Bitcoin price recovery over $ 100,000 may continue to face significant resistance as your exchange reserve continues to rise.

The trend indicates that more currencies are being moved to Exchange, probably for subsequent sales. This puts more pressure down the price of the BTC and keeps it away from exceeding the critical brand of $ 100,000.

Bitcoin reserves in Exchanges increase, raising sales fears

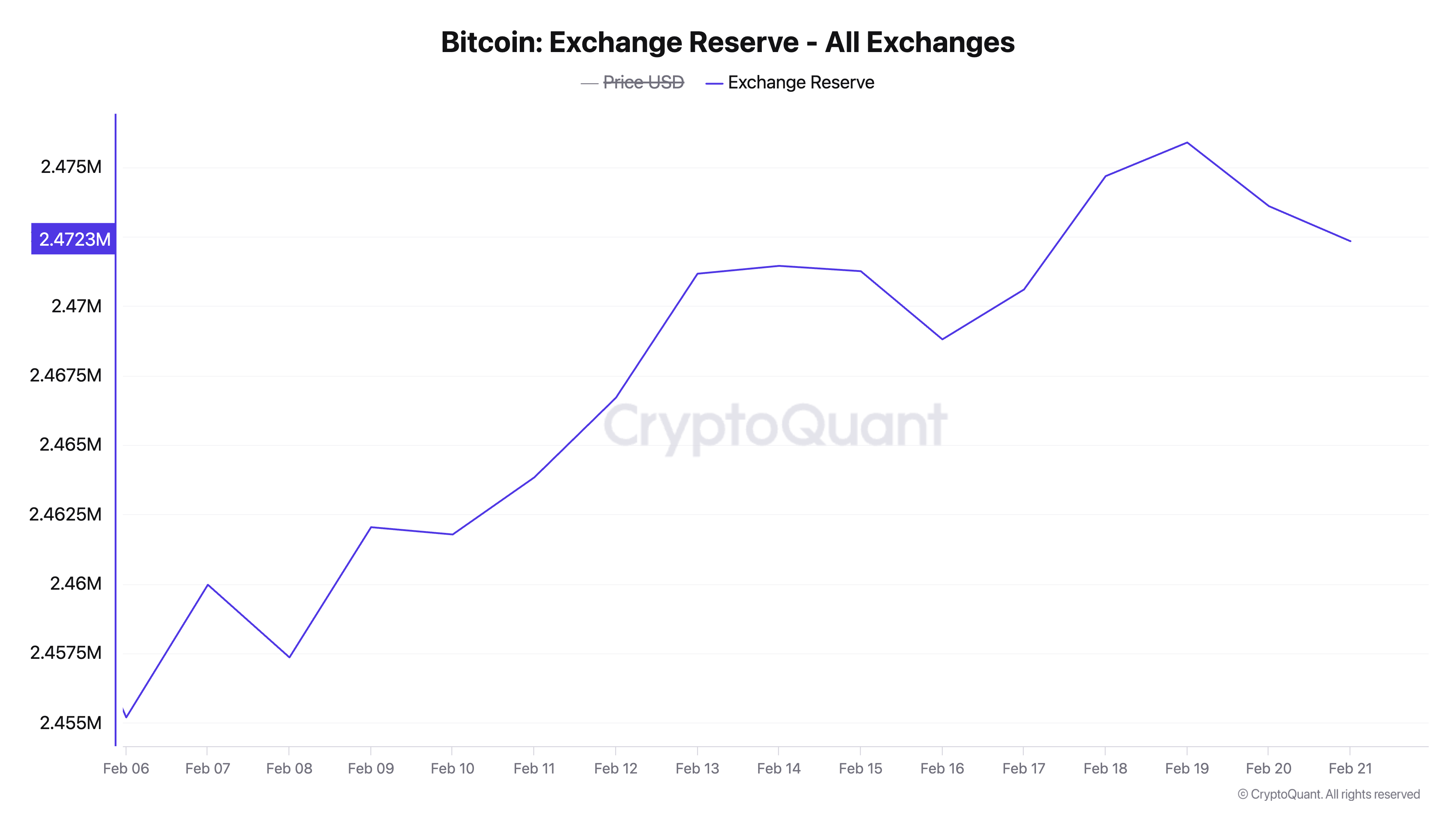

Cryptoquant data show a constant increase in the BTC reserve in Exchange since February 6. To date, 2.47 million BTC have been kept in Exchange Wallets, registering a 1% increase since the beginning of the month.

The Bitcoin Reserve in Exchange refers to the total of BTC kept in Exchange Wallets. When this increases, more coins are being deposited in the exchanges, signaling increasing sales pressure on the market.

