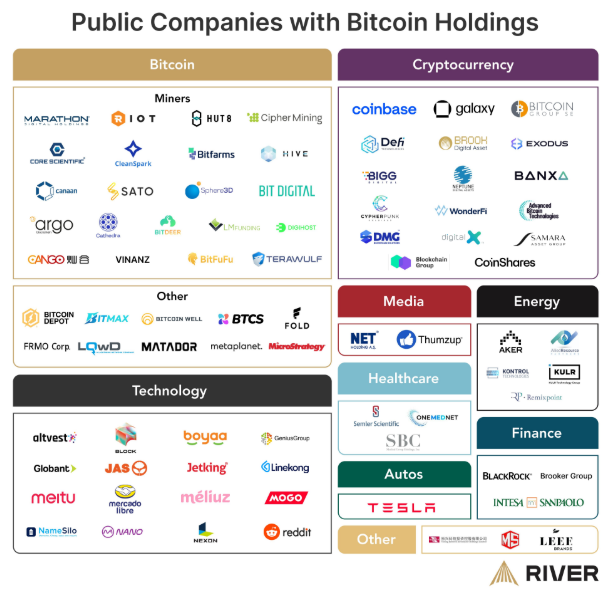

The number of publicly traded companies buying and maintaining Bitcoin (BTC) increased to 80 by 2025, a 142% growth compared to 33 companies in 2023.

This trend reflects the growing acceptance of bitcoin as a strategic reserve asset and inflation protection.

Why are public companies keeping Bitcoin in 2025?

The River Digital Asset Broker revealed that there was a large increase in the number of companies that are betting on Bitcoin between 2023 and 2025.

80 public companies are now buying Bitcoin. Two years ago it was 33. In two years will it be…?, River questioned no Twitter.

Companies that adopt cryptocurrency are part of various sectors. The technology sector represents half of public companies that have currency. Data from Bitcoin Treasuries show That companies like Microstrategy (now Strategy), Tesla and Block are at the forefront of Bitcoin integration into their financial strategies.

Financial institutions make up 30% of the total, including Fold Holdings and Global Coinbase, which have indirect exposure via ETFs. The cryptocurrency mining industry represents 15%, with mining giants such as Marathon Digital and Riot Platforms keeping significant bitcoin reserves.

The remaining 5% are composed of companies in other areas, including retail and energy. These companies use Bitcoin possession for transactions and balance diversification.

Several factors have driven the adoption of bitcoin among public companies. The search for inflation protection stands out as one of the main motivations, as companies seek value alternatives that go beyond traditional assets, as a way to preserve their purchasing power in an unstable economic scenario.

Bitcoin is the currency of freedom, an inflation protection for middle -class Americans, a dollar relegation remedy as a world reserve currency and the departure of a ruinous national debt. Bitcoin will have no stronger defender than Howard Lutnik, said recently US Secretary of Human Health and Human Services, Robert F. Kennedy Jr on social networks.

Many companies also adopted Bitcoin as a treasury reserve strategy, betting on its long -term appreciation. In this sense, companies like Strategy lead the way.

In addition, investor pressure was a decisive factor, with institutional shareholders and investors requiring companies to diversify their portfolios, incorporating digital assets. Greater regulatory clarity and policies favorable to cryptocurrencies in certain regions have also boosted the corporate adoption of these assets.

Bitcoin accumulation continues to rise

Meanwhile, public companies have accumulated Bitcoins at an unprecedented rate. Between 2020 and 2023, they held approximately 200 thousand BTC. In 2024, additional 257,095 BTC were purchased, doubling a total of five years ago.

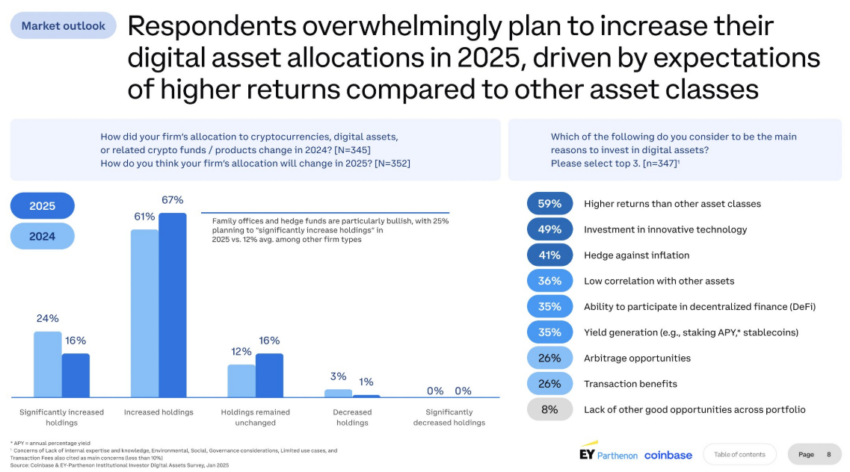

In the first quarter of 2025, it is estimated that between 50 thousand and 70 thousand BTC have already been added. In fact, Microstrategy and Fold Holdings lead the acquisitions. Recent search Coinbase institutional investors also indicated that 83% of institutions plan to increase their crypto allocation by 2025.

Public companies intensify BTC accumulation

The increase in the adoption of bitcoin by public companies coincides with a new wave of crypto -related IPOS (initial public offers). Notable companies, including Gemini and Kraken, plan Open capital, highlighting the growing institutional confidence in the digital asset space. These IPOS provide new capital influoxes and further legitimize the crypto market in general.

Bitcoin has also become a financial salvation board for difficulties that seek to increase their stock prices. Some falling companies have resorted to investments in Bitcoin to attract new investors and strengthen their position in the market. As a result, the BTC is playing an increasingly significant role in corporate strategies.

Despite the growth in corporate currency adoption, publicly crypto companies still represent only 5.8% of the total capitalization of the crypto market, according to a Coingecko report. This suggests that there is still a significant space for expansion.

In addition to corporate treasury, the growing adoption of bitcoin also influences financial planning in other areas. Parents are increasingly choosing Bitcoin as an alternative to traditional college savings plans, betting on their long -term growth potential to finance educational expenses.

With 80 public companies now holding bitcoin, the trend shows no signs of slowdown. In addition, if the current growth trajectory continues, institutional adoption will delve as more companies use cryptocurrency.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.