Bitcoin, the pioneering cryptocurrency, has transformed the way people around the world see finance and money. However, with the advancement of technology and the evolution of external factors, digital currency faces structural challenges that can impact its existence and growth in the future.

A recent discussion between industry leaders highlighted significant risks that may pose a black swan event for the future of Bitcoin.

What is the biggest threat to Bitcoin?

Lyn Alden, founder of Lyn Alden Investment, recently asked, “What is the biggest structural risk for Bitcoin in the next 5 to 10 years?” The question has generated great attention and responses from investors, experts and industry leaders, revealing urgent concerns.

One of the most mentioned risks is the threat posed by quantum computing. Nic Carter, general partner of Castle Island Ventures, answered concisely: “quantum.” Your answer was widely endorsed.

I agree more and more. That was the catalyst for my question, actually answered Lyn Alden to Nic Carter.

Future quantum computers can break the encryption algorithms that protect Bitcoin, such as Elliptic Curve Digital Signature Algorithm (ECDSA), which ensures wallet safety. If a sufficiently powerful quantum computer comes up, it can forge digital signatures, allowing invaders to steal bitcoin from any portfolio with an exposed public key.

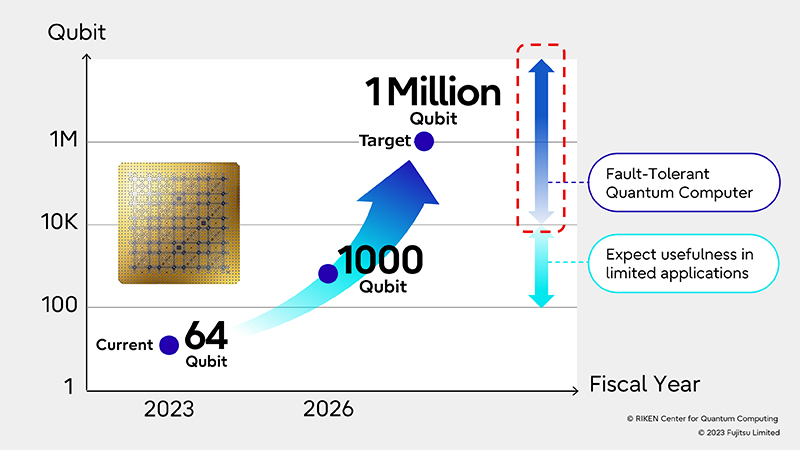

According to River research, a quantum computer with 1 million quibits could break a bitcoin address. Microsoft said its new chip, called Majorana, is paving the way to this milestone. This raises an urgent question: How long does Bitcoin have before it needs to become a quantum resistant?

Although the threat of quantum computing is evident, some argue that a more immediate challenge is whether the Bitcoin community will be able to reach a consensus and implement Quantum resistant solutions in time.

That would not be to reach a fast enough consensus on the implementation of a Quantum resistant hash algorithm, commented Stillbigosh, former Spellist in Cyberrsecurity at Flutterwave.

However, blocktower founder Ari Paul stressed that the Bitcoin network faces a more immediate risk as attack costs have fallen significantly.

Someone selling over 10% of BTC market capitalization and spending about 1/10 of this to get 51% control of hash power and mining empty blocks indefinitely, effectively turning off the network. You can fork the Pow algorithm, but that means the attack on the new network now costs less than 1/1000 of the previous one, Ari Paul noted.

The risk of conflict between the decentralized nature of Bitcoin and regulatory supervision

In addition to technical challenges, some investors fear that government and institutional intervention be the biggest risk for Bitcoin over the next 5 to 10 years.

“Governments and institutions changing the incentives of everything,” said investor Shinobi.

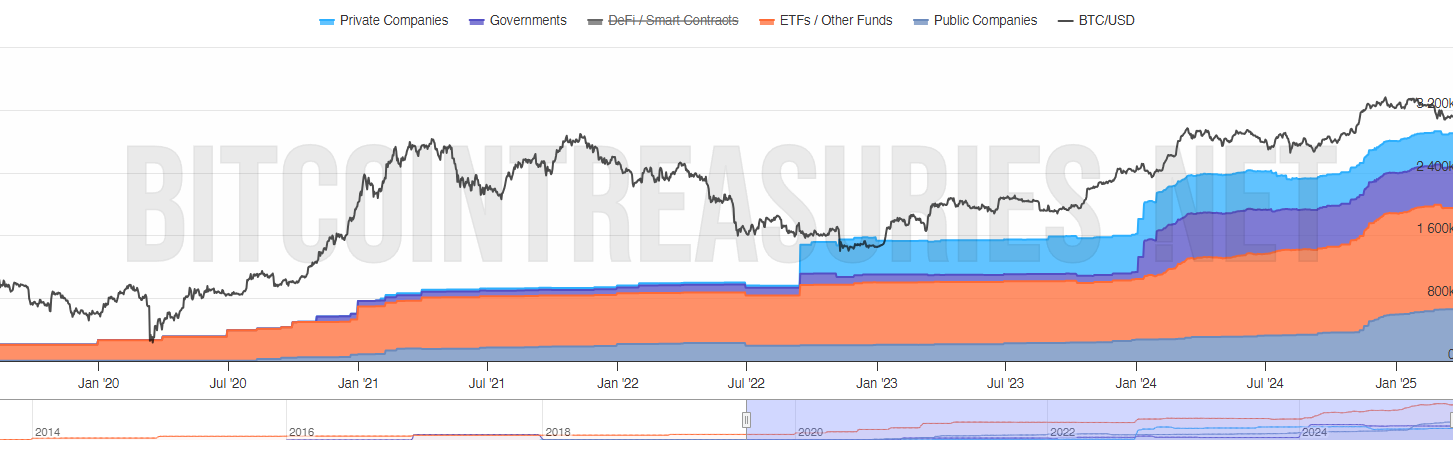

According to Bitcointreasuries, Bitcoin reserves in companies, governments and ETFs rose from 210,000 to over 2.6 million BTC in five years. As a result, regulatory intervention can introduce legal pressures or unwanted changes in Bitcoin’s fundamental operations.

The greatest structural risk is friction between the decentralized ethos of bitcoin and the growing pressure for centralized regulatory supervision. In essence, as governments and large institutions press control and impose compliance, the network can be forced to compromise its central principle, warned investor Misterspread.

In addition, the discussion caused by Lyn Alden’s question suggests risks that can trigger black swan events to Bitcoin. It also reflects the growing awareness between industry leaders and investors about the systemic risks of digital currency in an era increasingly shaped by political stability and artificial intelligence.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.