Bitcoin has experienced a sustained fall trend, despite maintaining a more optimistic macroeconomic perspective. While long -term projections remain positive, short -term weakness suggests that the BTC can continue to face sales pressure.

Investor behavior has not been particularly favorable, contributing to greater uncertainty in the market.

Bitcoin needs investors support

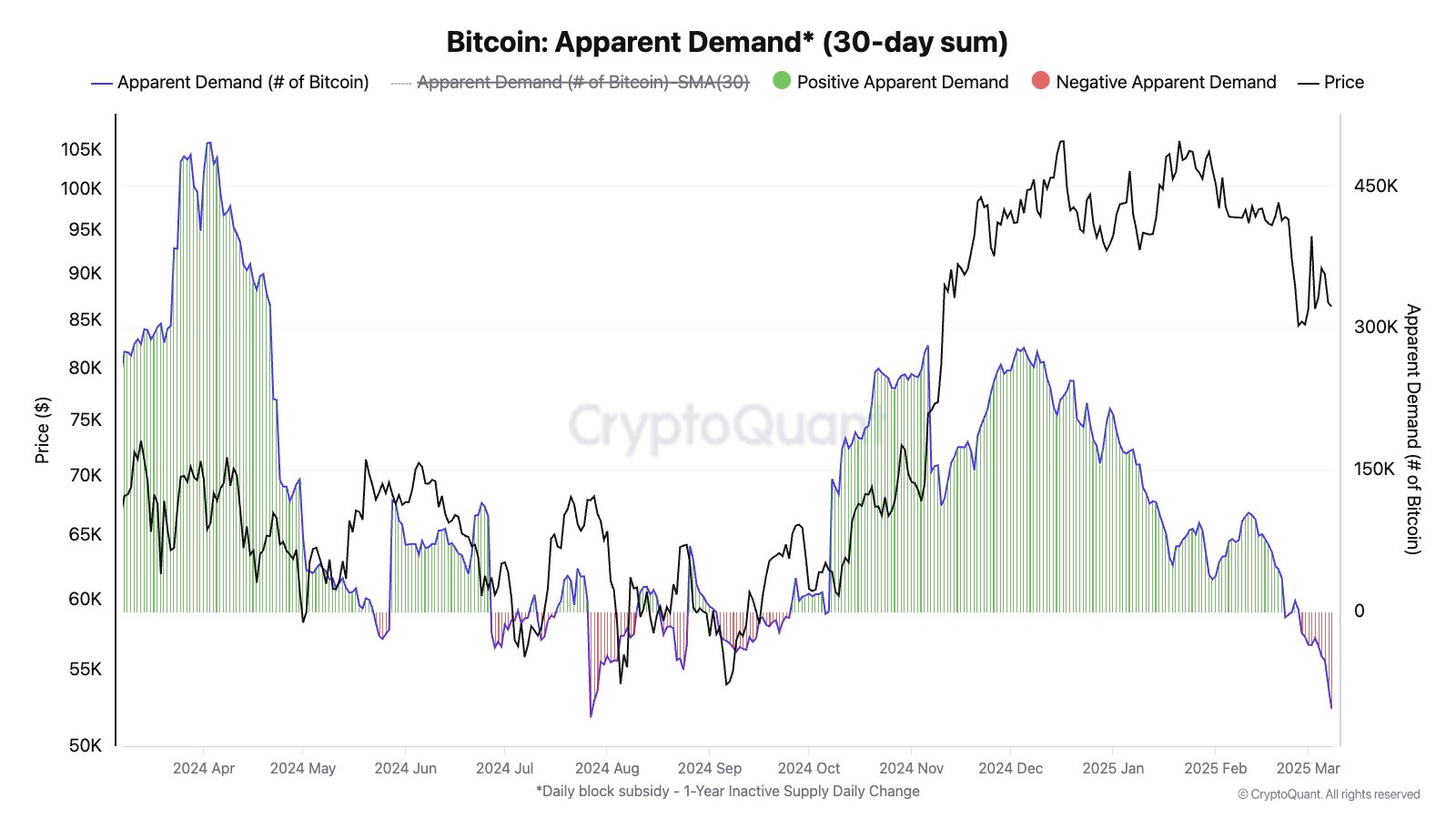

The apparent demand for Bitcoin has had a significant impact, with the sight demand contracting in the last days. This contraction marks the most substantial drop since July 2024 and the first instance in more than four months. The fall indicates increasing skepticism among investors, leading to a reduced purchase interest and a short -term low -term pressure.

A fall demand suggests that market participants are hesitant to enter new positions. If demand does not recover soon, Bitcoin may have difficulty sustaining its current price levels, increasing the risk of new falls.

