The feeling of panic is spreading through the investment community while the crypto market plunges under pressure from new global tariff policies.

Amid chaos, crypto whales show two contrasting trends: aggressive sales to cut losses and strategic accumulation expecting a recovery.

Crypto market plummers while tariff pressure increases

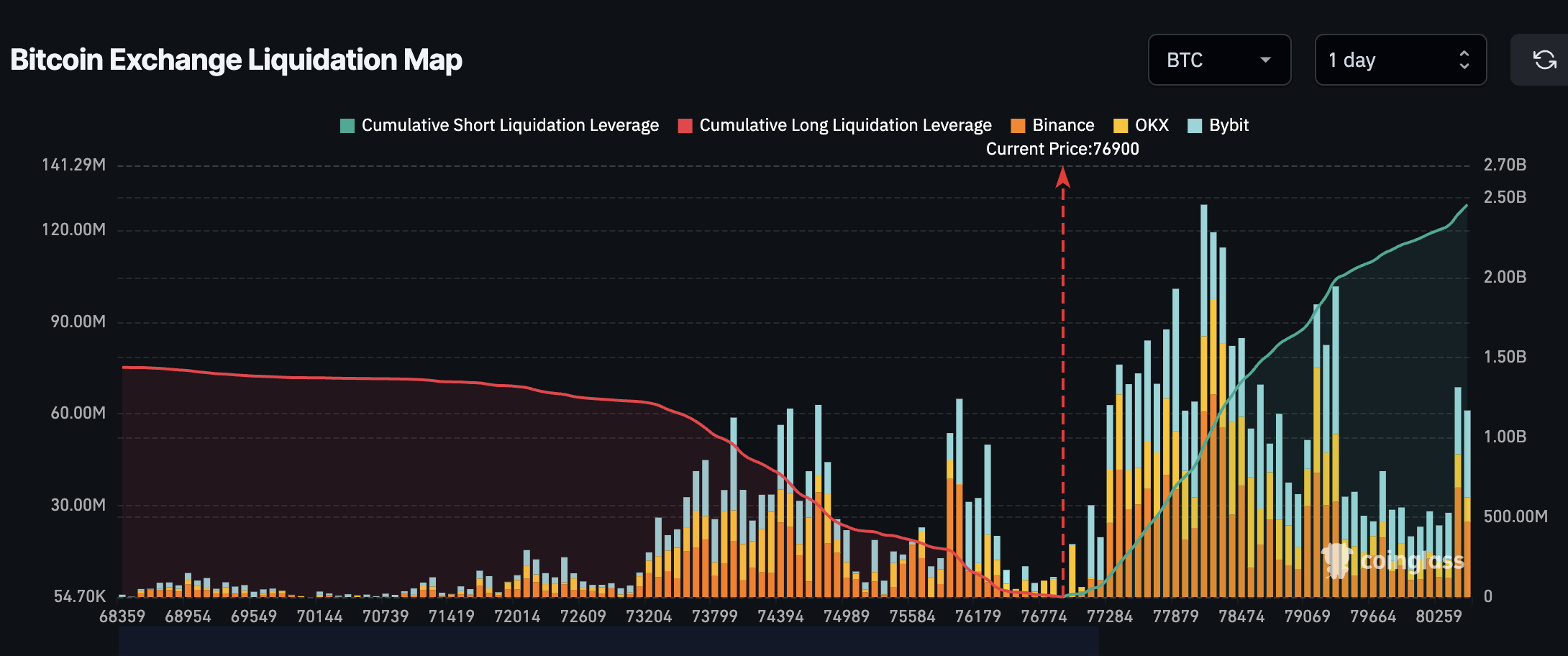

The crypto market is in free fall, with both Bitcoin and Ethereum facing marked falls. Bitcoin has fallen below the $ 75,000 mark, a 5.75% drop in the last 24 hours. Ethereum suffered even more, diving below $ 1,400 – a loss of 9.36% in the same period.

According to Coinglass data, if Bitcoin drops below $ 74,000, settlement pressure can trigger more than $ 953 million in purchase orders at important centralized exchanges. This alarming number shows the intense sales pressure that currently dominates the market.

Market feeling is also deteriorating. The fear and greed rate show that the crypto market is now in a state of “extreme fear.” This growing lack of confidence feeds generalized panic sales, pushing the main cryptocurrencies to minimums of several weeks.

Whales trigger large sales

Several crypto whales have chosen to settle assets during market chaos to minimize risk or avoid forced liquidations. A remarkable case is “Long ETH Whale“Which sold 5,094 ETH to reduce its settlement price, accepting a accumulated loss of over US $ 40 million. Likewise, Pump.Fun supposedly sold 84,358 sun at an average price of $ 105.

Even politically linked projects were not spared. WLFI, associated with Donald Trump, liquidou 5.471 ETH at an average price of $ 1,465.

The group “7 Siblings”It is suspected of selling MKR, although they still have 6,293 mkr. Other important movements include three whale wallets who parade the Staking of a total of 168,498 sun worth $ 17.86 million; a whale He withdrew 4,000 ethi from Ether.Fi and transferred the entire amount to Binance; two addresses They sold a total of 150 thousand sun in the last 14 hours.

These great transactions reflect a growing concern among high -risk investors amid growing market stress.

Smart Money accumulation: opportunity in the midst of the crisis

However, not all crypto whales are pessimistic. Some large investors see this fall as a purchase opportunity and accumulate crypto assets.

Intotheblock data reveal that the Bitcoin liquid outputs of centralized exchange exceeded US $ 220 million yesterday – a long -term accumulation indicator. In a separate transaction, a whale It spent US $ 6.93 million to purchase 4,677 ETH at an average price of $ 1,481.

In fact, according to the analyst there, as Bitcoin rose from $ 74,500 to $ 81,200, 1,715 transactions over $ 1 million were recorded on-chain. This data suggests confidence from the Smart Money that there may be a market reversal.

The current Crash Crypto is closely linked to new US tariff policies, which are increasing fears of global economic recession. This pressure is weighing on crypto markets and spreading through traditional financial markets, creating a domino effect.

Looking to the future, the market can face two possible scenarios. First, if Bitcoin cannot stay over $ 74,000, forced settlements can intensify, pushing prices even lower. Ethereum may fall to the $ 1,250 – $ 1,300 range if panic persists.

Alternatively, continuous accumulation of crypto whales can boost a recovery, potentially raising Bitcoin back to $ 80,000 and Ethereum over $ 1,500, especially if there are positive developments in tariff negotiations.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.