Bitcoin has been in a fall trend since mid -January, with attempts to break this cycle facing market resistance.

Although the recent price movement suggested that the BTC low trend could get worse, current market conditions show promising signs for possible recovery.

Bitcoin has suffered for a long time

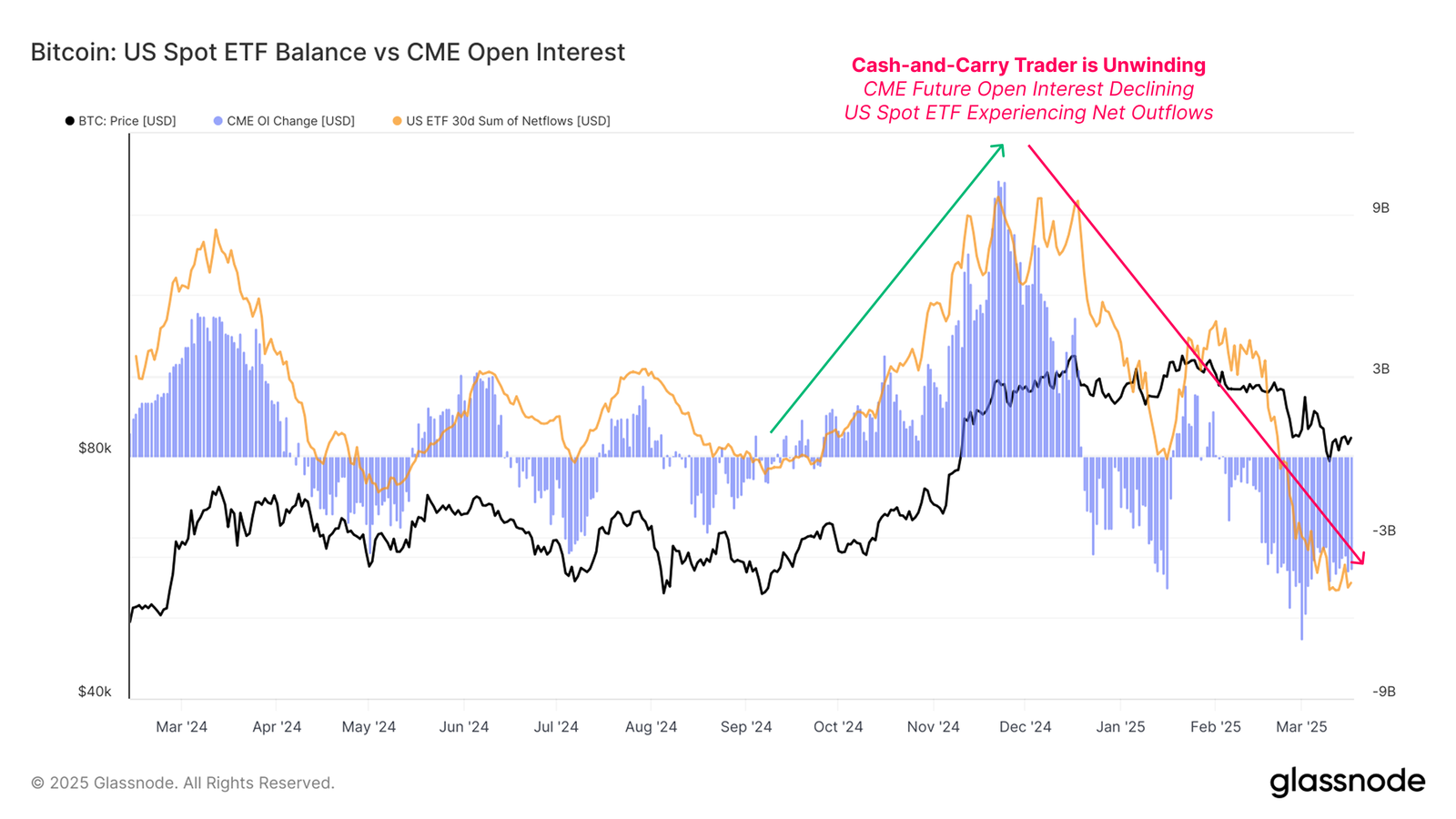

Strong evidence of a cash-and-carry operation can be observed when comparing the spot ETF flows in the US and Open Interest (Oi) in CME’s future contracts. As the purchase bias in the market begins to weaken, the unfolding of this operation becomes evident. Last month, this resulted in the highest rescues of ETFs and a drop in open interest, reaching the lowest level in 12 months.

These developments, while signaling weakness in the short term, historically precede phases of market recovery. Reducing redemptions suggests that liquidity pressure is decreasing, and investors’ feelings may lean again for accumulation. As market conditions improve, the gradual development of the “cash-and-carry” operation can provide Bitcoin the necessary support for long-term recovery.

