An inactive Bitcoin investor for almost a decade has recently reappeared, attracting great attention from the entire crypto community.

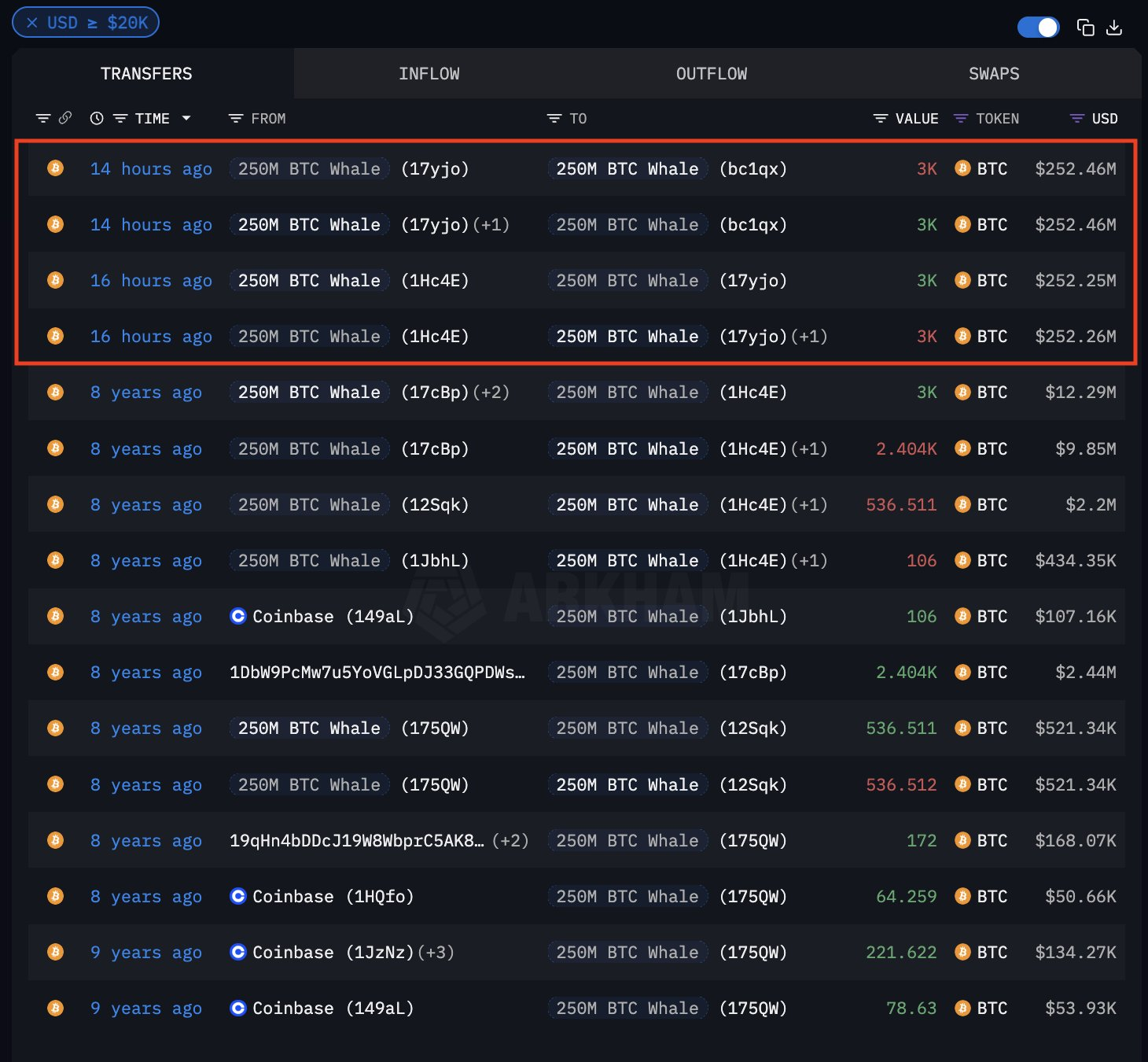

Last Saturday (22), a Bitcoin whale moved 3,000 BTC, representing more than $ 250 million at the time of the transaction. The crypto universe defines a bitcoin whale as an individual or entity that has over a thousand BTC.

Why did the Bitcoin Baleira back to active?

Arkham reported that Bitcoin’s whale created its wallet at the end of 2016, when Bitcoin was negotiated for less than $ 1,000.

The investor’s original investment-estimated at about $ 3 million-has grown since, becoming a massive fortune, reflecting the long-term potential of the asset.

During this retention period, Bitcoin reached a historic record of nearly $ 110,000 in January 2025. Although the price retreated to about $ 84,274, the whale ROI remains impressive.

The reason behind the transfer remains uncertain. However, analysts observed that the funds were moved to another wallet – not to an exchange – which suggests that the holder may be restructuring his position instead of preparing to sell.

This detail seems to have calmed the fears of a fall in the market. Beincrypto data show that the crition market has generally remained stable despite the activity of the whale. Bitcoin and other main assets had little price volatility in response.

Meanwhile, this transfer is not an isolated case. In the last year, several dormant wallets for a long time showed signs of activity.

Some analysts believe that the initial holders are reevaluating their positions, as Bitcoin operates close to historical maxims. Others suggest that these investors may be preparing for more complex strategies, involving futures or options.

However, this case reinforces Bitcoin’s reputation as a long -term value reserve. The whale’s decision to hold the asset for almost a decade shows how he has overcome traditional wealth reserves, such as gold and the US dollar.

In addition, the recent integration of the main cryptocurrency into the traditional financial system – driven by the launch of a Bitcoin ETF in sight and plans for a US Bitcoin Strategic Reserve – only strengthens this narrative.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.