After weeks of departures, Bitcoin’s Bolsa Bolsa Funds (ETF) finally changed direction, registering a $ 274.6 million entry yesterday (17).

This marks the largest daily net entry after 41 days, suggesting a renewed interest of investors. Although a positive day does not confirm a trend, it raises an important question: is demand returning to Bitcoin ETFs or is this just temporary relief?

Bitcoin ETFs have first major influx in weeks

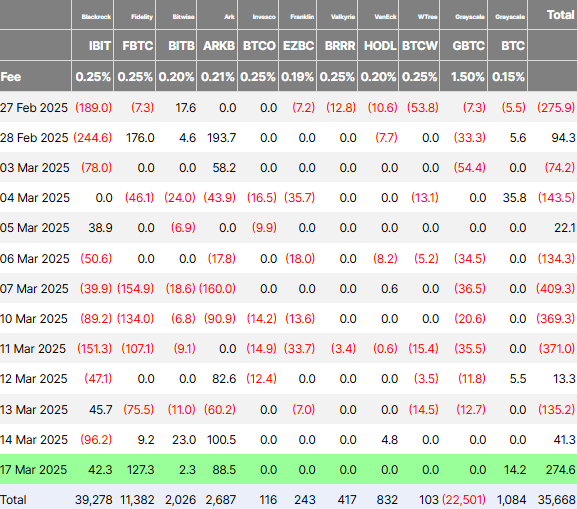

According to the latest data from Farside Investors, Blackrock’s Ishares Bitcoin Trust (Ibit) recorded a $ 42.3 million entry yesterday. Despite positive flows, Ibit failed to lead due to the correlation with the stock market.

Fidelity Bitcoin ETF (FBTC) attracted US $ 127.28 million, becoming the biggest winner of the day. The Arkb Bitcoin ETF (Arkb), managed by Ark Invest and 21shares, also saw a significant interest, raising $ 88.5 million.

On the other hand, the Grayscale Bitcoin Trust (GBTC), which has been in the center of large exits, remained stable. This is remarkable because GBTC has lost billions in assets from the transition to an ETF Spot.

Meanwhile, another Grayscale Bitcoin product saw a modest entry of $ 14.22 million. Other Bitcoin ETFs, including those from Valkyrie, Invesco, Franklin and Wisdomree, have not registered daily entries.

However, while Bitcoin’s ETFs performed strongly, ETFS -based ETFs continued their fall trajectory. Data from Farside Investors showed which recorded their ninth consecutive day of net outputs of US $ 7.3 million.

Bitcoin ETFS Spot attract $ 275 million in entries, while Ethereum ETFs experience exits, reflecting changes in investor preferences, suggested an X user suggested .

In fact, while this may suggest the return on the demand for Bitcoin ETFs after weeks of exits, analysts They claim that a positive day does not make a tendency. However, it is a change that is worth noting.

Bitcoin ETFs have lost billions in recent weeks

Just a week ago, Bitcoin ETFs had recorded four consecutive weeks of liquid outputs totaling more than $ 4.5 billion. Performing profits, regulatory concerns and broader economic uncertainty have fueled the change in investors’ feeling.

The crypto market as a whole has also seen a capital escape. As reported by Beincrypto, crypto exits totaled more than $ 800 million last week, signaling a strong negative feeling among institutional investors.

With this context, while the $ 274 million entry yesterday can be seen as a sign of stabilization, it is early to determine if this marks the beginning of a broader recovery.

However, the sudden increase in ETF inputs raises the question of whether this is a resurgence of the so -called Trump’s “crypto boom” or a fear of losing (fomo). Some analysts believe that Hedge Funds and institutional players boost the action more than retail investors.

Crypto entrepreneur Kyle Chassé has already argued that Hedge Funds play an important role in Bitcoin ETF flows. He states that large investors remove and reinvested capital strategically to manipulate price movements, making it difficult to determine organic demand.

The “demand” for ETFs was real, but part of it was purely for arbitration. There was a genuine demand for having BTC, but not as much as we were led to believe. Until real buyers enter, this oscillation and volatility will continue, the analyst explained .

If true, the latest ETF inputs may not represent new buyers. Instead, it can mean institutional capital recycling to capitalize on short -term price fluctuations.

Adding to uncertainty, many investors are considering federal reserve’s upcoming policy decisions. Some have speculated that the Fed will turn to Monetary Celling (QE) soon, but experts in the sector warn that such expectations are mistaken.

Nic Puckrin, the financial analyst and founder of The Coin Bureau, believes that those who anticipate an imminent QE are “deceived.” He notes that the Fed’s interest rate remains at 4.25-4.5%, and historically, QE does not start until the rates approach zero.

… Why is anyone suddenly waiting for a massive injection of liquidity into the system? In fact, if a large -scale monetary stimulus comes from somewhere, it will be from China or Europe, which have already implemented monetary flexibility measures. The most we can expect from Powell tomorrow is a tip on the moment of the next interest cut, but perhaps it doesn’t even happen. Therefore, investors should prepare for markets to do another scandal this week, Puckrin told the beincrypto.

.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.