Bitcoin (BTC) shows signs of a possible high, with the recent price movement indicating positive momentum.

While the general conditions of the market are stabilized, crypto remains stable, with consistent behavior of investors feeding hopes for additional gains. Altcoin is positioned for possible growth, continuing to attract participants’ attention.

Bitcoin has the support of large holders

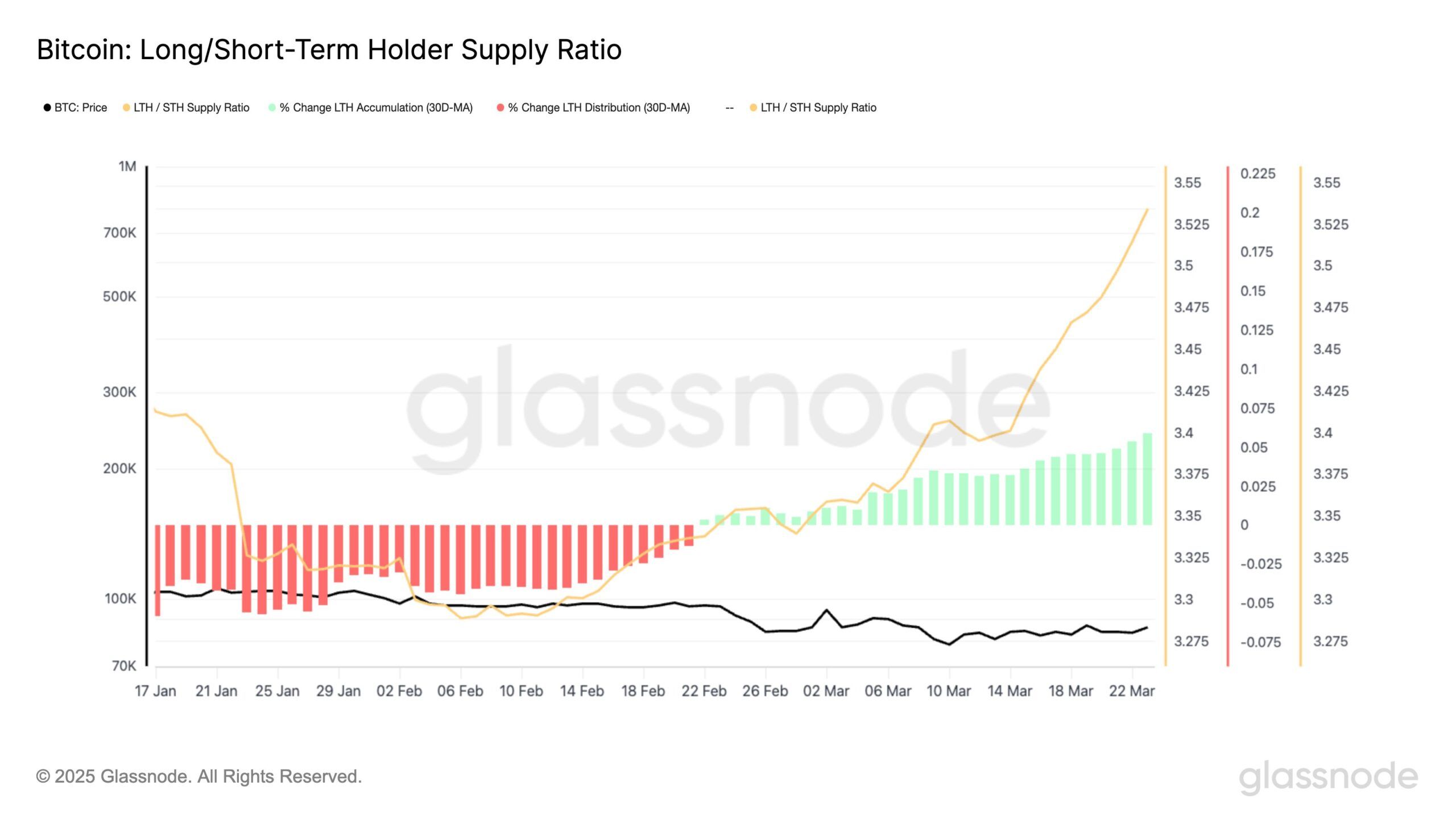

The relationship between supply of long and short -term holders has shown significant growth since late February, signaling a positive change in investors’ behavior. Long -term holders (LTHS) are constantly accumulating, with the accumulation rate in 30 days reaching close to 6%. The pace of this change has also increased, with a daily average of 7% since the end of February.

This sustained accumulation suggests that LTHs have strong confidence in Bitcoin’s potential future, which can help maintain recent growth. These investors are often seen as a stabilizing force, and their consistent accumulation can serve as the basis for the high price trend.

