Strategy’s action (former microstrategy) suffered a significant impact. The action fell two digits after a sharp drop in the price of Bitcoin (BTC).

While speculation revolves around the possibility of the company being forced to settle its stakes in Bitcoin, Kobeissi Letter opined, suggesting that although such a movement is highly unlikely, it is not fully discarded.

MSTR falls amid the fall of Bitcoin

In the last 24 hours, the price of Bitcoin has dropped more than 3%, triggering a domino effect that made MSTR fall 11%. Accordingly With Yahoo Finance, the action closed at $ 250. This marked a 55% drop from its historic record (ATH) in November 2024.

In the midst of this fall, Kobeissi Letter explored the prospects for forced liquidation from the company’s Bitcoin stakes.

MSTR’s forced liquidation is not necessarily impossible. But it is highly unlikely. A mayday situation would be necessary to occur, the publication said leia.

The analysis detailed that the company’s business model depends on raising capital rather than selling Bitcoin, to finance their cryptocurrency purchases.

Emitting 0% convertible notes and selling new shares to a prize, Strategy has been able to finance its Bitcoin acquisitions without liquidating assets, even during market falls.

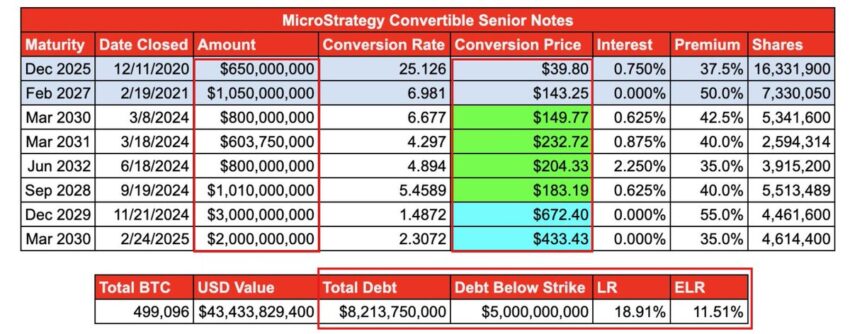

According to the latest data, Strategy has approximately $ 43.4 billion in Bitcoin against $ 8.2 billion in debt. Thus, its leverage ratio is about 19%.

In fact, most of this debt consists of convertible notes. Conversion prices are below the current price of stock and the salaries extend to 2028 and beyond. This structure offers a significant space for the company.

Nevertheless, the company’s ability to lift new capital is not totally immune to challenges.

In a situation where your responsibilities increase significantly more than your assets, this capacity can deteriorate, analyzed publication.

Although this does not automatically mean “forced liquidation,” could restrict the company’s financial flexibility. However, the analysis stressed that liquidation still remains a possibility, but only under a “fundamental change.”

Indeed, for liquidation to occur, a first vote of shareholders or corporate failure would be first, observed Kobeissi Letter.

Saylor protects microstrategy, but future risks worry

However, the scenario was considered unlikely, given the voting power of 46.8% of Michael Saylor. This effectively protects the company from such movements without its consent.

Saylor has been a vocal defender of Bitcoin, emphasizing her long -term growth. In fact, last week, the company increased its participation with an addition of 20,356 BTC.

However, Kobeissi Letter emphasized that the true concern for Strategy lies in the future, especially when the company’s convertible titles win after 2027.

If Bitcoin’s price drops more than 50% and remains low, Strategy may have difficulty refinance or paying the cash debt, potentially testing their reserves and investor confidence.

Maintaining investors’ confidence will be crucial for MSTR in the midst of falls, added the publication.

Therefore, while liquidation remains unlikely in the short term, the long -term risks associated with Bitcoin’s volatility and the company’s debt obligations remain an area of concern.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.