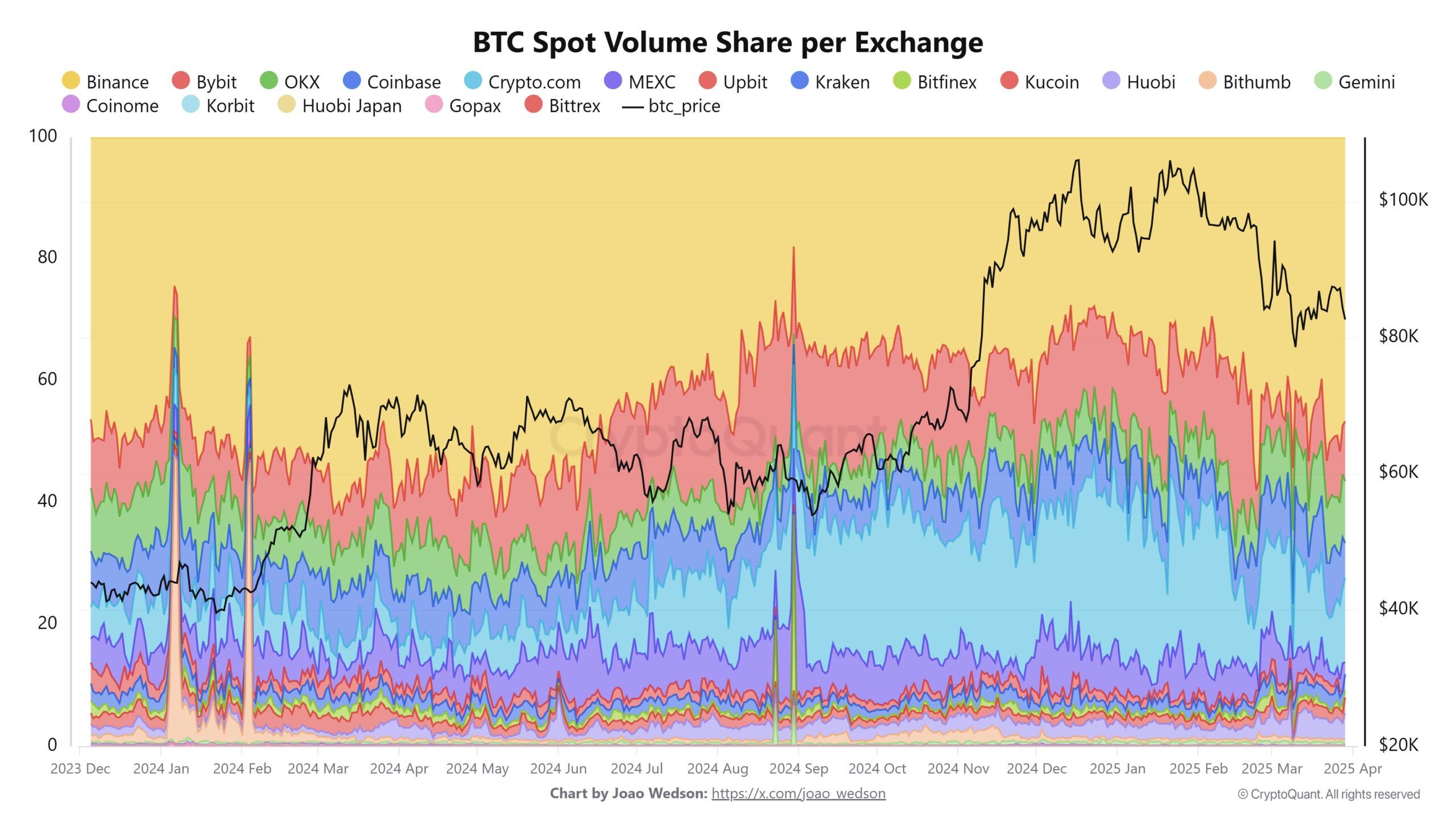

Binance’s sight negotiation volume surpasses all other combined exchanges and has reached a market share of 41.87% – the largest in the last 10 months.

