Financial and crypto markets are generally recovering from renewed volatility and increasing geopolitical pressure. As a result, speculation is intensifying about if the Federal Reserve (Fed) will adopt quantitative loosening (QE) again.

A possible QE would remember the 2008 and 2020 aggressive monetary interventions. For crypto, the implications can be huge, with many traders preparing for a possible V -recovery and a historical rally if QE is resumed.

Analysts share signs of why the Fed can act

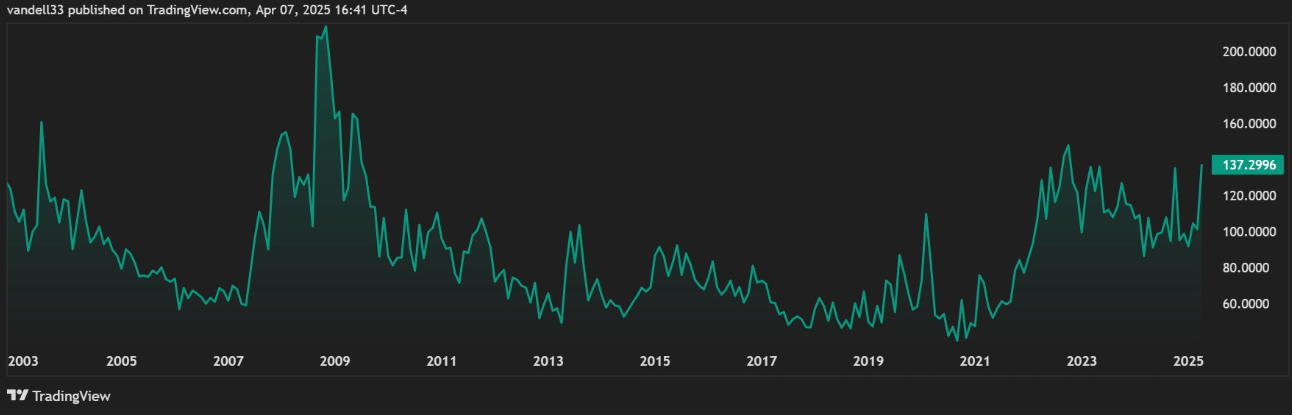

Analysts shared reasons that could lead the Fed to intervene, with one of them citing the Move index. This is Wall Street’s “fear meter” for the title market. With 137.30, the index is currently within the 130–160 range, where the Fed historically acted during seizures.

It is now in 137.30, in the 130–160 range where the Fed can intervene, depending on the economy. If they do not, they will still cut their fees soon because they need to refinance the debt to keep the Ponzi scheme underway, he wrote Vandell, co -founder da Black Swan Capitalist.

This signal is aligned with other financial instability alerts, including global market sales that have defined the tone for Crypto’s Black Monday narrative. This led the Fed to schedule a board meeting to closed doors.

According to analysts, this moment was not random, with increasing pressure probably leading the Fed to give in and President Trump to get what he wants.

With the Fed hinting that, everything changes. The Risk: Reward now favors optimists. Watch out for volatile price stocks, but don’t miss the recovery rally. And remember… it’s easier to negotiate in this market than to keep it, these Aaron Dishner, a trader and cryptian analyst.

This suggests that investors are reading between the lines. JPMorgan recently became the first Wall Street bank to predict a US recession amid Donald Trump’s tariffs, adding urgency to the conversation.

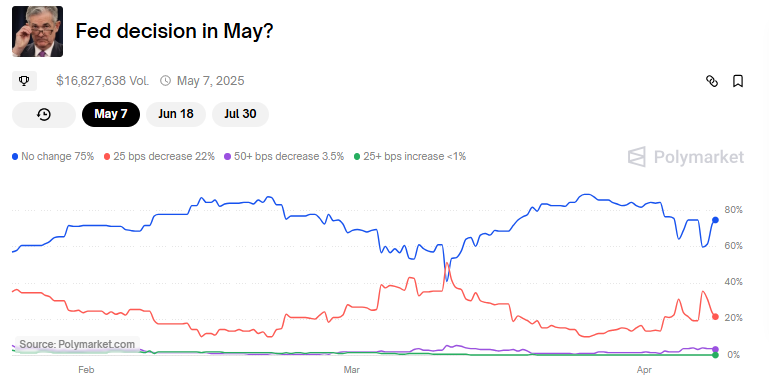

The bank suggests that the Fed can be forced to act earlier, possibly with cuts of fees or even QE, before the Fomc scheduled meeting. In this context, the investor of Crypto Eliz shared a provocative opinion.

I honestly think Trump is doing all this to speed up the Fed process of reducing rates and QE, she noted.

