Bitcoin ETFs started the week in red, without liquid entries recorded in all backgrounds yesterday. This marks a cautious beginning, because the feeling of investors seems to be worsening

In the derivative market, the King of Crypts continues to record an increase in sales contracts, aligning with a more optimistic perspective. What should you observe?

BTC ETFS WITHOUT INPUTS WHILE OUTPUTS

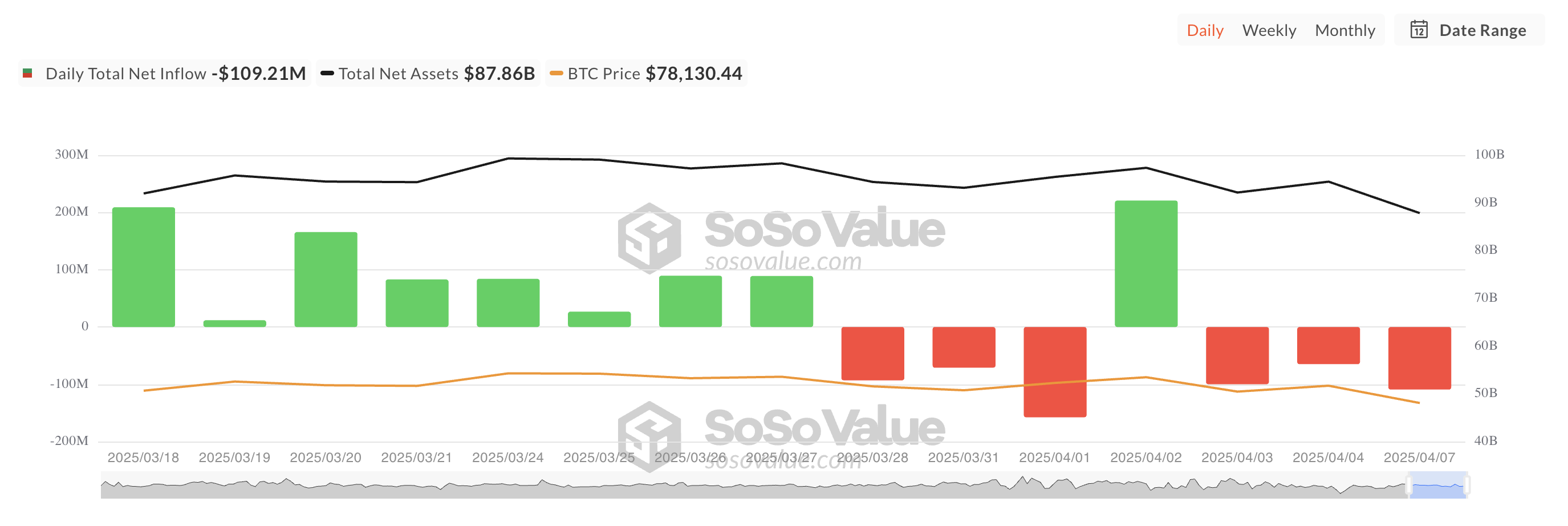

On Monday (7), the departure of capital from BTC ETFs in sight rose to a maximum of seven days of US $ 109.21 million. The increase occurs after blood bath in the weekend cryptocurrency market, which triggered more than $ 1 billion in settlements.

According to Sosvalue, Grayscale’s ETF GBTC recorded the largest net exit on Monday (7), totaling US $ 74.01 million. This brings its net assets under management to US $ 22.70 billion.

Invesco and Galaxy Digital’s BTCO followed the second largest daily output of US $ 12.86 million. At the time of publication, BTCO’s total historical net entry is US $ 85.32 million.

In fact, none of the twelve Bitcoin ETFs in sight recorded a net input yesterday (7). This trend highlights a wide retraction in the institutional interest to start the week.

