Bitcoin has long been considered a value reserve, often compared to digital gold. However, with rapid advances in decentralized finance (Defi) and blockchain infrastructure, the demand for new ways to use bitcoin and passive possession has increased.

Satlayer, a pioneer Bitcoin -based infrastructure provider, is at the forefront of this transformation. Through Resting and Validated Bitcoin (BVS) services, Satlayer aims to unlock new use cases for Bitcoin (BTC), ensuring its integration into the change financial ecosystem. The benchrypto talked exclusively with Satlayer’s co-founder and CEO Luke Xie to explore how Bitcoin’s role expands and what the future reserves for Bitcoin-based infrastructure.

In addition to a value reserve: the next evolution of Bitcoin

According to Xie, Bitcoin has gone through several phases – from an experimental digital currency to a widely recognized value reserve. Now, as the widest crypto ecosystem has evolved with smart contract capabilities, Bitcoin holders sought new opportunities and simply keeping their assets.

Xie points out that bitcoiners observed Ethereum (ETH) and other networks, including Solana (Sol), offering staking opportunities and income generation. Meanwhile, Bitcoin itself remained widely passive.

According to Xie, Satlayer’s mission is to change this by introducing resting. By doing so, it allows Bitcoin holders to generate yield while protecting decentralized applications (Dapps).

“Naturally, the bitcoiners, who watched this innovation to occur as they firmly maintained their assets, want part of this action: performance, use cases, Onchain opportunities. As we all know, the Bitcoin network was not built for this kind, but developers met the Bitcoin infrastructure defi in layer 2. Processing is high, and the types of primitives you would expect to find – for negotiation, loans and more – they are all in place, ”Xie told beincrypto.

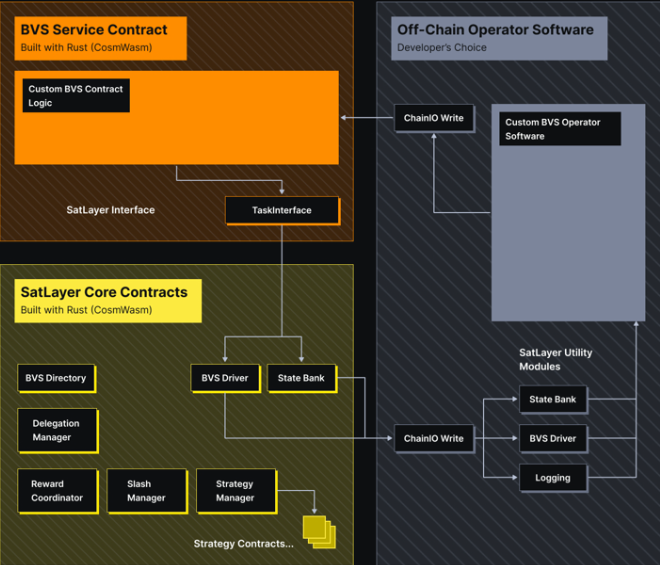

Bitcoin Validated Services (BVS): Improving Safety and Utility

At the center of Satlayer’s vision are the validated Bitcoin (BVS) services. This concept allows Dapps to be protected by BTC restoked. Unlike native tokens, which may lack liquidity and stability, the incomparable value and liquidity of Bitcoin make it the ideal asset to protect defi protocols.

BVS allows Bitcoin holders to cock their assets while simultaneously gaining staking rewards. Xie explained how BVS improves the safety and usefulness of Dapps.

“BVS describes any decentralized application or protocol that uses BTC restoked to protect your network. In real terms, this means that participants will use BTC Restoked as a guarantee in exchange for the right to validate transactions on the network. As Bitcoin is valuable, this effectively eliminates the incentive for validators to act in a dishonest way,” said Xie.

Any crypto asset, like a native token, could serve as a guarantee for this purpose. However, it will be less liquid, valuable and stable than the BTC.

Restaking on Bitcoin: Unlocking Yield and Safety

In addition, Xie shared that Satlayer’s resting mechanism is designed to be friendly and safe. By taking advantage of Wrapped Bitcoin (WBTC) or BTC Liquid Staking tokens, users can participate in Resting through the Satlayer platform, selecting Protocols like Lombard, Lorenzo or SolvbTC for Restake.

This process allows BTC holders to gain rewards while actively participating in the safety of Bitcoin -based emerging applications. The system mirrors the success of Ethereum -based restaking protocols such as Eigenlayer (Eigen). It allows Bitcoin holders to contribute to the safety of the network without risk of custody.

Binance’s recent integration with Babylon, a major stinging infrastructure provider, is a significant boost for this ecosystem. Beincrypto reported that Binance has incorporated Babylon’s BTC Staking Solutions into its offers. This marks a big step in the legitimation of Bitcoin Staking on a large scale.

This integration provides bitcoin holders at Binance continuous access to Staking and Resting services, further boosting institutional and retail adoption. Similarly, with partnerships such as Babylon, Satlayer enhances Bitcoin’s Staking Ecosystem.

“It’s a symbiotic relationship in which everyone benefits – Babylon, Satlayer and, most importantly, Bitcoin holders,” he added.

By collaborating with Babylon, Satlayer strengthens Bitcoin’s presence in Defi. Creates a solid structure where the BTC can be staked and restoked without compromising safety. The synergy between these platforms accelerates Bitcoin’s growth from a passive value reserve to an active financial instrument within the broader crypto economy.

Security and future innovations

Security remains a priority for Satlayer. Xie emphasizes that strict audits and careful protocol design ensure that Bitcoin’s resting maintains the safety and decentralization by which Bitcoin is known.

Looking to the future, Satlayer plans to introduce yield optimization with AI. The company also foresees on-chain insurance supported by Bitcoin collateral and simplified resting services. Xie also sees Bitcoin’s infrastructure growing rapidly over the next five years.

“It’s too early for Resting, so the obvious answer is a massive increase in TVL and active users. It’s a self -realizable narrative of the ‘days without incident’ nuclear power plant: the longer Bitcoin resting successfully, the greater the confidence it will gain,” concluded Xie.

As Bitcoin grows, Satlayer’s innovations can be crucial to transforming the world’s most valuable cryptocurrency into an performance active. With the expansion of Bitcoin infrastructure, along with these developments, the pioneering crypton can go beyond its role as digital gold and turn into a fully integrated asset and income generator within the widest crypto economy.

Its dominance in the digital economy is about to grow besides being just a value reserve.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.