Bitcoin is standing for a possible break that could raise its price over $ 91,000. The main cryptocurrency is currently negotiating within a symmetrical triangle, signaling a possible high movement.

However, this discharge faces challenges, as short -term holders adjust their posture as long -term holders (LTHS) contribute to sales pressure.

Bitcoin holders are stabilizing

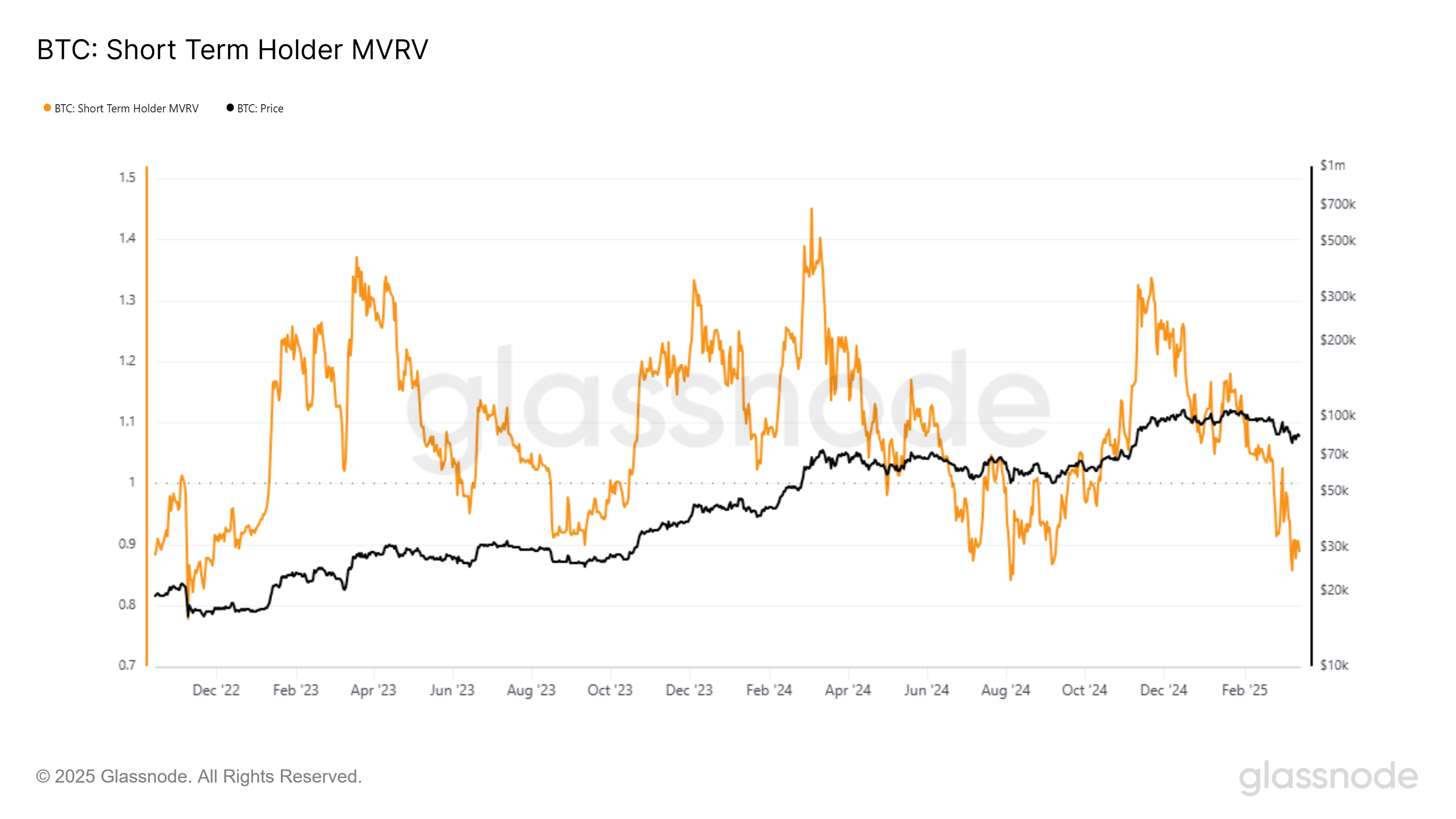

Short -term MVRV fell below the 0.9 mark, a level historically associated with saturation points for STH selling. This indicator often signals the end of a selling phase and a possible price reversal. If the story is repeated, the currency may soon witness a renewed purchase pressure, preparing the land for recovery.

Bitcoin has previously shown a price recovery pattern when short -term MVRV falls to these levels. If the same trend follows, the BTC can gain upward boost in the short term.

