Total capitalization of the crypto market and Bitcoin (BTC) are on the rise today, while the wider market remains volatile. Altcoins are benefiting from this oscillation, with Story (IP) leading gains after a 43% increase in the last 24 hours.

In today’s news (20):

- SEC is postponing key inspection processes against crypto companies, including the coinbase case, possibly to gain time before a possible filing. Under Gary Gensler’s lead, the commission had directed shares against companies like Ripple and Kraken, but now it seems less willing to follow this way. An important deadline for Ripple’s case is scheduled for April.

- Nigeria filed a $ 81.5 billion process against Binance, requiring $ 2 billion in late taxes and additional fines. The lawsuit stems from previous charges, including tax evasion and alleged facilitation of illegal manipulation of local currency through Exchange.

The crypto market returns to its barrier

The total capitalization of the crypto market has risen $ 58 billion in the last 24 hours, reaching US $ 3.15 trillion. Now the market approaches the critical resistance of US $ 3.16 trillion. The ability to break this level will be essential to define the next phase of growth.

Totalcap seeks to turn $ 3.16 trillion into support, which would allow an advance until the next resistance of US $ 3.28 trillion. However, this potential rally will depend on the general conditions of the market. If the positive feeling continues, the market can reach new maximums.

On the other hand, if it cannot consolidate US $ 3.16 trillion as support, total capitalization of the crypto market may continue its consolidation above US $ 3.09 trillion. In this scenario, the lack of impulse can result in market stagnation and the extent of the lateral movement.

Bitcoin follows consolidated

The price of Bitcoin has risen in the last 24 hours, currently being negotiated at $ 97,068. Cryptocurrency seeks to keep its trend high, aiming at the next resistance at $ 98,212. If you can break this barrier, Bitcoin may reinforce its recent positive moment.

The BTC also faces resistance on the 50 -day exponential moving average (EMA), which signals the short -term perspective. Turning this level into support would indicate that Bitcoin is on the way to a high trend, being a key factor for a new altist impulse on the market.

However, if Bitcoin cannot break the 50-day EMA, it can retreat to $ 95,761, remaining in consolidation. This scenario can make it difficult an immediate discharge, keeping bitcoin within a narrow trading track for now.

Story reaches a new historical record

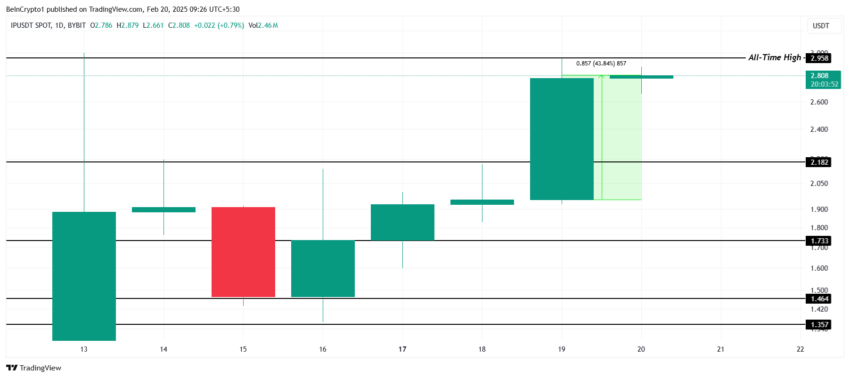

The IP, a newly released coin, quickly entered the top 100 of crypto tokens, recording continuous growth. Currently negotiated at US $ 2.80, Altcoin has a high of 43% in the last 24 hours. Its rapid appreciation indicates a growing interest of investors, expecting the impulse to continue if market conditions remain favorable.

Altcoin reached a new historic maximum of $ 2.95 during the intraordinary discharge after breaking the resistance of $ 2.18. With this optimistic break, IP is well positioned to continue its high trend, potentially surpassing the mark of $ 3.00. If this trend remains, new gains can occur.

However, if investors decide to sell and make profits, IP may suffer significant correction. This can take the price back to $ 2.18, erasing recent and potentially invalidating the optimistic perspective.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.