Five US Economic Indicators (United States) can influence the feeling of Bitcoin (BTC) this week amid increased pessimism in the crypto market.

The influence of US events and economic policies on Bitcoin and crypto generally continues to grow. This makes data advance particularly important for traders and investors.

US economic data to observe this week

Amid the concerns of Crypto Black Monday, this week’s US economic data will be crucial to Bitcoin and Altcoins markets.

MINUTES OF THE MARCH FOMC

The minutes of the Federal Open Market Committee (FOMC) of the March meeting will be released on Wednesday. This US economic indicator will offer traders and investors a vision on the direction of Federal Reserve (Fed) monetary policy.

These minutes detail discussions about interest rates, inflation and economic growth, influencing market feeling. If the tone is Hawkish, suggesting a stricter policy or less rate cuts, Bitcoin may face downward pressure, as investors prefer safer assets as titles, strengthened by a stronger American dollar.

On the other hand, a DOVish perspective indicating rate cuts can increase risk appetite, directing capital to crypto. This would occur as the cheapest loan encourages investing in high growth assets.

Based on this, crypto traders will be aware of clues about the Fed’s position on inflation. This is even more relevant considering that recent data has not shown a significant re-aceleration.

Fed President Jerome Powell may reaffirm previous comments about resisting premature rate cuts, or new signs may arise. Given Bitcoin’s sensitivity to liquidity, any unexpected change can cause volatility.

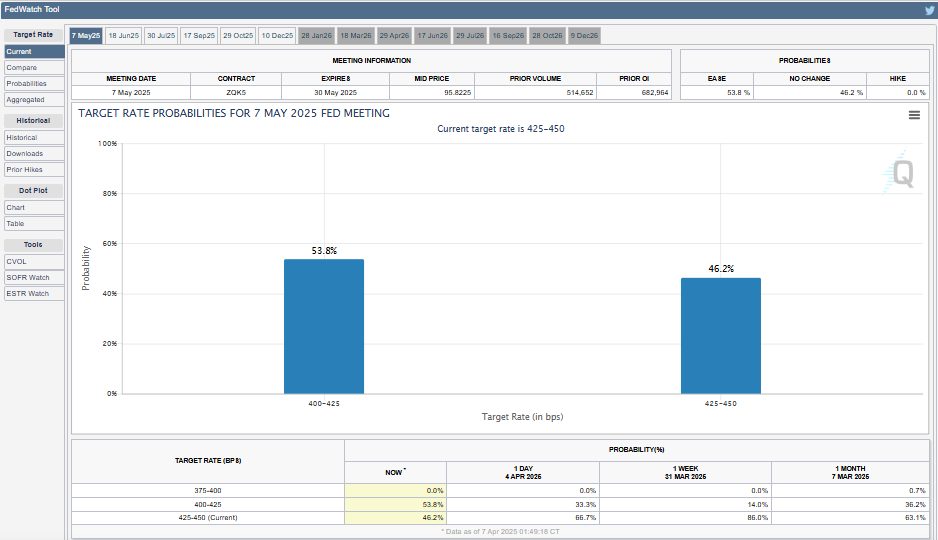

Traders and investors should prepare for short -term price fluctuations, especially if the minutes differ from market expectations priced by CME Fedwatch.

JPMorgan is Wall Street’s first bank to predict a US recession after Trump’s rates. According to the bank, the Fed can be forced to cut rates before the next meeting. In fact, the next FOMC meeting after the minutes of April 9 will be on May 6-7, 2025.

Despite JPMorgan’s fears and appeals, the current blood bath in the crypto market, no emergency gathering has been announced to April, according to the official Fed calendar. Thus, the next probable date for any change in policy, such as the rate cut mentioned by JPMorgan, is May 6-7.

The next FOMC meeting is in the first week of May, can investors wait? Can the US people wait? How high is current inflation? Can we have an urgent rate of tax cut? Until China enters the crypto, the BTC still depends on US liquidity, a user commented.

