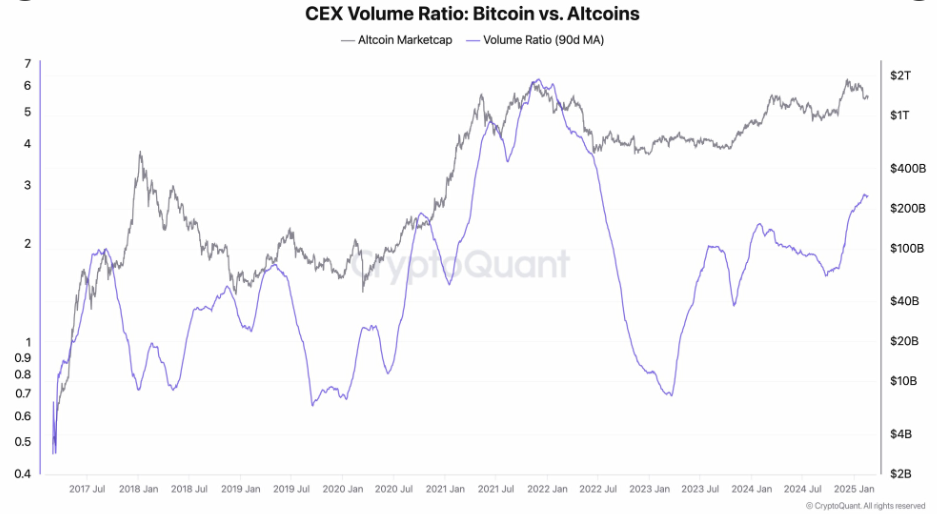

The long -awaited Altcoins season (Altseason) arrived, according to Cryptoquant CEO Ki Young Ju.

However, the analyst states that this time, the period follows different rules, unlike previous cycles driven by a clear rotation from Bitcoin capital to Altcoins.

Analyst predicts Altcoins season, but not as expected

Ju’s latest observations suggest that Stablecoins holders, not Bitcoin traders, boost selective altcoins gains while market liquidity remains restricted.

In a recent X (former Twitter) post, Ju stated that Altseason started by citing a sharp increase in altcoins trading volumes. According to the analyst, the altcoins negotiation volume is now 2.7 times larger than Bitcoin. However, Ju also noted that this is not a widespread rally.

It’s a very selective Altseason… only a few coins are going up. Without new liquidity, it looks like a PVP fight for a fixed slice, it he wrote.

Tempora de Altcoins: “Strange and Challenging”

This statement is aligned with its previous warnings. In January, ki alerted That the Altcoins market remains a zero sum, with capital circulating between assets instead of seeing new entrances. In December, he also predicted that this Altseason would be “strange and challenging”, favoring only selected assets.

Altcoins used to move based on their correlation with the BTC, but this pattern has now broken. Only a few are starting to show independent trends by attracting new liquidity, ki had written.

While some traders are excited, others remain skeptical. Robw, an X user, questioned Ju’s definition about Alt Season.

Some tokens are rising, so it must be Altseason? None of the usual metrics apply, but it’s Alt Season if you choose very carefully, it doesn’t look like an Altseason, Robw challenged.

Similarly, Deimosweb3 suggested That, although some altcoins are doing well, the market has not yet entered a complete Alt Season.

China’s tax movements and crypto markets

A parallel discussion in the cryptian community involves the recent tax maneuvers of China. Some speculate that the economic policies of the Asian giant could inject liquidity into global markets, benefiting crypts.

However, analysts ask for caution, pointing out that China has not injected new capital, but recalculated the M1 monetary supply to include cash deposits and prepaid funds.

They did not inject new capital. They “recalculated” to include other deposits and funds. There is no new impression, said a User in X.

Local media confirms this, indicating that Banco Popular da China, the country’s Central Bank, will include these elements from 2025.

The Crypto and Defi Bear Researcher highlighted that the change led to a dramatic increase of 67.59% in the reported M1 supply. However, he emphasized that this does not equal the new liquidity reaching financial markets.

Historical comparisons with the US money print frenzy in 2020 also emerged. At the time, the United States (USA) rapidly increased M1 monetary supply, feeding a 16 -time increase in Altcoins market capitalization.

Although China’s current actions are different, some traders speculate that even a fraction of new liquidity flowing to crypts could trigger another rise.

If this will translate into another explosive rally of crypto continues to come. But one thing is certain: when a major world economy infuses liquidity – it doesn’t matter how measured it – financial markets tend to notice, and crypts are often at the center of this conversation, NFT Bear said.