Long -term holders show greater confidence

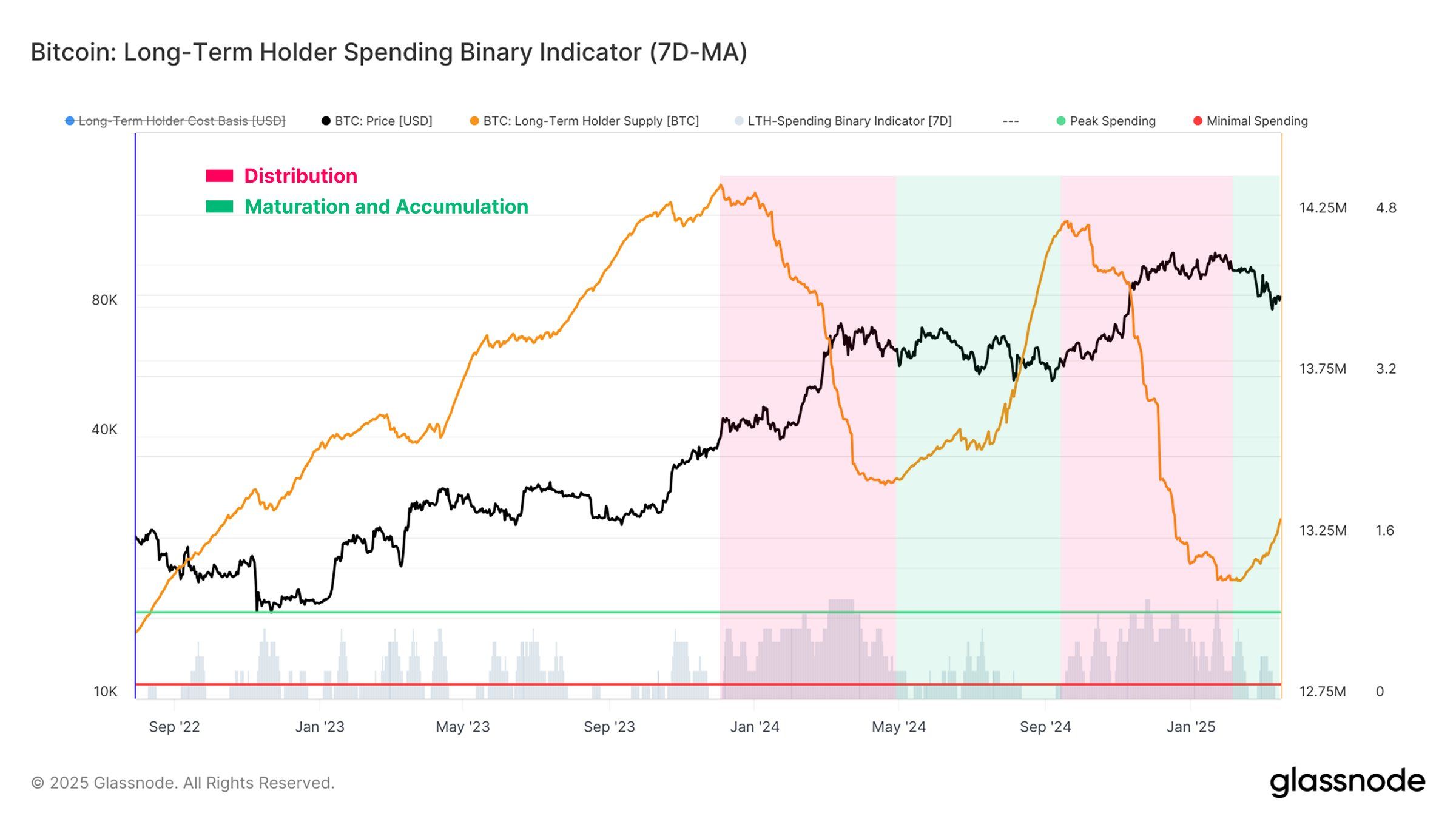

The binary expenditure indicator of long -term holders (LTH) recently slowed down, signaling a change in feeling. The indicator tracks when a significant proportion of Bitcoin’s long -term holders begins to spend their assets.

However, a slowdown in this spending behavior suggests that LTHs are less inclined to sell, indicating greater confidence in keeping their assets during this volatile period. Historically, when this trend occurs, it leads to a phase of accumulation, in which holders await a more favorable market environment.

In addition, the lowest LTHS spending activity may indicate that they expect a more favorable price, reducing sales pressure. This increases the chances of a high sustained and a possible recovery of Bitcoin.

BTC price needs to find a breach

Bitcoin is trying to break a two -month descendant wedge pattern, which has a rise opportunity for cryptocurrency to exceed $ 90,000. However, a successful breakage of resistance of $ 89,800 would confirm this movement, potentially starting a new high trend.

The high signs mentioned earlier support this optimistic perspective. If Bitcoin successfully surpasses the $ 89,800, it can rise to $ 95,761, recovering a significant part of recent losses. This could also increase investor confidence, reinforcing momentum.

However, this high thesis is at risk if Bitcoin cannot break the $ 89,800 or face difficulties to overcome the $ 87,041. In this case, the price could fall below $ 85,000, towards the $ 80,000, invalidating the discharge scenario and postponing any potential recovery.

Check out our page focused on Bitcoin Forecast Traders (BTC).

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.