The price of Bitcoin (BTC) historically experienced multiple “bear traps” or bear traps. Depending on market conditions, these traps appeared in short -term phases or longer periods.

Some analysts believe that Bitcoin is currently in one of these bear traps and that a rise will begin after the end of the current phase.

What does the Bitcoin bear trap cycle mean?

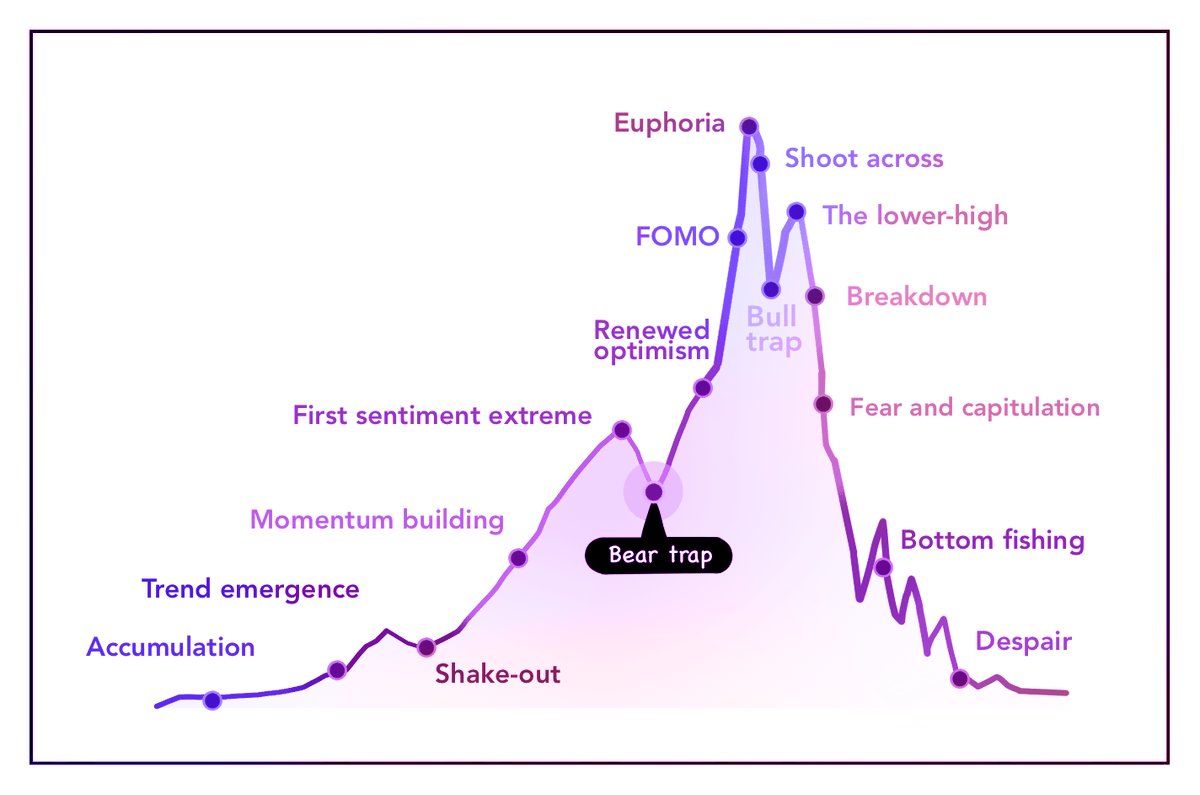

A bear trap occurs when the price of an asset (such as shares, cryptocurrencies or indices) shows a sharp drop. This fall convinces investors that a low trend is beginning. However, the price soon reverses and rises again, “holding” those who sold to discover or left their positions, waiting for additional falls.