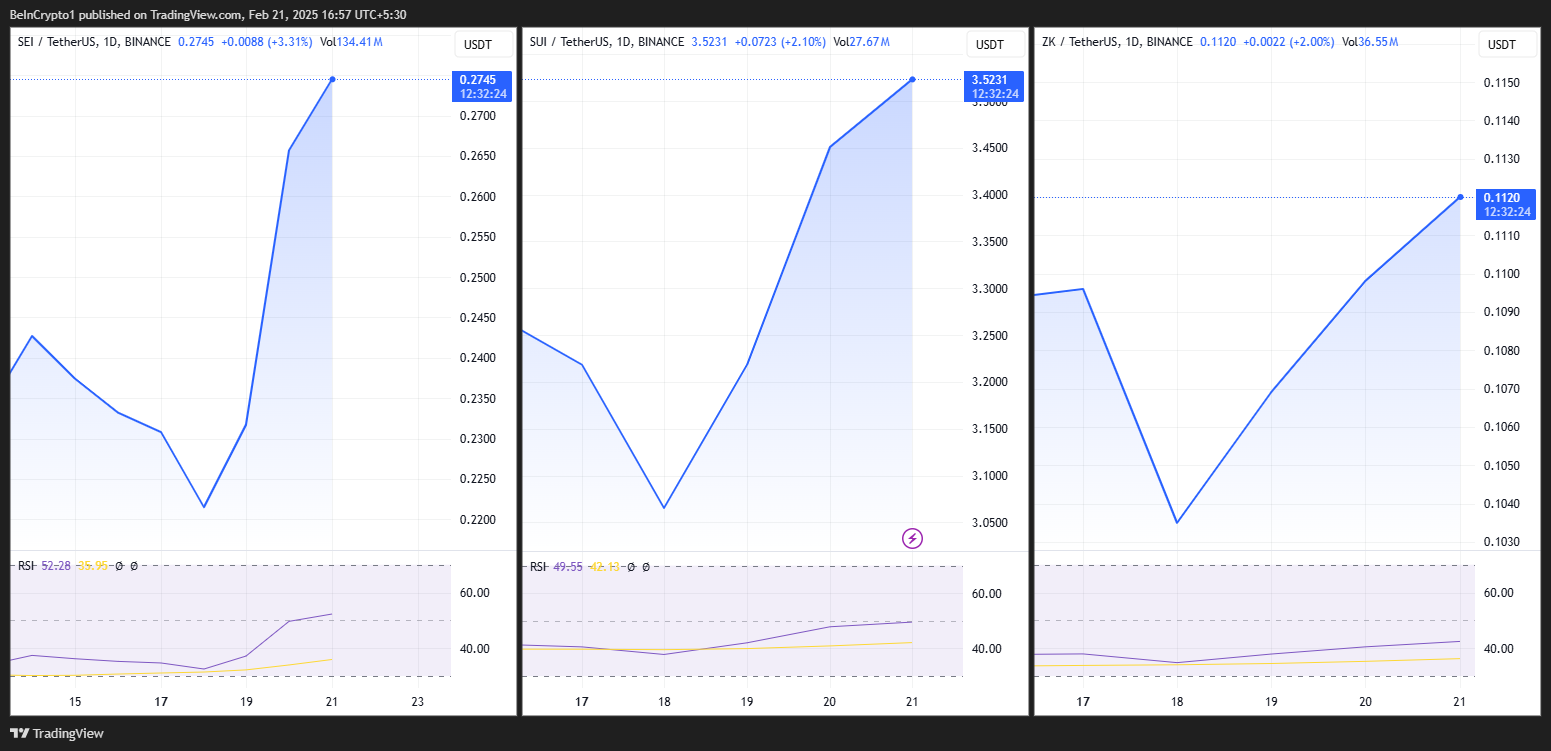

Despite the uncertainty, some altcoins surpassed. Projects like SEI (SEI), Sui (Sui), Zksync (ZK) and Story (IP) attracted attention, possibly signaling emerging narratives in space.

If these gains are sustainable or only temporary increases in a fragmented market is still seen. In fact, analysts agree that traditional Altcoins season metrics no longer apply.

The crypto market is changing, with Bitcoin acting as an active based on ETFS (Exchange-Traced Funds) and institutional funds (EXCHANGEED-TRADED. Instead of wide BTC capital rotation to Altcoins, which seem to be creating independent narratives and utilities to attract capital.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.