Bitcoin (BTC) faced a challenging start in 2025, recording his worst returns in seven years during the first quarter.

The significant fall has left investors wondering if it is now the time to buy or sell.

What is behind the low performance?

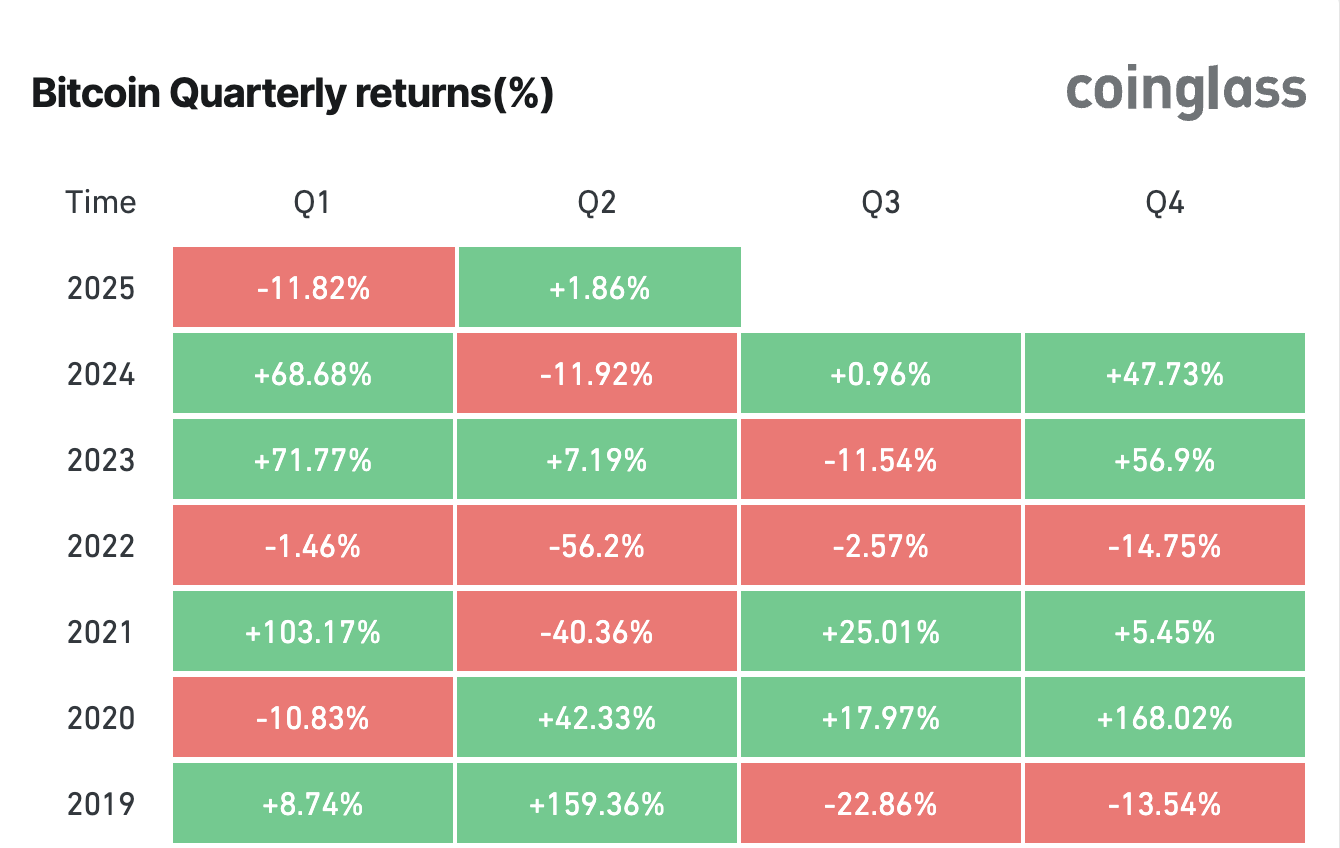

By 2025, Bitcoin had its weak performance in the first quarter since 2018, a year marked by a severe low market that made BTC lose more than 50% of its value. Coinglass data show that asset performance in the first quarter of 2025 fell 11.82%. In the first quarter of 2024, Bitcoin registered an increase of more than 68%.

The price of Bitcoin fell from $ 106,000 in December 2024 to about $ 80,200 at the end of March 2025.

