The so -called ‘Trump Trade’ is under criticism while Bitcoin (BTC), Tesla (Tsla) and the US dollar face significant falls.

President Donald Trump’s initial enthusiasm for the pro-training policies has shrunk, leading to disappointment in the financial markets.

Given the optimism of frustration?

Bitcoin, which had exceeded $ 100,000 with optimism for a Trump second administration, has now dropped to less than $ 85,310. Market analysis points to the lack of solid support between the range of $ 90,000 and $ 70,000, raising concerns about new falls.

The sharp drop occurs as traders react to President Donald Trump’s lack of concrete action to relieve crypto regulations despite previous promises. Analyst and influencer Crypto Crypto Rover summed up disappointment on social networks.

Trump has promised us a Bitcoin strategic reserve. He gave us a trade war instead, wrote the analyst.

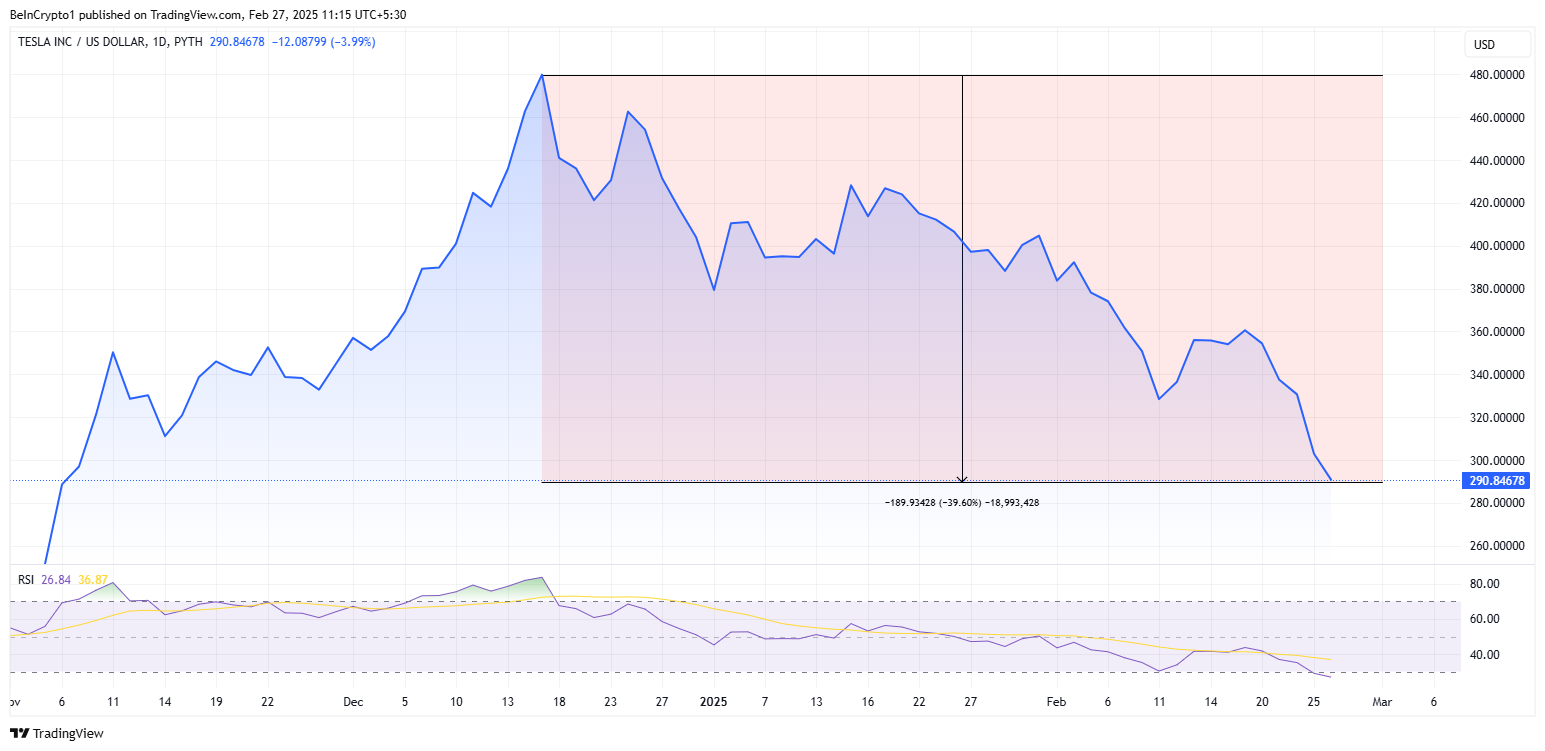

In addition, Tesla, often seen as a so -called ‘Trump Trade’ thermometer, has experienced a sharp drop. Their shares, Tsla, fell almost 40% since Pico after Trump’s electoral victory. The electric vehicle giant fell almost 4% only on February 26. This fall extended a sequence of losses that made their actions fall 24% in the year.

Investors are increasingly concerned that Tesla is being set aside by the focus of CEO Elon Musk in federal reforms. In addition, Musk’s polarizing political stance impaired Tesla’s performance in Europe, where sales fell 45% in January, despite the general increase in electric vehicle sales in the region by 37%.

Similarly, the US dollar and the Treasury income, which had initially strengthened with Trump’s expectations of economic policies, are now declining. Analysts cite fears that Trump’s aggressive trade policies-especially his newly informed tariffs-can lead to a resurgence of inflation while slowing economic growth.