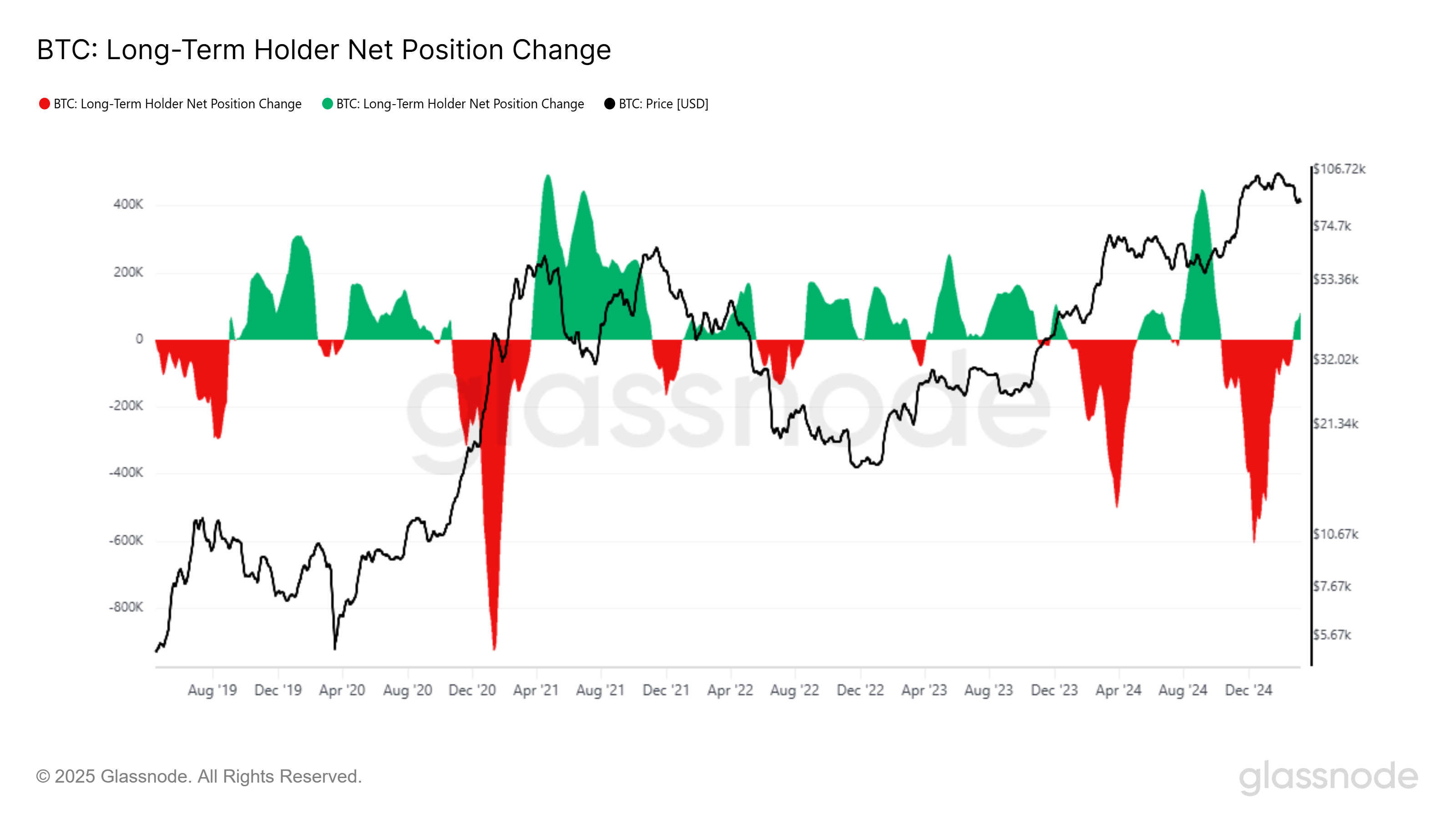

Long -term holders (LTHS) have changed for accumulation instead of sale, as shown by the LTHS net change metric. In the last 30 days, these investors have accumulated more than 107,413 BTC. Historically, LTHS accumulation signals long -term confidence, but in the short term, it often precedes periods of price weakness.

LTIs tend to accumulate at lower prices and start distributing during the highs. This pattern suggests that Bitcoin may still face a drop before a significant recovery begins. Although long -term accumulation is positive, immediate impact may be an additional short -term volatility and potential price corrections.

BTC price can fall even more

The price of Bitcoin, currently at $ 82,305, is moving within an expanding descendant wedge pattern. Although this pattern is historically optimistic on a macro scale in the short term, it indicates a higher probability of continuity of the fall. BTC may need to test lower support levels before confirming a reversal.

Given market conditions, the short -term price forecast is that Bitcoin could lose the crucial support level of $ 80,000 and fall to test $ 76,741. If the broader macroeconomic factors get worse, the fall may extend further, potentially reaching up to $ 72,000. Such a scenario would put additional pressure from low in the crypto market.

However, a change in investors’ feeling can change this trajectory. If accumulation increases in psychological support of $ 80,000, Bitcoin can recover the rise impulse. A movement beyond $ 82,761 would make way for BTC to exceed $ 85,000, eventually reaching $ 87,041. Such development would invalidate the perspective of low and signal a renewed force in the market.

Check out our Bitcoin Forecast Page (BTC) for traders.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.