Thus, the fall reflects a combination of macroeconomic pressures and political uncertainties, especially after US President Donald Trump’s new tariff policies.

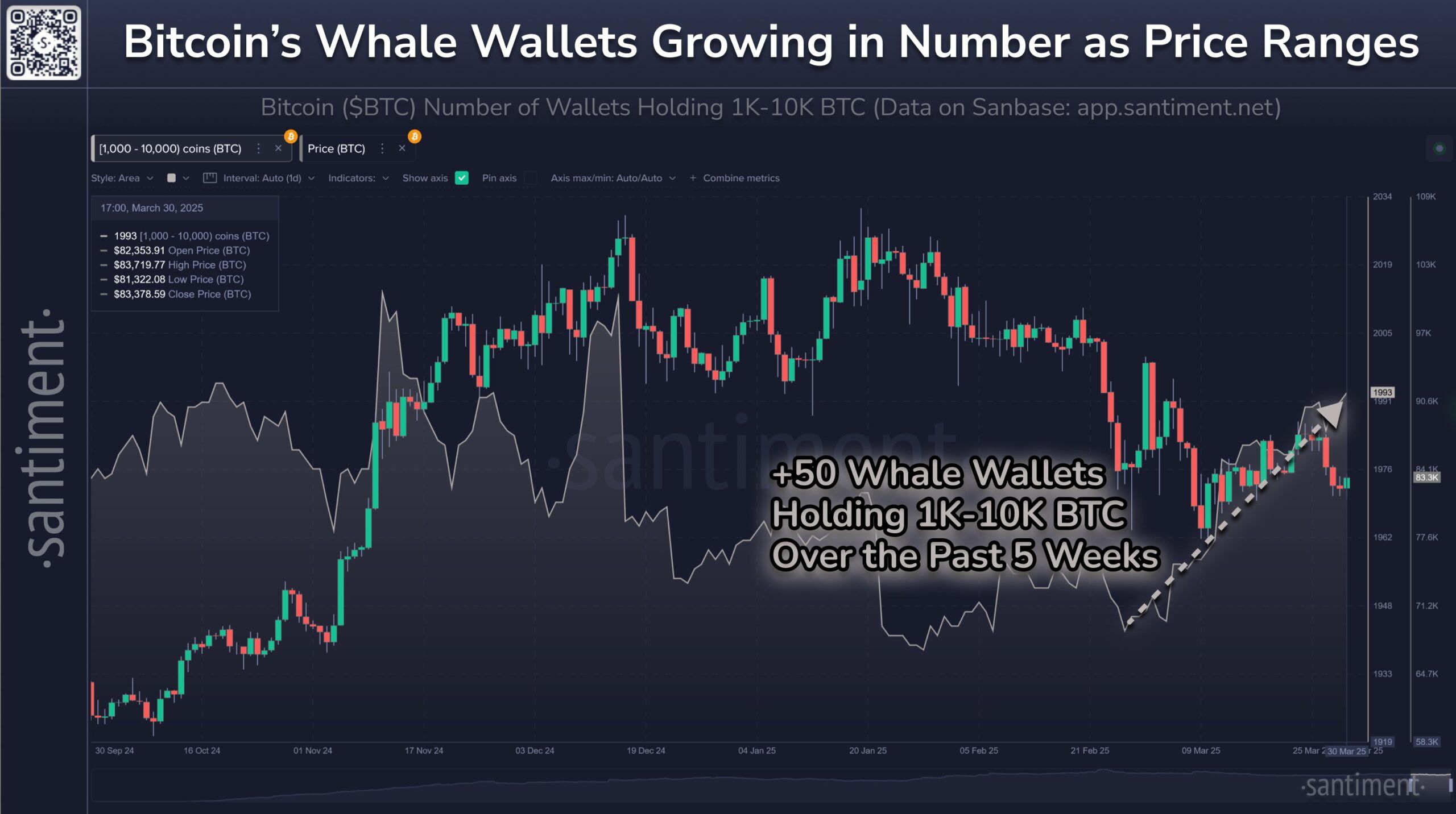

Amid this low scenario, on-chain data reveals a contrasting trend: Bitcoin whales are accumulating. A sanctiment publication yesterday (31) reported that the number of whale addresses with 1000 to 10,000 BTC reached 1,993.

This is the largest number since December 2024. This represents an increase of 2.6% in the last five weeks, signaling increasing confidence among large holders.