Binance has solidified its position as the main exchange of crypto. However, this domain raises concerns about market concentration and its broader impact on the crypto industry.

Binance continues to lead the crypto market

Binance has reinforced its status as the main crypto exchange, with its view volume overcoming all combined competitors. An X publication by analyst Joao Wedson yesterday (30) pointed out that the volume of trading in sight of Exchange is now eight times larger than coinbase.

Although this number has fallen compared to the beginning of 2024, it still shows Binance’s global dominance. Despite the fall in the overall volume of sight in the market, Exchange’s leadership remains unshakable.

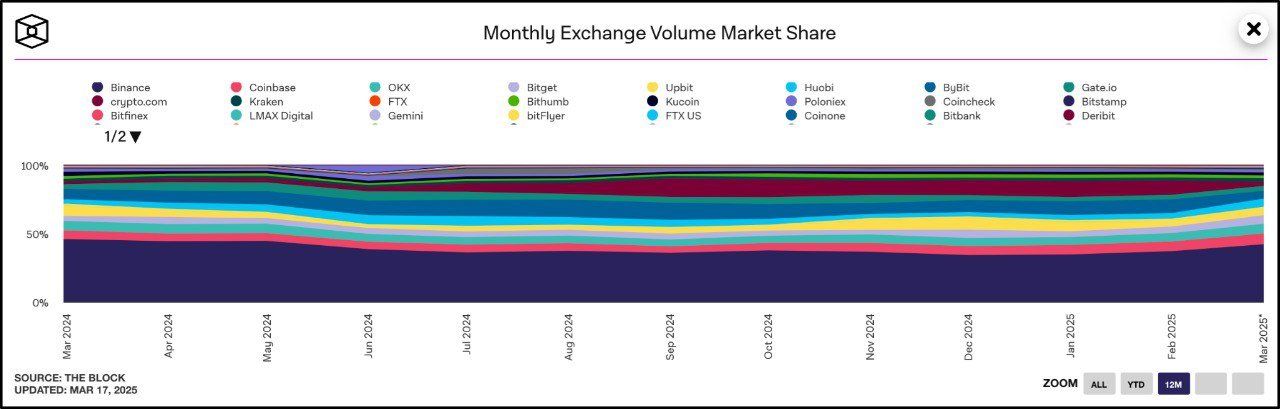

Additional data from an X Cryptoverse publication indicates that Binance market share has risen to 41.87%, marking a 10 -month peak. This number is five times larger than coinbase and almost six times larger than OKX, another great participant.

