Bitcoin -based decentralized finance sector (BTCFI) has grown a lot in a year. Binance Report indicates strategic change of investors and positive reinforcement for medium and long term cryptocurrency.

The research “Monthly Market Insights – Abril 2025Da Binance presents recent data from the cryptocurrency market and points to changes in Bitcoin dynamics.

Bitcoin defi fires and reflects new market phase

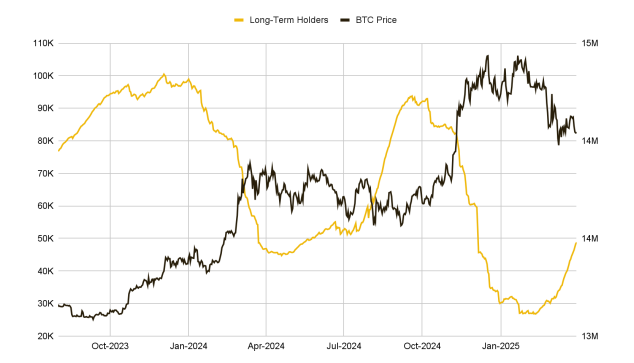

Bitcoin supply maintained by long -term investors has been increasing. However, after the peak registered in December 2023 and another minor in September 2024, the supply of BTC maintained by long -term investors suffered a major drop in February 2025. Currently, the movement was growing again.

This movement follows the creation of a Bitcoin strategic reserve in the United States and the increase in institutional purchases. Facts that have been accompanied by reports from companies and governments that are part of the currency in their coffers.

The report also pointed out that Bitcoin’s on-chain ecosystem has been following BTCFI transformation. The report “The Future of Bitcoin #4: DeFi”He noted that the sector had a total blocked (TVL) growth from US $ 0.3 billion to US $ 8.6 billion, ie an increase of 2,767% in the last year.

The expectation of new interest rates by the Federal Reserve has influenced the feeling of the market. This scenario, added to recent advances, strengthens positive projections for Bitcoin in the medium and long term.

In addition, the research pointed out that: “Interest rate cuts can reinforce positive feeling for Bitcoin in the medium and long term”, relating BTCFI’s evolution to possible adjustments in monetary policy. These data show that the long -term holder movement and Bitcoin’s advancement is aligned with the strategic changes observed in the market.

Regulatory disputes and changes in market domain shape the crypto scenario

Binance’s survey also pointed out that the cryptocurrency market registered a drop of 4.4% in March 2025, reflecting the instability caused by new political and economic factors. The creation of the Bitcoin Strategic Reserve in the United States has contributed to instability in the sector. The uncertainty about the federal reserve of the next steps of monetary policy also influenced the market.

Tariff tensions between the United States, Canada and Mexico aggravated the scenario of uncertainty in the market. On March 4, this context led to a $ 1 billion settlement in cryptocurrency derivative markets.

In the regulatory field, two recent milestones indicate advances in the institutional adoption of cryptors. The Genius Act project has advanced in the legislative process, and the OCC authorized banks to custody cryptocurrencies.

At the same time, the competitive environment between Decentralized Exchanges (DEX) has changed. Uniswap, once dominant, has seen its market share drop from 45% to 29% in one year. Pancakeswap and Raydium, in turn, gained traction, driven by strategies focused on ecosystem growth.

In the digital portfolios segment, Binance Wallet exceeded 50% market share after the temporary suspension of OKX Dex aggregator services. The movement was intensified by the growth of BNB Chain and the launch of new features focused on users retention.

Already in the universe of memecoins, the Pump.Fun platform – associated with the high cycle in Solana – had relevant retreat. Since the release of Token Trump, the Pump.Fun platform has recorded expressive falls in its weekly metrics. The total volume fell 69.9%, tokens creation fell 51.8% and the number of active portfolios decreased 45.1% over the January 2025 peaks.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.