The market is experiencing a renewed optimism, with crypto inputs reaching $ 644 million last week.

This is a significant reversal after five consecutive weeks of exits, suggesting a significant change in investors’ feeling.

Crypto entrances reach $ 644 million and market feeling recovers

The recovery follows a challenging period when investors’ feeling remained cautious, leading to substantial withdrawals from the market. With total assets under Management (AM) rising 6.3% since March 10, the latest data suggest a decisive change in market trust.

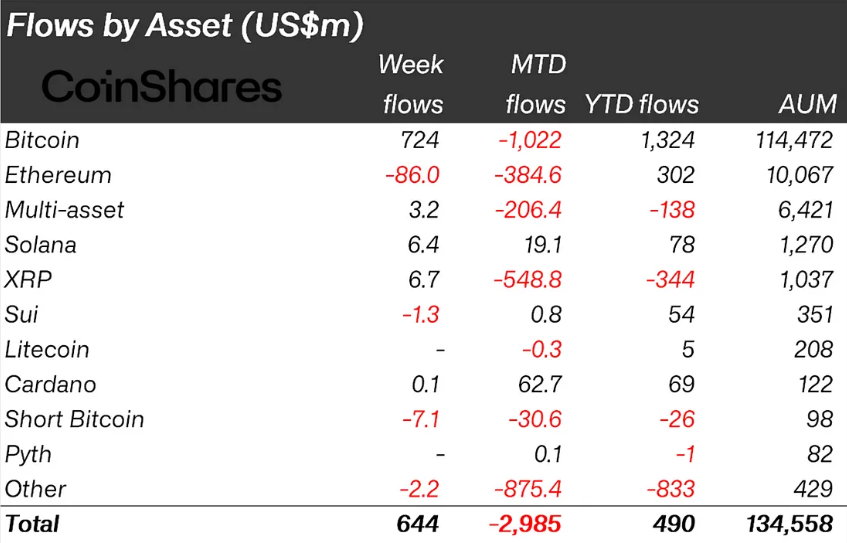

According to the latest Coinshares report reportBitcoin emerged as the main engine of market recovery. The pioneer cryptocurrency attracted US $ 724 million in tickets, effectively ending a sequence of five weeks of exits that totaled US $ 5.4 billion.

The increase in influences reflects the growing confidence of investors in Bitcoin, which had previously recorded sustained withdrawals amid the broader uncertainty on the market. While Bitcoin had a strong recovery, the Altcoins market had a mixed performance.

Ethereum faced the largest exits, with $ 86 million leaving the asset. On the other hand, Solana registered $ 6.4 million.

The divergence in feeling about altcoins points out that investors remain selective about where they allocate capital. Specifically, they focus on projects with foundations perceived as strong. While data point to continuous caution compared to Ethereum (ETH), also indicate that investors see potential in Solana (sun).

Meanwhile, most of last week’s starters originated in the US, which saw $ 632 million entering investment products in digital assets.

March reverses negative trend of February

The return to the entrances follows a difficult February and early March, during which time the crypto exits triggered. A week earlier, the exits totaled $ 1.7 billion, with Bitcoin suffering the largest withdrawals.

Prior to that, the exits reached $ 876 million, led by US investors who have undertook digital assets in the midst of a low trend. Therefore, the recent influx of capital suggests that feeling may be changing, possibly driven by renewed institutional interest and a more stable macroeconomic scenario.

Further reinforcing market recovery, Bitcoin ETFs (scholarships) also recorded a strong capital influx. After five consecutive weeks of exits, these funds recorded $ 744 million in entries last week. This signals greater institutional participation.

Recovery is aligned with Bitcoin’s broader resurgence and suggests that investors are recovering confidence in crypto -based financial products.

I bet the BTC will reach $ 110,000 before retesting $ 76,500. Why? The Fed is passing from QT to QE in Treasury titles. And tariffs don’t matter because inflation is transitory, he wrote Arthur Hayes, founder of Bitmex.

Meanwhile, beincrypto data show that the BTC was being negotiated at $ 87,720 at the time of this publication. This represents an increase of almost 4% in the last 24 hours, with the pioneer cryptocurrency advancing towards the psychological level of $ 90,000.

Bitcoin rose over $ 87,000 on Monday, its highest value since March 7, after falling to $ 76,000 earlier this month. The rally occurs while reports suggest that Trump fares, scheduled for April 2, will be more targeted and less disruptive than the fearful, finance expert Walter Bloomberg noted.

Trump’s upcoming April 2 and nicknamed “Liberation Day”, should be less disruptive than expected. This can increase investor confidence in higher risk assets such as bitcoin. The White House plan for reciprocal tariffs aims to equalize trade barriers, with the former president emphasizing that there will be no exceptions, but offering “flexibility” not specified for some countries.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.