O Trump trade war impact

Kobeissi Letter, a well -known vehicle of financial analysis, highlighted the comprehensive impact of Trump’s aggressive commercial posture. The president recently announced comprehensive tariffs, including 25% of Canada and Mexico, 25% over the European Union, 10% over China and a possible 100% tariff over BRICS nations.

These rates are expected to increase the cost of goods in the US, with expectations of inflation firing and analysts warning that it can double in relation to recent levels.

Markets are now pricing a return on inflation, as the prices of many goods should rise, noted a Kobeissi Letter.

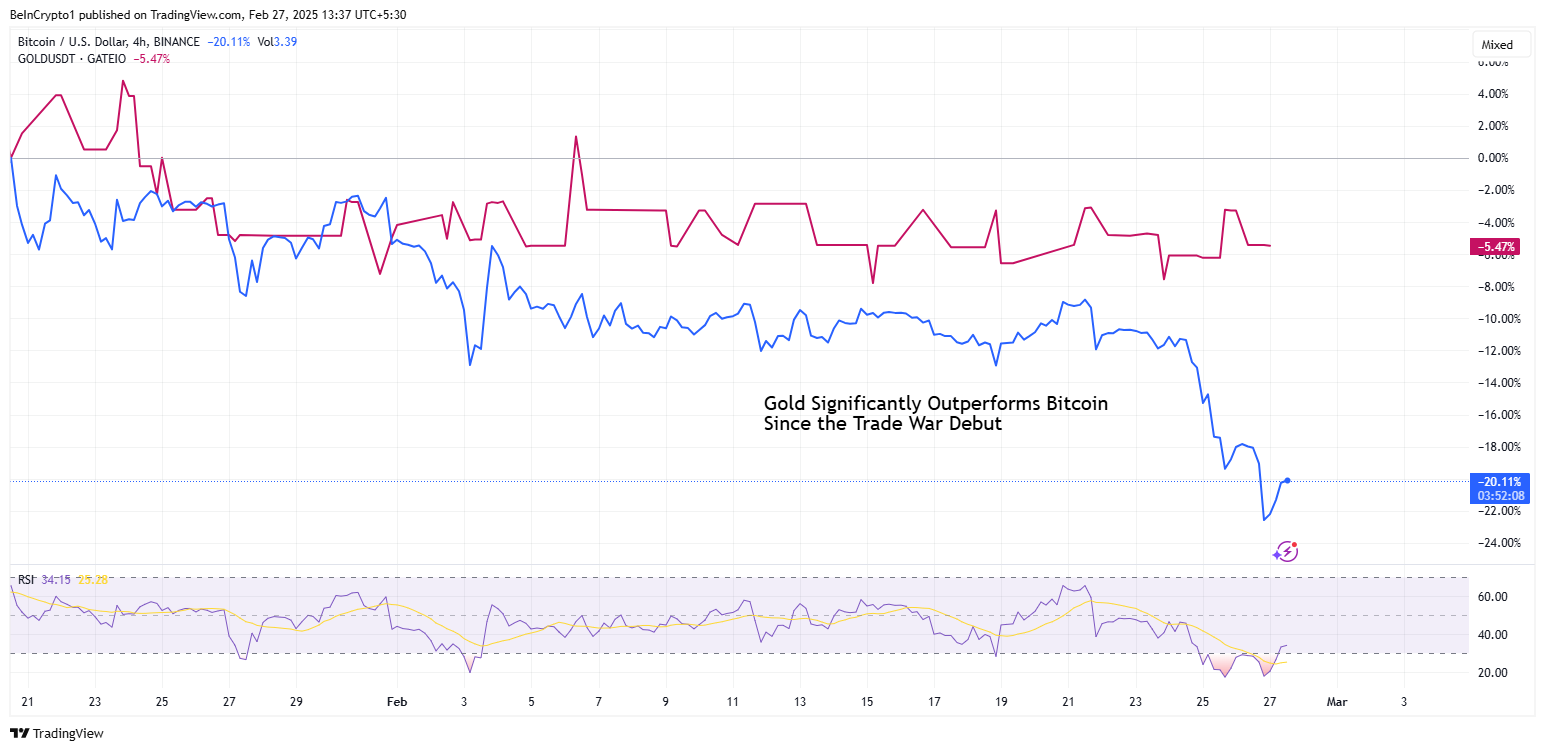

Meanwhile, one of the most striking trends in financial markets is the marked divergence between bitcoin and gold. While gold rose 10% recently, Bitcoin fell 10%, although historically seen as a protection against economic uncertainty.

Amid the turmoil of the market, a new study Dance Numbers suggests that Trump’s tariff plan could offer significant fiscal relief to Americans. The study found that replacing income taxes on import tariffs could save up to $ 325,561 in taxes throughout the life of an average American.

If Trump’s tariff plan eliminates federal income taxes, New Jersey, Connecticut and New York residents could save $ 146,160, $ 149,535 and $ 136,215 over their lives.

With many Americans fighting high tax charges, Trump’s proposal could represent a seismic change in the country’s financial space. However, skeptics fear that dependent on tariffs can increase inflation and create new economic challenges.

This can shake global markets! Volatility is the new normal, and can inflation in the US stay high – rates in rates? Not so soon, Jagadish, an X (former Twitter) user, expressed.

Investors remain cautiously with more volatility while markets adjust to Trump’s policies. The ‘Trump Trade’ faces its biggest test with increasing concerns about inflation and important actives faltering.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.