BTC’s shorts coverage rally faces low bets on the derivative market

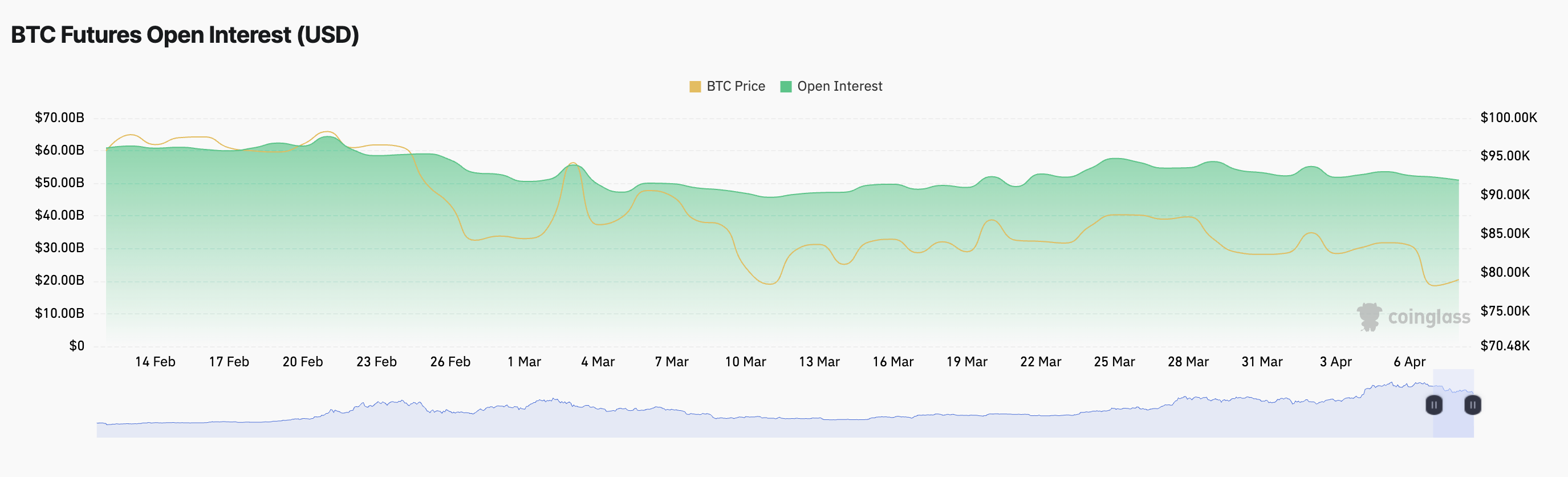

While the BTC fights below $ 80,000, its negotiation activity continues to plummet. This is reflected in the open interest in currency futures, which is at $ 50.95 billion at the moment, registering a 2% drop from the previous day.

Interestingly, the price of the BTC rose 3% during the same period, while the market attempts a recovery. When open interest in an asset falls as its price rises like this, this suggests that the rally can be driven by coverage of positions sold instead of new purchases.

This signals that BTC futures traders are probably closing sales positions, temporarily pushing the price up.

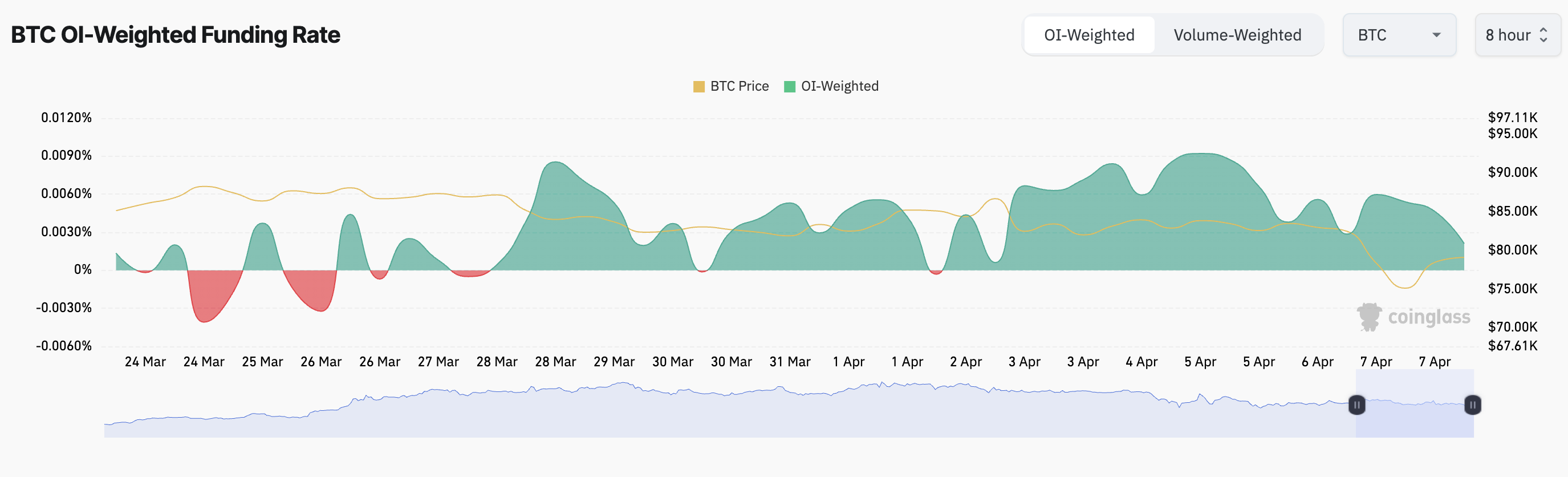

However, despite the drop in price and open interest of the BTC, the constant positive financing rate indicates that the feeling remains inclined to the optimistic side. Traders are still willing to pay a prize to maintain long positions, suggesting continuous optimism about the short -term price trajectory of the currency.