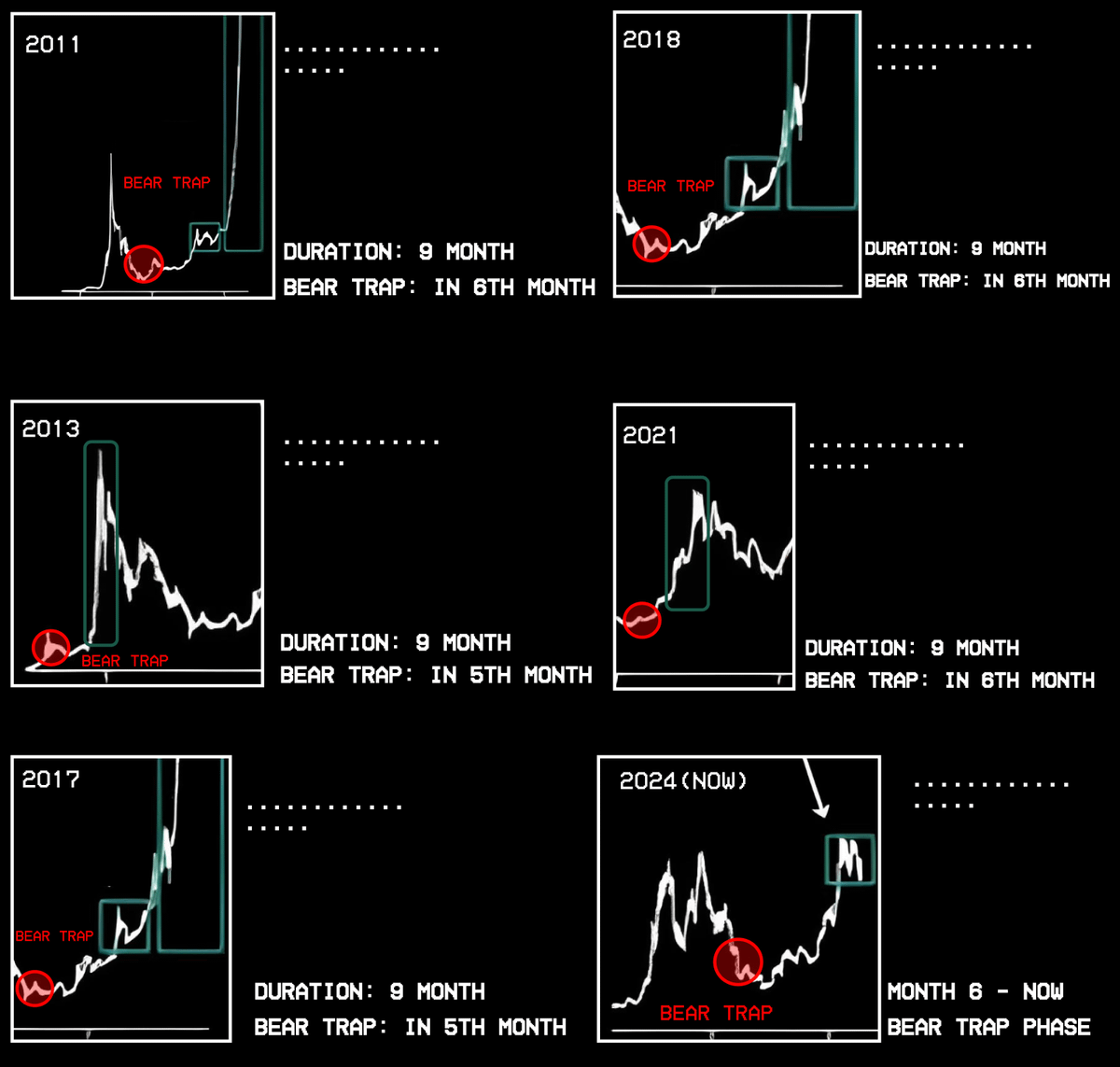

According to Pseudonym FinishBitcoin’s discharge cycles usually last about nine months. A bear trap often appears in the sixth month of the cycle. During this phase, the price of Bitcoin falls sharply, causing panic and sales. But after that, the price recovers and reaches new maximums.

Historical data from previous cycles – including 2011, 2013, 2017, 2021 and the current cycle (2024–2025) – show that this pattern is consistently repeated.

The 2025 cycle is the same. Six -month bear trap, then a new ATH, predicted Finish he prepared.

In his analysis, Finish also explains the driving forces behind the bear traps in each cycle. For example, the 2013 bear trap was triggered by the closure of Silk Road, an online black market, and the ban on Bitcoin in China, which caused panic in the market.

Bitcoin: Patterns are repeated in high cycles

In 2017, Icos boom boosted Bitcoin’s rise, raising its price to $ 20,000. However, a bear trap appeared in the sixth month due to the release of Bitcoin futures at Exchange CME. This was combined with the media and concerns about Tether (USDT), which faced transparency issues.

Similarly, in 2021, Bitcoin fired to $ 69,000. But the six -month bear trap was triggered by an overheated market feeling and the sudden change in Elon Musk posture on Bitcoin payments.

For the 2024–2025 cycle, Finish believes Bitcoin is currently in its bear trap phase. Macroeconomic factors, especially policies of US President Donald Trump, play a crucial role.

Trump’s policies – such as interest rates, tariff war, and their promise to make the US “crypto” in the world – created optimism, but also caused short -term price volatility. This aligns with the six -month bear trap model described by Finish.

