With the Bitcoin ETF market registering new entries, broadcasters are expanding their acquisitions in large volume. Fidelity and Ark Invest, two of the leading managers, have acquired more than $ 40 million in Bitcoin since yesterday.

Rumors also suggested that Blackrock, the largest ETF station, made similar purchases, but they remain not verified. In general, new acquisitions of asset managers can contribute to an optimistic narrative necessary for the market.

Will Bitcoin ETFs influence a new high cycle?

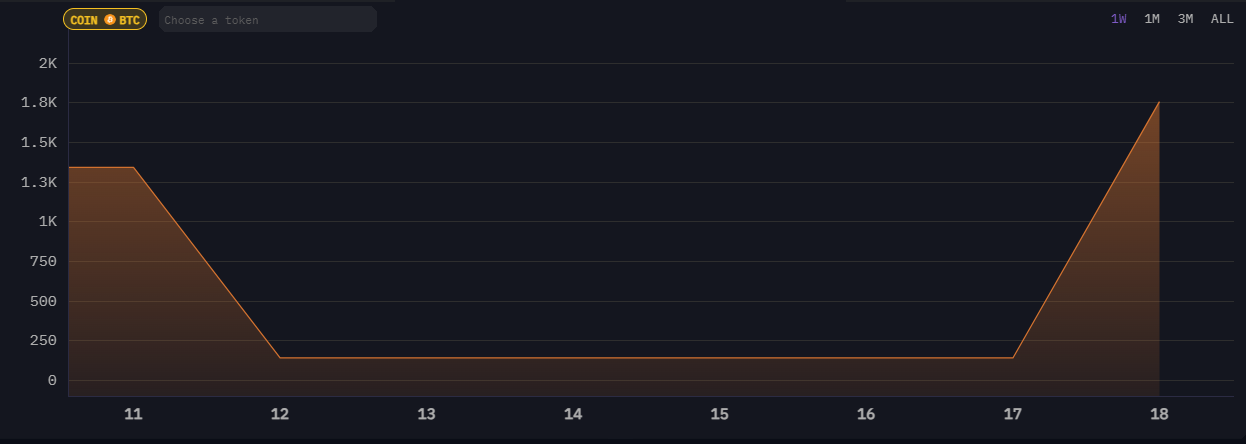

After weeks of consistent ETF exits, the market is starting to recover. On Monday (17), Bitcoin ETFs in sight in the US registered $ 274 million in net entry-the largest daily entry since February 28.

Meanwhile, the Blockchain Arkham analysis platform said Blackrock is also making major BTC purchases.

… Alert Arkham: Blackrock is buying $ 40 million in BTC. Blackrock is buying. Fidelity is buying. Ark is buying, said the company via social media.

However, despite these allegations, on-chain data do not correspond. THE Fidelity and ARK Investments They acquired large amounts of BTC today (18), registering input transactions of US $ 41.16 million.

Both ETF stations had other Bitcoin inputs, but Blackrock’s on-chain data actually show a net decrease in BTC appearances.

These other main ETF broadcasters have, in fact, bought bitcoin, as independent verification can clearly show. ETF analyst Shaun Edmondson stated that they bought 665 BTC in the last Friday (14) by 3.261 btc is yesterday.

The price of bitcoin has been highly volatile, which may be increasing confusion over the ETF market. Last week, the broadcasters of the stations fell below the Satoshi wallet, a milestone that surpassed three months ago.

However, it seems that institutional investors are recovering confidence to enter the market, as most Bitcoin ETFs stayed in green this week.

Overall, institutional investors have been a key influence on the Bitcoin market movement last year. If liquid entry remains positive in the ETF market, it can help create an optimistic narrative necessary in the face of the present feeling of current.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.