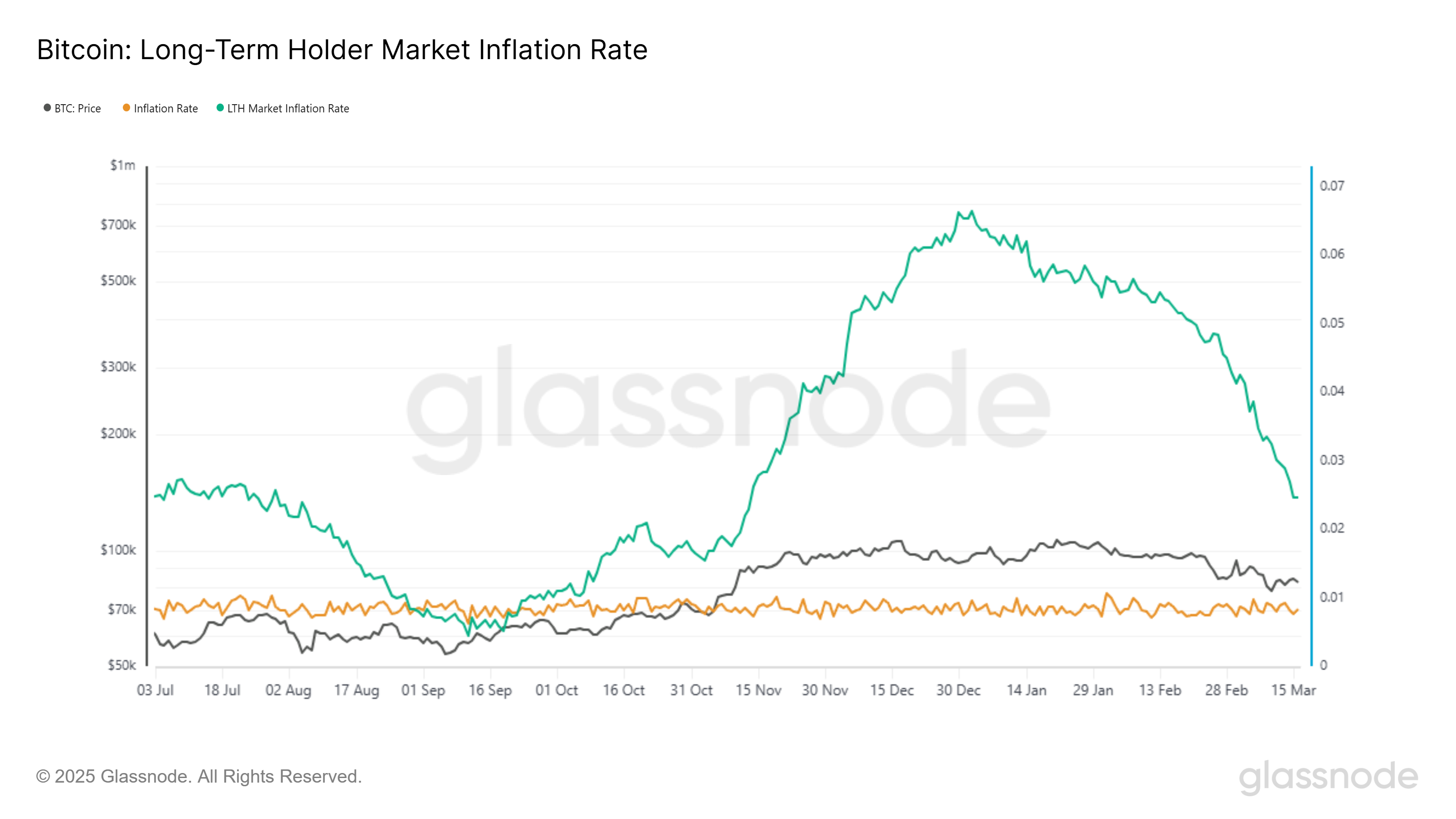

The inflation rate of the long -term holder market measures the annualized net accumulation rate or LTHS distribution in relation to the emission of miners. Currently, values of 0.025 suggest that LTHS are still adding sales pressure. Although this indicator is noticing a fall, it continues to impact the currency price movement.

Since the inflation rate of the LTY market falls below miners emission levels (inflation rate at 0.008), the pressure on the price of bitcoin will likely decrease. This change would allow the BTC to gain traction, increasing its chances of breaking the resistance. Until then, the market remains vulnerable to fluctuations driven by the sales activity of LTHs.

BTC price breaking ahead

Bitcoin is currently being negotiated at $ 83,336, maintaining above the crucial support level of $ 82,761. The symmetrical triangle pattern suggests a potential break of 8.8%, indicating a price movement that could raise the BTC in the coming days.

The target of a break of $ 91,521 will only become viable once Bitcoin exceeds $ 85,000 and sets $ 87,041 as a stand. Achieving this milestone would bring Bitcoin closer to recovering its recent losses, reinforcing an optimistic perspective for cryptocurrency.

However, the failure to exceed $ 85,000 may result in Bitcoin falling back to $ 82,761 or even falling even more to $ 80,000. This scenario would invalidate the optimistic pattern and introduce additional fall risk, delaying any potential short -term recovery.

Check out our Bitcoin Forecast Page (BTC).

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.