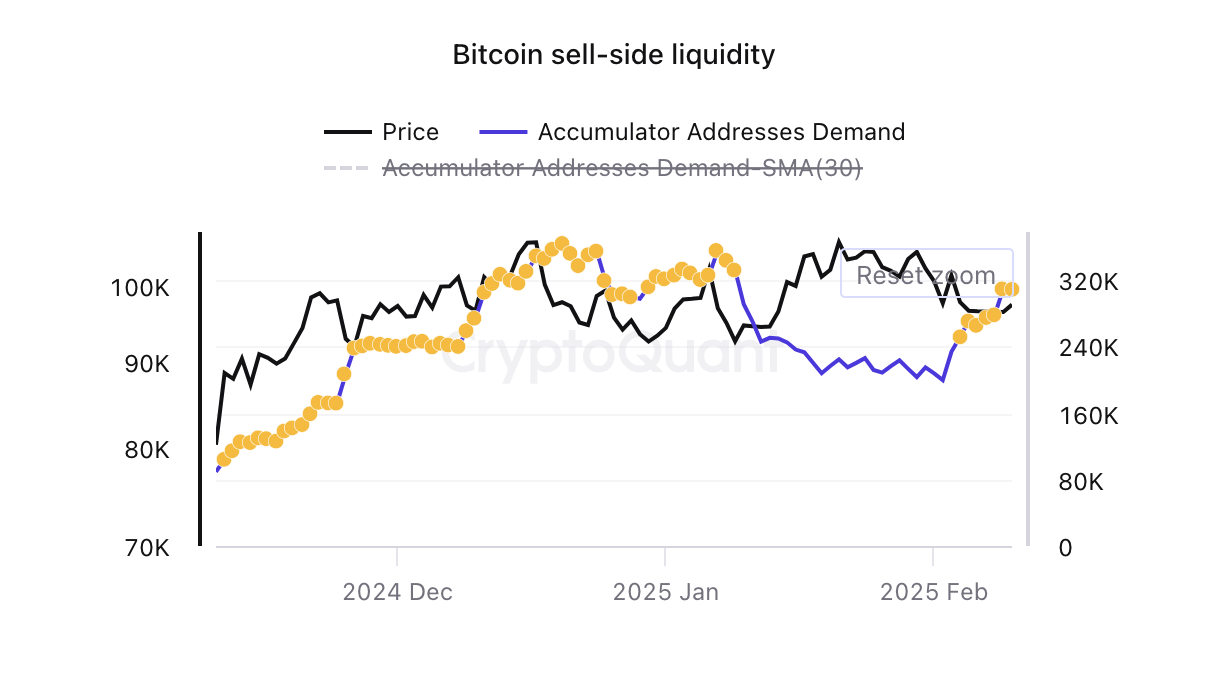

Data from the on-Chain Cryptaquant analysis platform show an increase in demand for permanent bitcoin holders. According to the data provider, Bitcoin permanent holders are owners who accumulate currency over time and never perform sales transactions, indicating a long -term maintenance strategy.

The assessment of the beinchrypto on the demand for currency accumulating addresses reveals that, since it reached a minimum in February 2, it fired. This reflects the increase in accumulation between these long -term investors.

The demand recovered even in the midst of Bitcoin correction in early February, signaling that long -term holders remain confident in the main asset. Compared to previous cycles, fewer long -term holders are selling, reinforcing optimistic conviction.

In addition, the BTC attempt to cross above its 20 -day exponential moving average (EMA) confirms the resurgence of demand for the main currency. At the time of publication, the BTC is negotiated at $ 98,022, slightly below this key key average, which forms resistance above it at $ 98,995.

The 20 -day EMA follows the average price of an asset in the last 20 days of negotiation, giving more weight to recent price data. When an asset is about to overcome this moving average, this signals a growing optimistic impulse, suggesting a possible change to a high trend.

Can strong holders demand the BTC above key resistance?

The BTC -supported demand among its permanent holders can trigger a discharge above the resistance formed by its 20 -day EMA. A successful rupture above this level would provide the impulse necessary for the currency to recover its historical record of $ 109,356.

However, if the accumulation between BTC investors Estagnar, this can reverse the current gains and fall to $ 92,325.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.