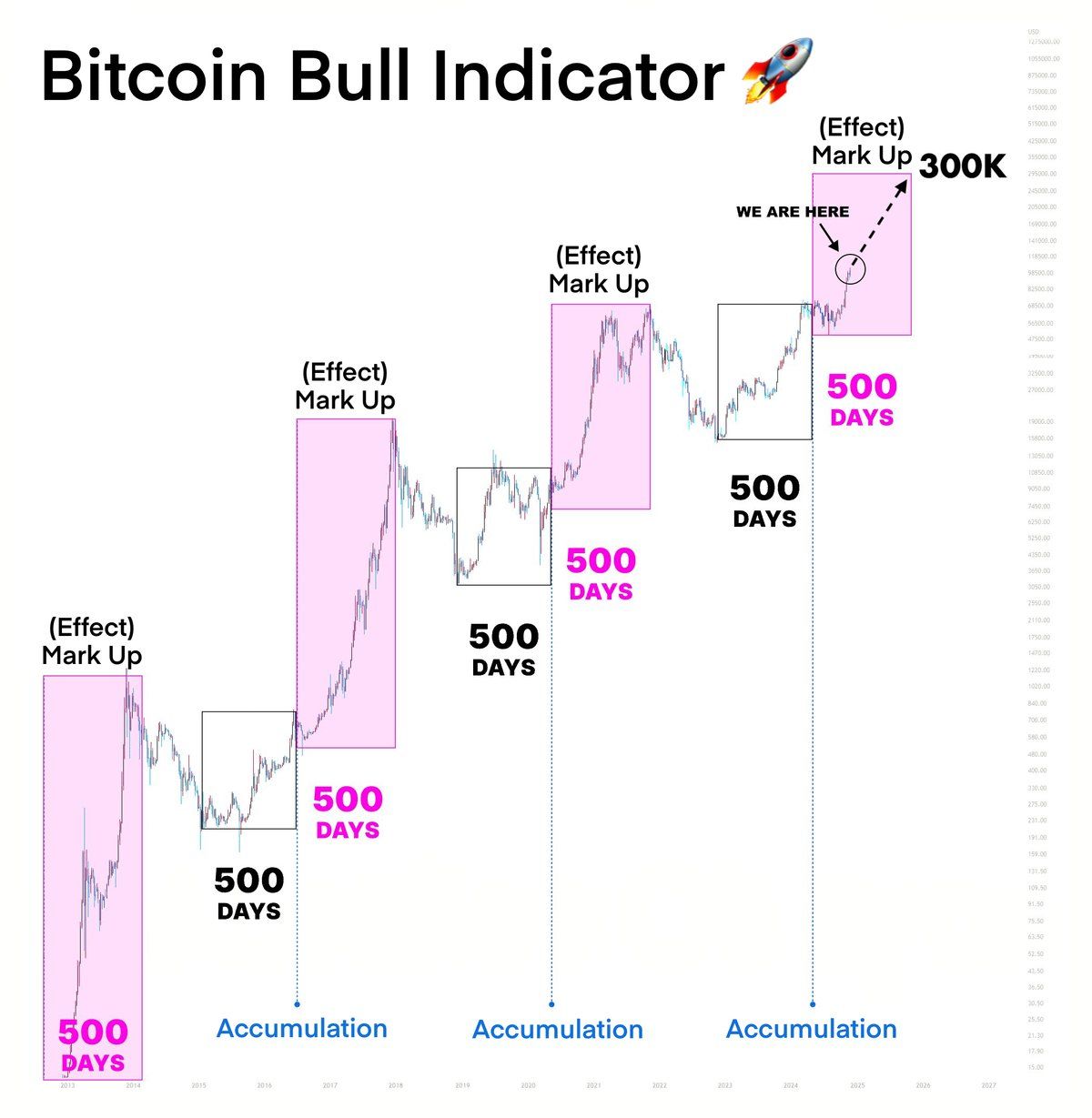

In addition, analyst Danny agree with this perspective. He predicts that Bitcoin’s largest rise will officially begin in April 2025, as the current bear trap phase is over. Danny suggests that Bitcoin can reach $ 300,000 by 2026.

We are in the Markup phase, right after a classic bear trap. Historically, the biggest gains follow as the dominance of Bitcoin falls and capital moves to medium and low market value, predicted Danny.

However, some analysts reduced their expectations for asset growth. Ecoinometrics observes that the Bitcoin growth rate in this cycle is significantly lower than in previous cycles. Ki Young Ju, founder of Cryptoquant, analyzed Bitcoin’s NLP signs and predicts Bitcoin’s discharge race has already ended.

Bitcoin seeks to break barriers

After a slight recovery, Bitcoin faces resistance in the $ 85,000 region, where he previously found difficulties to move forward. If the price can exceed this level, the next relevant resistance is $ 88,000. On the other hand, the most immediate support remains at $ 80,000, which proved to be a strong defense zone in the last falls.

Indicators suggest balance in the market

The relative force index (RSI) is in 54.51, pointing to a neutral market, with no signs of overcomparance or overwheliness. This level suggests that there is still room for a more significant movement, depending on the volume of negotiations and the behavior of institutional investors. In addition, Bollinger’s bands are narrowing, which may indicate an increase in volatility soon.

What to wait for the next few days?

The indecision of the market puts the traders on alert. For an optimistic scenario, BTC needs to break the resistance of $ 85,000 and consolidate above this level. Otherwise, a rejection can lead to new falls towards the $ 80,000 support. In addition to technical aspects, external factors such as economic data and regulatory decisions, they can influence the next Bitcoin movements.

The market remains attentive, and investors should monitor these critical points to make more assertive decisions in the coming days.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.