In addition, Glassnode reported yesterday (31) that the negotiation activity between Bitcoin holders with a horizon of 3 to 6 months has fallen to its lower level since June 2021. The fall indicates that short -term holders or maintain their positions or leave the market, reducing sales pressure.

“BTC holders are at the lowest levels since mid -2021. This inactivity reinforces the idea that recent buyers are keeping their positions instead of leaving despite recent volatility.” reported a Glassnode.

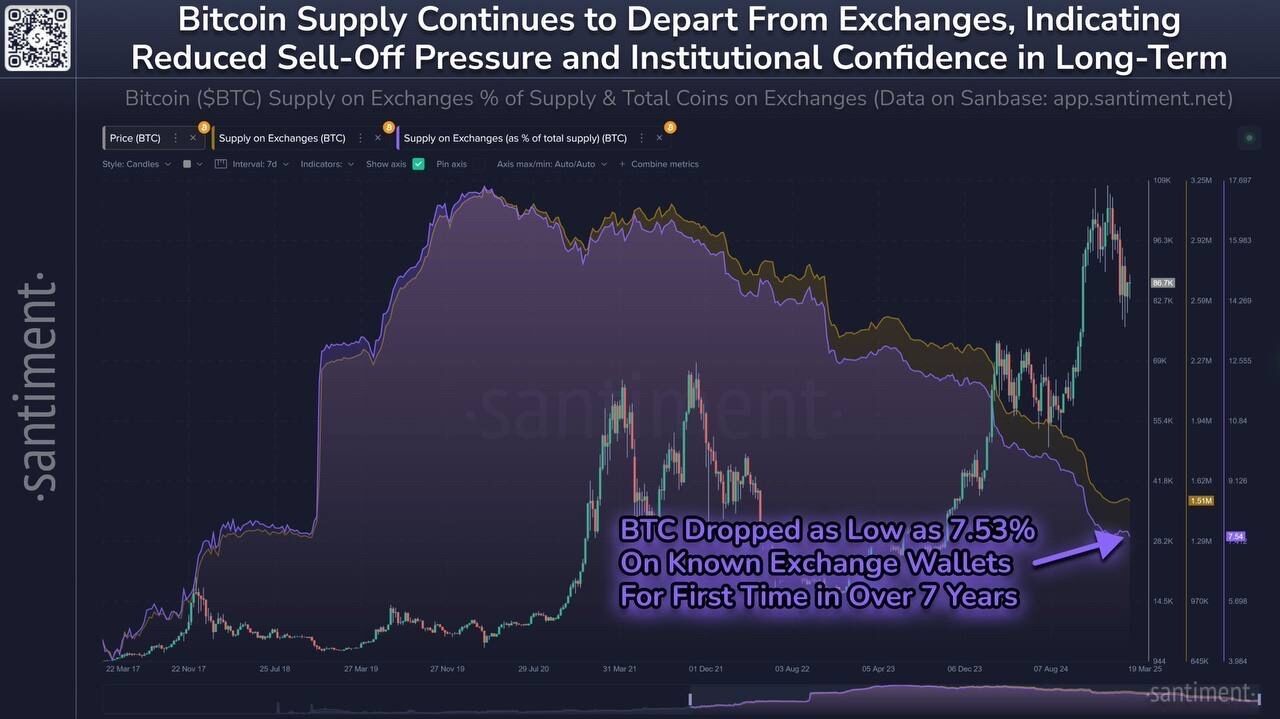

In addition, on the same day, the offer of Bitcoin at Exchanges has fallen to 7.53%, the lowest level since February 2018. This is usually correlated with long -term holding holding, creating scarcity that can raise prices over time. Together, these indicators suggest that Bitcoin may be entering a phase of accumulation and consolidation.

Time to buy bitcoin?

Thus, the market analyst Axel Adler Jr. stated In X today (1) that Bitcoin’s sales pressure has been exhausted. In addition, Adler foresees a consolidation range forming in April and May, suggesting that the market can stabilize before its next significant movement.

A Fidelity Research belief that Bitcoin is gaining momentum for the next phase of its “acceleration phase.” Thus, the company’s analysis is based on historical cycles, noting that periods of consolidation often precede large price increases. This is driven by institutional adoption and the role of Bitcoin as inflation protection.

Therefore, the analysis is aligned with the trend of accumulation of whales and the decrease in supply in the exchanges, pointing to potential high impulse in the medium to the long term.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.