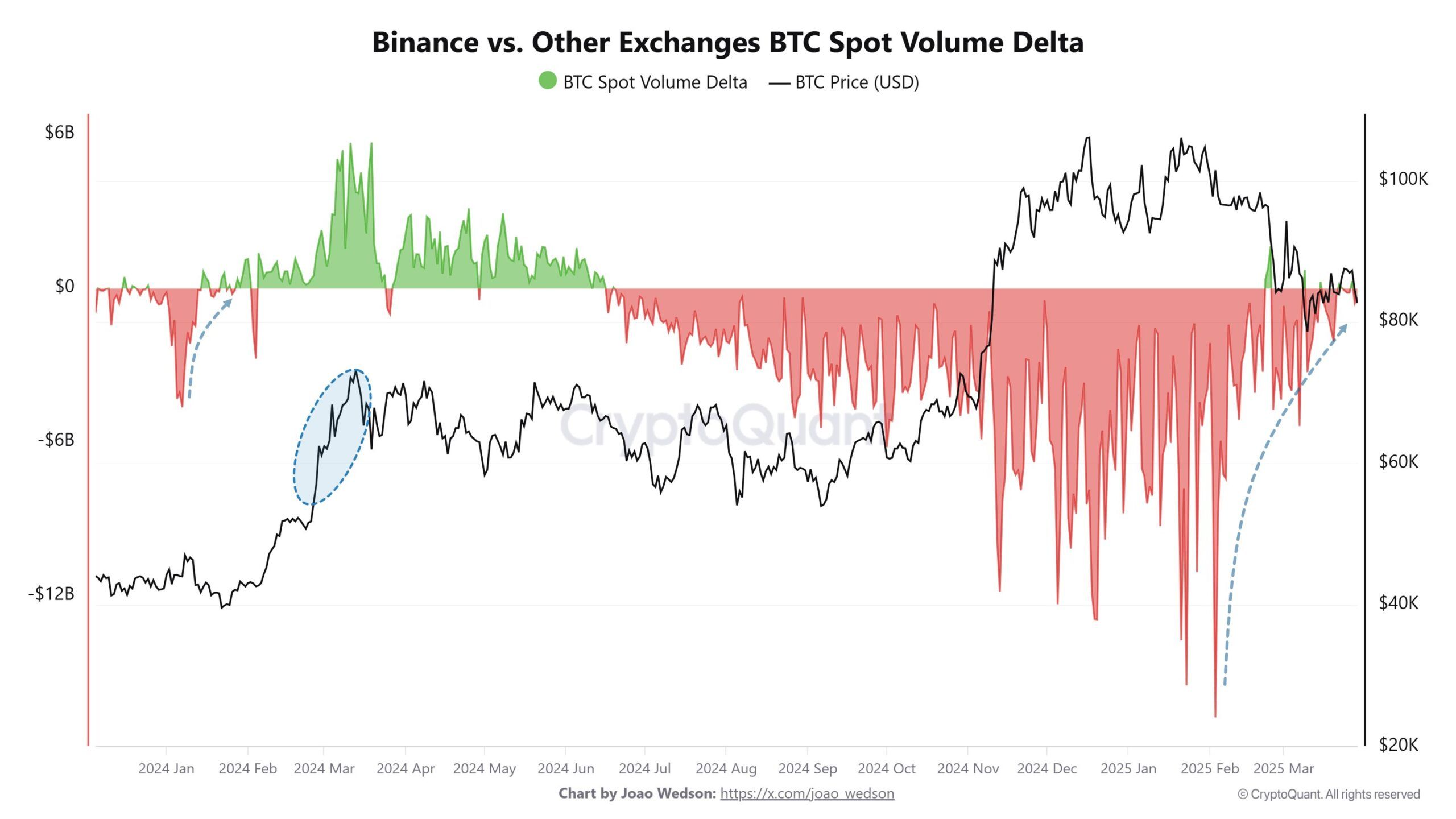

One of the most intriguing aspects of the company’s dominance is its historical correlation with Bitcoin’s price movements. According to Joao Wedson, in January 2024, when Binance’s cash trading volume exceeded all other combined exchanges, the price of the BTC rose from $ 42,000 to $ 73,000 in the following weeks.

This pattern will be repeated by 2025. The Binance VS BTC Vs. Delta Vs. Delta Index. Other exchanges, which measures the difference in Bitcoin’s sight negotiation volume between Binance and its competitors, became positive again. In addition, according to the analysis, this can signal a high trend for Bitcoin in the coming months, even with the fall in the overall volume of cash negotiation.

Binance faces centralization concerns

The correlation suggests that binance dominance may be a main indicator for Bitcoin discharge races. Exchange’s ability to attract significant negotiation activity often reflects a high market interest and liquidity. This can boost the momentum of prices.

Several factors contribute to the sustained dominance of binance in the cryptocurrency market. First, its broad global reach. According to one Binance reportExchange has served more than 250 million users worldwide and consistently reports daily trading volumes over $ 30 billion. About that, data From The Block indicate that coinbase, with 110 million users, deals with only about $ 15 to 20 billion daily.

On the other hand, Binance’s high volume of negotiation improves market liquidity. Thus, facilitating to traders the execution of large orders without causing significant prices fluctuations.

However, Binance market share raises concerns about centralization. This can make binance vulnerable to hack or data leaks. Binance has also been the target of many tokens listing accusations, causing mixed reactions in the community.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.