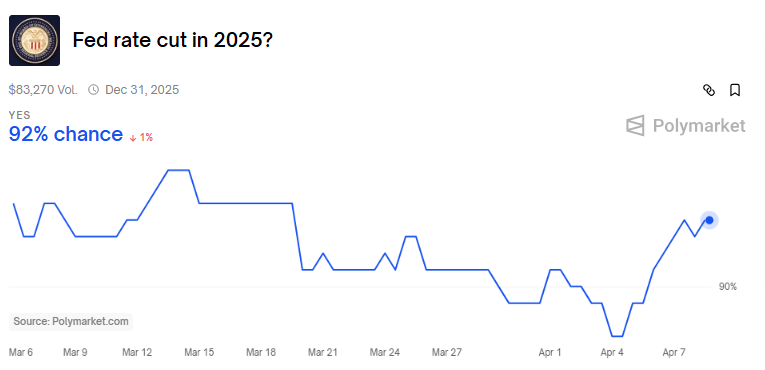

This may not be so unlikely, since the Fed should also manage more than $ 34 trillion in federal debt. In fact, this becomes more difficult to manage with higher interest rates. According to Polymarket, there is now a 92% chance of the Fed cutting rates at some point in 2025.

Why can Crypto benefit from QE?

If what is materialized, history suggests that crypto can be one of the greatest beneficiaries. The founder of Bitmex and former CEO Arthur Hayes predicted that QE could inject up to $ 3.24 trillion into the system, almost 80% of the amount added during the pandemic.

Bitcoin has risen 24 times since its low covid-19 thanks to $ 4 trillion in stimuli. If we see $ 3.24 trillion now, the BTC can reach $ 1 million, it these.

This is aligned with its recent forecast that Bitcoin could reach $ 250,000 by the end of the year if the Fed changes to QE to support the markets.

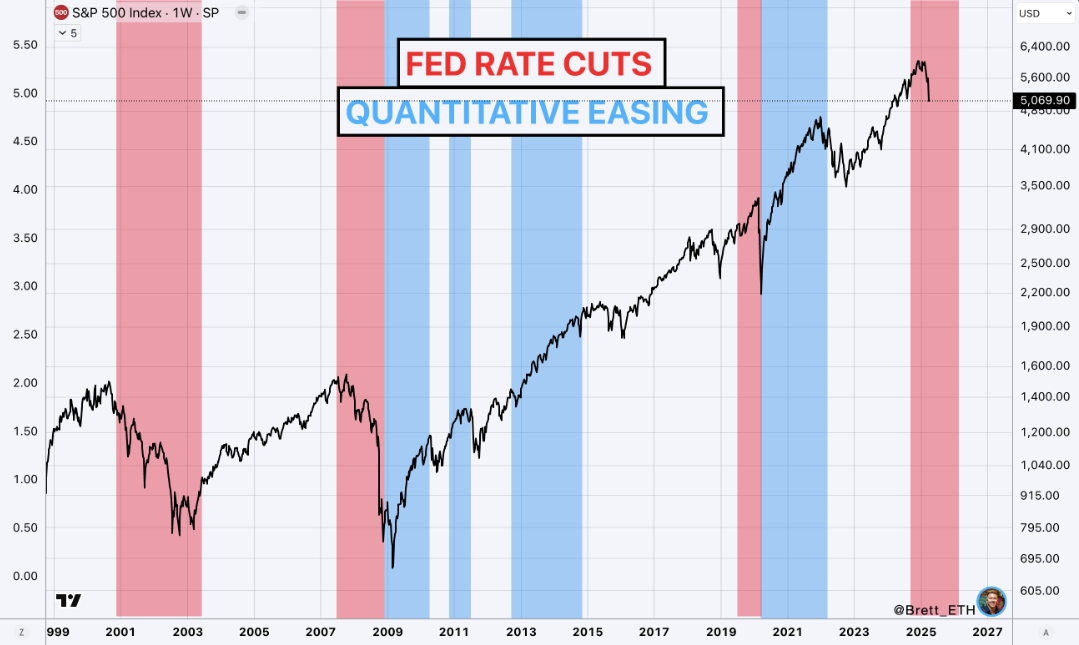

In addition, analyst Brett has offered a more thoughtful view, noting that QE usually follows rates of rates rather than precede them.

We will probably see cuts of rates until mid -2026… as in 2008 and 2020, Powell said the QE does not come until the cuts of rates are complete, Brett explained.

Based on this, the analyst committed to buying selectively, but did not expect a V-shaped recovery unless something drastic changed.

This “something” could be Trump reversing their fares or the Fed anticipating a recession with emergency flexibility measures. If any of these occurs, the crypto market can rapidly fire.

Altseason not horizon?

Meanwhile, the Our Crypto Talk state that quantitative flexibility in May could prepare the ground for a possible Altcoins season.

The forecast of them echoes anterior cycles where QE has triggered explosive movements from risk assets. When the loosening began in March 2020, the Altcoins fired more than 100 times until its end in 2022.

Traders are now keeping an eye on May as a possible start to the next liquidity wave, with gamblers estimating a 75% chance that the Fed keeps the rates stable. If these odds change, traders expect the money printer to take action.

While some anticipate more short -term price oscillations, most agree that the long -term configuration is increasingly favorable.

If QE really starts in May, this oscillation is only calm before the big high, he wrote MrBrondorDeFi no X.

Even if quantitative flexibility does not occur immediately, confidence remains strong that it will happen this year.

Maybe not in May, but then. It will happen this year, which is good for another rally and new maxims, Our Crypto Talk added.

Therefore, the final decision is up to the Fed. Whether cuts of rates, QE or both, the implications for crypto are huge.

If the story repeats itself and the Fed opens the liquidity floods again, Bitcoin and Altcoins may be ready for a historical break. This could eclipse the gains seen during the increase of 2020-2021.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.