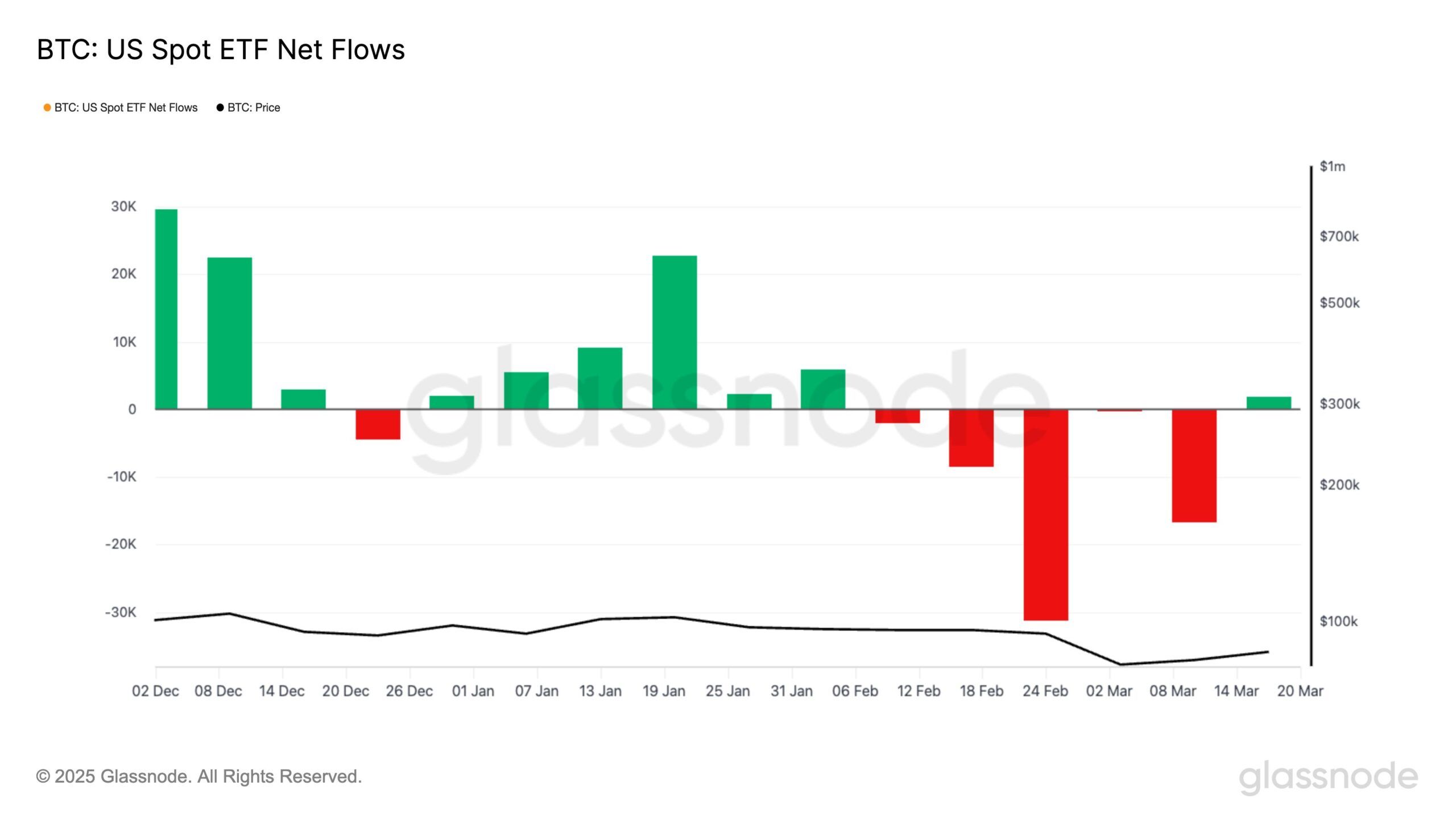

The BTC also recorded a positive change in Momentum Macro, especially with recent influoes in ETFS Spot. Last week marked the first influx in a month, interrupting a sequence of four weeks of exits. This change indicates a return of trust among investors, especially macropinance. The renewed interest in these products reflects the growing demand for crypto exposure in institutional portfolios.

Influxes show that large investors are again seeing bitcoin as a valuable asset. This can be a strong sign that demand is recovering, which can boost the price even more. The involvement of institutions can lead to significant appreciation in the coming weeks.

The high price of the BTC is consistent

Bitcoin is currently being negotiated at $ 86,630, breaking a descendant wedge pattern. The price tries to consolidate $ 86,822 as a support, which will be crucial for the next movement. If the support is maintained, crypto can continue its rise trajectory towards the level of resistance of $ 89,800.

In addition, the confirmation of the rupture will come when the resistance of $ 89,800 is transformed into support. A sustained movement above this level can take the price at $ 93,625 and potentially $ 95,000.

However, if Bitcoin cannot exceed $ 89,800, it may have difficulty maintaining its current momentum. In addition, a consolidation below this level or a drop to $ 85,000 would delay recovery, changing market feeling to caution. This would interrupt progress and could lead to a longer phase of consolidation.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.