A Hyperliquid decentralized Exchange Walk Wallet (DEX) stirred the community by running a long leverage long position with a tight settlement price. This negotiation caught the attention of other whale groups, triggering an unprecedented public whale hunting in the market.

In addition, Hyperliquid believes that such an easily traceable negotiation activity represents the future of decentralization.

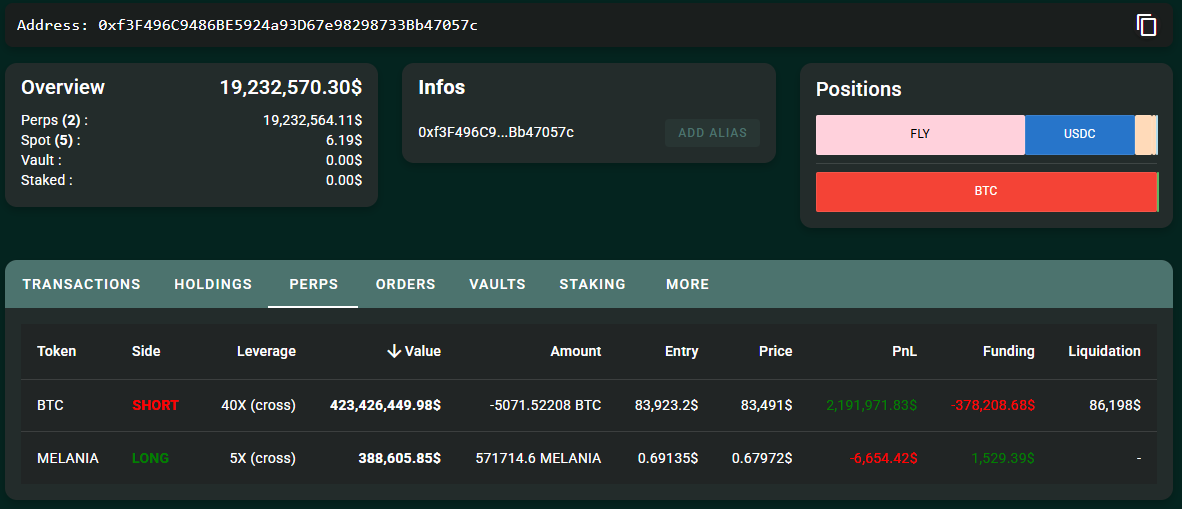

Attempt to settle a high leverage negotiation in the amount of more than $ 420 million

A whale with a portfolio address 0xf3f496c9486be5924a93d67e982987333337057c opened a 40x leverage position in Bitcoin, totaling more than $ 423 million. At the time of writing, its settlement price was $ 86,198. Currently, the Short position is profitable of more than $ 2 million.

This whale has also recently executed great leverage negotiations, raising suspicions among specialists about possible calls with North Korean hackers.

The massive size of the position and the tight settlement price caught the attention of a user in the X (former Twitter) called CBB. He summoned a collective effort to hunt the position of the whale, raising the price of the BTC. In an X post, he stated that “eight digits”(Millions of dollars) were committed to the plan.

If you are willing to hunt this guy with size, send a DM, setting up a team now and we already have a good size, CBB stated.

CBB too revealed that Justin Sun, founder of Tron (TRX), was part of the group. However, Sun did not officially confirm this. In addition, CBB invited Eric Trumpson of former President Donald Trump, to join.

The story is still unfolding, and it is unclear as far as the CBB whale hunting effort will. For now, the position remains profitable, and Bitcoin is being negotiated at $ 83,460, only 3% far from the settlement.

One Kaiko report From early March it states that the market depth of 1% of Bitcoin is $ 300 million. This means raising BTC by 1% can require at least $ 300 million in capital.

Battle of Whales: the bold strategy that came out for the Culatra

Many X users are following the event as a high -risk drama. Cryptovikings believes Hyperliquid’s whale is publicly shortered while simultaneously long on a centralized exchange (CEX).

The HL whale strategy was simple. Short a huge amount with high leverage publicly on Hyperliquid to gain attention. Long at CEX at the same time. He expected MMS and institutions to eliminate the settlement, raising the BTC to $ 1,000, triggering a short Squeeze and a good pump. He would profit from his longs. But MMS and Exchanges understood the strategy. First, they pushed the price down to settle their position in CEX, then raised the much higher price to hunt it on both sides, Cryptovikings PREVENTED.

Hyperliquid embraced the event, praising the transparency of public negotiations as the future of decentralization.

Hyperliquid redefined the negotiation. When a whale shorts over $ 450 million in BTC and wants a public audience, this is only possible at Hyperliquid… Anyone can edit a NLP capture. No one can question a position on Hyperliquid, just as no one can question a Bitcoin balance. The decentralized future is here, Hyperliquid stated.

The market is closely watching while this whale war continues to unfold.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.