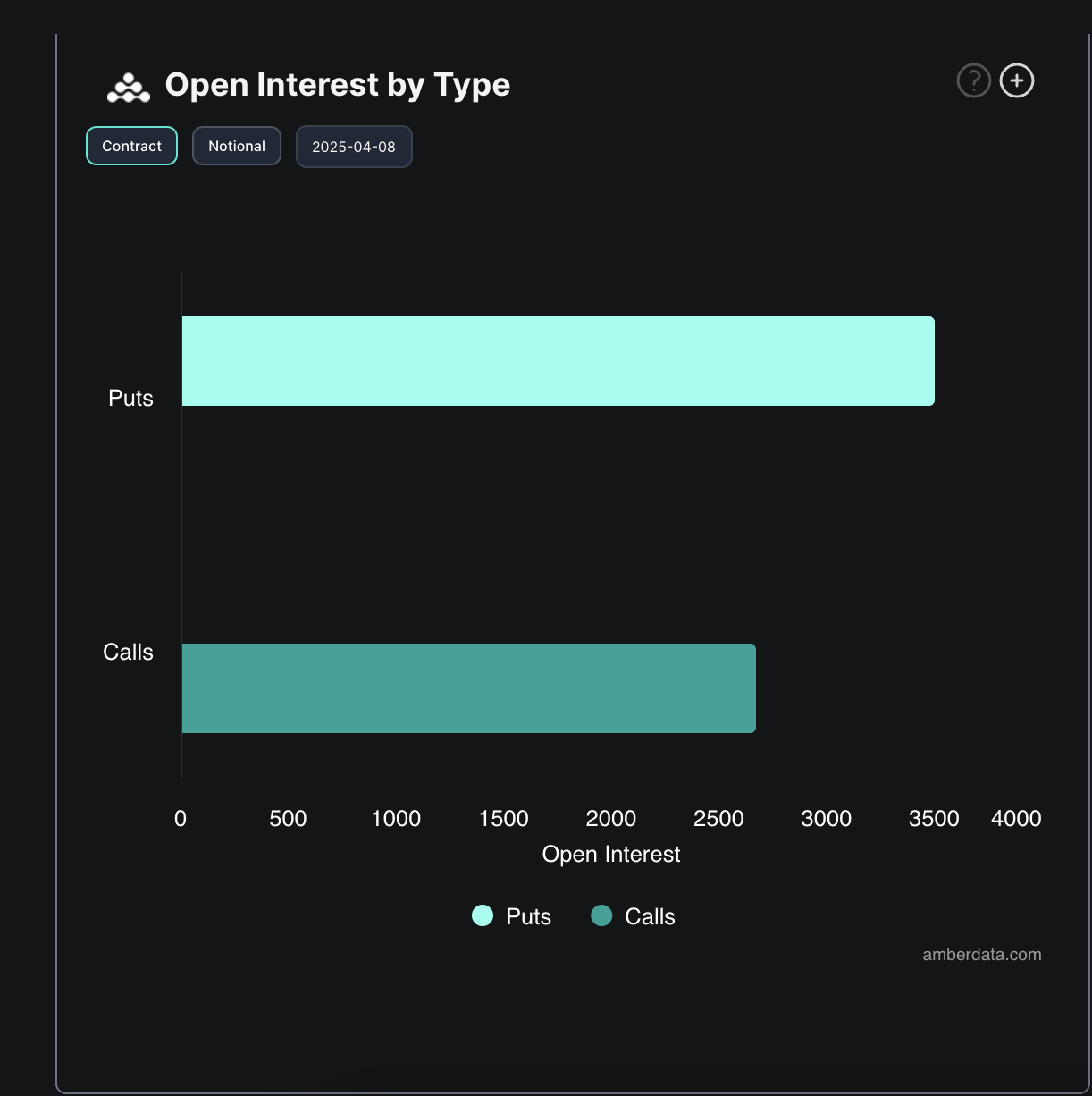

On the derivative side, things are not so promising. Investors continue to open more sales contracts, further confirming the prospect of falling the price of the asset.

This indicates that BTC traders are preparing for a potential risk of falling and expecting the price to fall.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.