After five weeks of consecutive exits, Bitcoin ETFs in the US recovered with $ 744 million in liquid entrances this week. On Monday, March 17, ETFs recorded, for example, a $ 274 million entry, the highest daily value in more than one month.

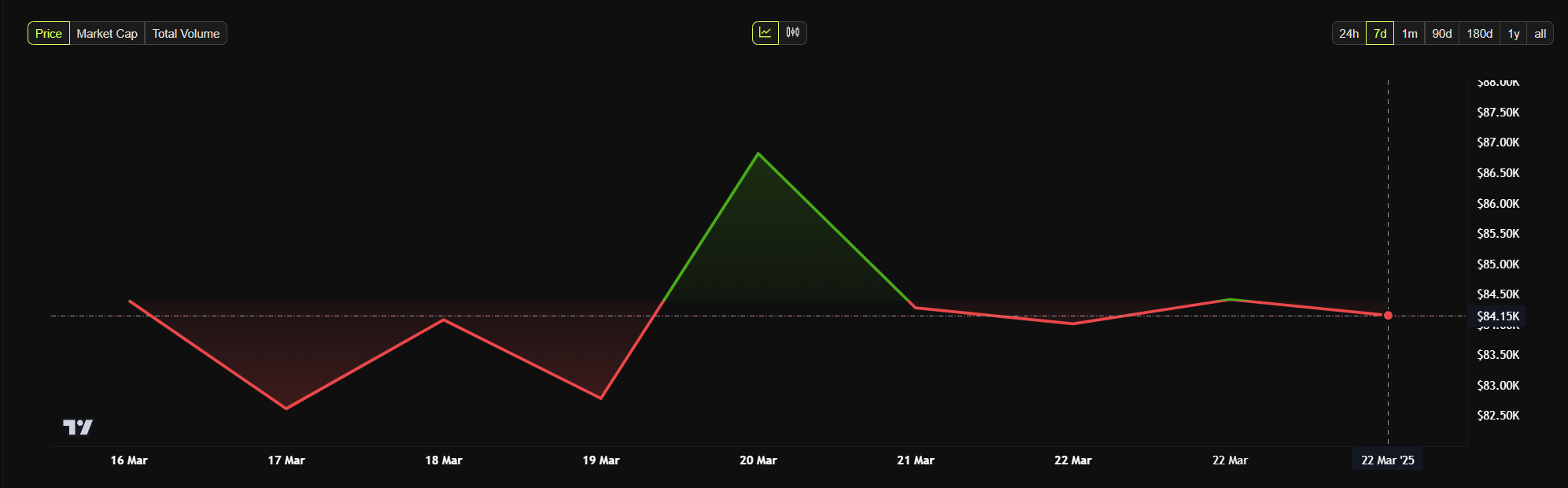

This recovery suggests that institutional investors are returning to the bitcoin market, as macroeconomic factors have been priced. However, the BTC remains below the level of $ 85,000.

Bitcoin ETFs start recovering after losses of $ 5 billion

Bitcoin ETFs in the US has lost more than $ 5.3 billion since the second week of February. The month was particularly difficult for these funds, with a record of $ 4.5 billion in exits.

The strong sale was attributed to the settlement of positions by institutional investors, amid market volatility and changes in macroeconomic conditions. However, March signaled a turn, with the entries gradually increasing over the past week.

With macroeconomic concerns decreasing, institutional investors seem to be recovering trust in the market. The week started hard, with Bitcoin ETFs registering $ 274 million in tickets on Monday.

The positive momentum persisted, culminating in six consecutive days of liquid entrances. On March 21 alone, ETFs registered a total net input of US $ 83.09 million.

O IBIT da BlackRock He led the way, recording up to $ 150 million in positive flows on Friday. Meanwhile, all other broadcasters remained stagnant. The only exception was the Grayscale GBTC, which remained the trend of exits, losing $ 21.9 million that day.

Bitcoin ETFs has a larger sequence of entries in March

This change suggests, for example, that major institutional players may be positioning themselves for possible market recovery. Open4Profit’s crypto and founder, Zia Ul Haque, highlighted this resumption, questioning whether institutional investors are acting based on privileged information.

The institutions started to accumulate again: do they know about something?! Bitcoin ETFs have recorded positive entries in the last 5 consecutive days! This is the largest sequence of entries this month. Since early March, the giants have sold BTC heavily, which created a great panic and a drop in market price. But in recent days, they are accumulating again. This can be a good sign for the market, wrote UL HAQUE no X.

This observation is aligned with the constant recovery in the ETF inputs and the Bitcoin price movement, which continues to defend itself mainly against new falls.

Market in doubt

However, despite the positive flows of ETFs, not everyone shares the optimistic view of Bitcoin’s price recovery. Some analysts believe that entrances to Bitcoin ETFs do not clearly reflect the return on buyers’ interest.

Institutional negotiation strategies are potentially undergoing structural changes. Hedge funds often use a low -risk arbitration strategy involving Bitcoin ETFs and CME futures.

The ‘demand’ for ETFs was real, but part of it was purely for arbitration. There was a genuine demand for having BTC, but not as much as we thought. Until real buyers enter the scene, this volatility and oscillation will continue, explained popular analyst, Kyle Chasse no X .

If this structural change continues, it may influence market stability, despite the recent return on ETF inputs.

At the time of this publication, Bitcoin is being negotiated at about $ 84,148. It records a modest drop of 0.46% in the last 24 hours, without reflecting optimism in the face of the recent increase in investments in Bitcoin ETFs.

Meanwhile, Ethereum ETFs continue to register negative flows, with net entries within 12 consecutive days of negotiation (more than two weeks).

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.