In fact, this trend coincides with the lateral movement of the price of the BTC since the beginning of February. In the last 15 days, the main cryptocurrency has been negotiated within a narrow interval, facing resistance to $ 98,663 while supporting $ 95,650.

The growing reserve in Exchanges suggests that persistent sales activity is preventing a strong break up. If the buildup of exchanges reserves continues, this can trigger a downward break by putting the BTC at risk of a price correction.

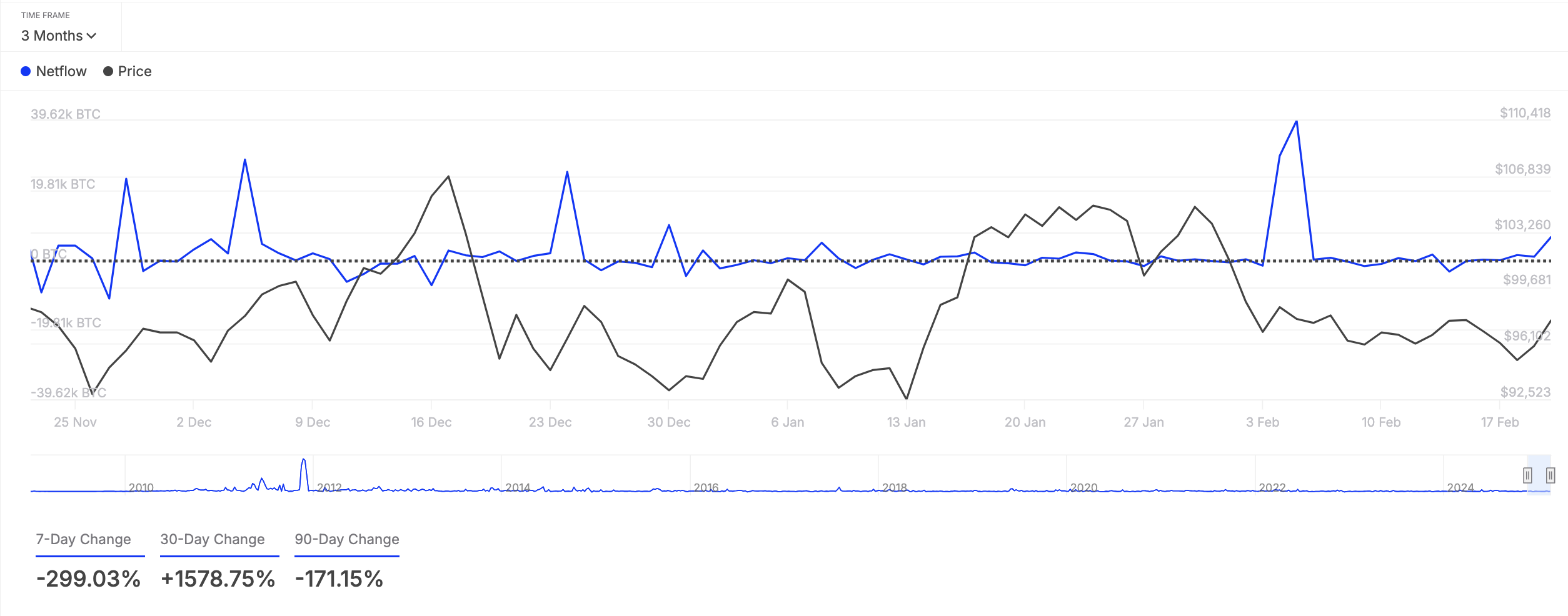

Another concern is the drop in BTC whales activity. Last week, the net flow of large coin holders plummeted 299%, highlighting a significant sale between them.

Large holders refer to whale addresses that have more than 0.1% of the circulating supply of an asset. Its liquid flow measures the difference between the amount of currencies they have and sells in a specified period.

When liquid flow falls, it means that whales and institutional investors deposit more tokens in Exchanges than they remove. This signals increasing sales pressure among major holders, a trend that can also lead retailers to sell their participation, further amplifying the pressure down in the price of the BTC.

BTC in a crossroads: Will it break $ 98,000 or fall to $ 92,000?

If sales intensify, the price of the BTC can try to test the support at $ 95,650. If this level does not support itself, the currency risks falling to $ 92,325.

On the other hand, a resurgence in demand can boost a break above the resistance formed at $ 98,663. If successful, the BTC can extend its gains toward $ 102,753.

A breach of this price level can lead the currency toward its historical record of $ 109,356, reached for the last time on January 20.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.