Initial requests for unemployment insurance

In addition to Fomc’s March minutes, the next US economic indicator for crypto traders to observe is the initial requests for unemployment insurance. Published every Thursday, this report provides participants in the crypto market a real-time health view of the US labor market. This makes it a key engine of economic stability.

Measuring new requests for unemployment, lower requests would signal a strong economy, while higher requests indicate weakness.

For crypto, a strong (less requested) job market can decrease Bitcoin’s appeal as investors include traditional actions. However, increased requests can feed recession fears, leading the Fed to consider rate cuts. Historically, this has been beneficial for crypture, as lower rates make the loan cheaper and increase liquidity.

Traders will therefore monitor if requests exceed 219,000 from the previous week. Such a result would drive Bitcoin as a protection against economic uncertainty.

Meanwhile, recent trends show that requests have diminished. However, increased continuous orders suggests that the challenges to find employment persist.

Crypto volatility can increase if the data surprise, especially along with the interaction of Thursday, with the disclosure of the CPI shortly thereafter.

US and CPI (Qui10) core inflation rate and initial unemployment insurance (Qui10) are first-rate market engines, probably impacting USD, securities yields and Fed Rate expectations amid tariff uncertainties, a user commented.

US CPI

The Consumer Price Index (CPI), which will be released on Thursday, is another US critical economic indicator for Eye Cryptifying Market participants. The data measure inflation through changes in consumer goods and services prices.

A above -expected CPI can signal persistent inflation, potentially leading the Fed to maintain or increase rates. This would strengthen the dollar and press down the prices of crypts down, as risk assets would lose appeal.

Previous CPI data showed that inflation cooled to 2.8% in February. If the March CPI exceeds the expected annual increase of 2.6%, Bitcoin may fall as investors migrate to inflation resistant assets.

On the other hand, a lower CPI can reinforce the expectations of rates in rates, boosting crypts as a value reserve amid a milder monetary policy.

Crypto traders will also focus on the CPI nucleus (excluding food and energy) to a clearer inflation trend, as this strongly influences Fed decisions.

Given Bitcoin’s performance in April falling below $ 75,000, this data can dictate your next movement. Volatility is almost certain, so participants should be ready for market reactions, especially with the minutes of FOMC still fresh in memory.

US PPI

Friday’s Producer Price Index (PPI) tracks inflation at wholesale level. This US economic indicator offers participants in the crypto market a vision of production costs that can reach consumers.

Increasing PPI suggests higher input costs such as energy or hardware, which are crucial for crypto mining. This can tighten the profitability of miners and reduce the growth of bitcoin supply.

If the March PPI rises significantly above 3.3% year by year, it can signal increasing inflationary pressure. This could lead to a bias of the Fed tightening that could weigh on crypt prices as liquidity tightens.

On the other hand, a smoother PPI can relieve inflation fears, supporting an optimistic perspective for crypts combined with Fed’s dovish signs on Wednesday.

Crypus investors should observe PPI’s leading indicator status for the CPI. A sharp divergence from the CPI on Thursday can confuse markets and increase volatility.

Massive Macro Week Ahead: Minutes of FOMC, CPI and PPI. A battlefield for tax cuts, ”Deribit highlighted.

With dollar -sensitive bitcoin, participants should observe how PPI molds Fed expectations. A balanced reading can stabilize the feeling, but surprises can trigger sudden movements.

Consumer feeling

The University of Michigan Consumer Sentiment Index, released on Friday, will reflect the economic confidence of US consumers. This is a vital signal for participants in the crypture market.

High reading indicates optimism, potentially stimulating spending and risk taking, which can raise Bitcoin as investors seek growth assets. A strong feeling can also reduce recession fears, indirectly supporting crypts by maintaining market liquidity.

However, a drop below 54.5 expectations may indicate concerns about inflation or employment, reducing risk appetite. This can push funds to safer refuges by pressing crypt prices. This index often incorporates inflation expectations, so that the Bitcoin protection narrative can be strengthened if consumers anticipate prices.

These events collectively shape the emotional market feeling this week, intertwining the investor’s monetary policy, economic health and psychology.

Participants must remain agile and combine data insights with market reactions to develop informed strategies. They must also conduct their own research.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.