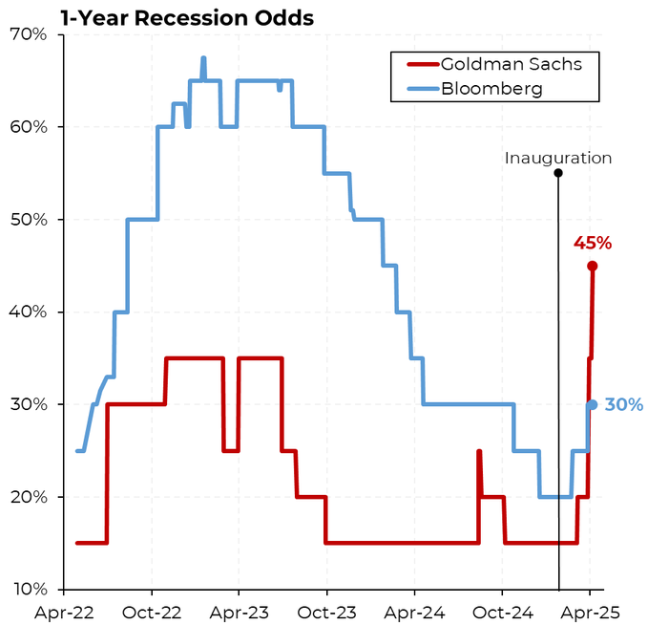

Goldman Sachs increased the likelihood of a US recession next year to 45%. The forecast signals increasing economic uncertainty in the midst of global tensions, more rigid financial conditions and imminent tariff impacts.

This marks the highest probability of recession provided by the investment bank since the beginning of postpandeia inflation and interest rates increases.

Goldman Sachs sees 45% chances of recession in the USA

Goldman Sachs’s last note, “countdown to recession,” describes a marked deterioration under economic conditions. This includes the implications of the rates that should come into force on April 9.

Steven Rattner, former chief of Obama’s automotive task force and current Wall Street financier, shared the news on social networks, emphasizing the severity of Goldman’s new perspective.

Goldman Sachs now foresees a 45% chance of recession next year, Rattner he wrote.

According to Rattner, the recent increase in political uncertainty and concerns about capital spending aggravate the instability of the financial market.

Meanwhile, Nick Timiraos, chief of economics at The Wall Street Journal, echoed the news, indicating that the bank adjusted its GDP growth forecast to the fourth quarter from 2025 to only 0.5%.

“We are reducing our GDP growth forecast from 2025 Q4/Q4 to 0.5% and increasing our probability of recession by 12 months from 35% to 45% after a sharp tightening in financial conditions, foreign consumer boycott and a continuous increase in political uncertainty that will probably depress capital spending more than we had taken earlier,” thimiraos had taken over, ” reportedciting Goldman Sachs.

Although this reflects the expected consequences, the bank’s current forecast assumes that many new tariffs scheduled for April 9 will not be realized.

However, Goldman Sachs articulated that if Trump implemented these tariffs, the bank would adjust its forecast and formally predict a recession. This could feed already growing inflation and further pressure US economic growth.

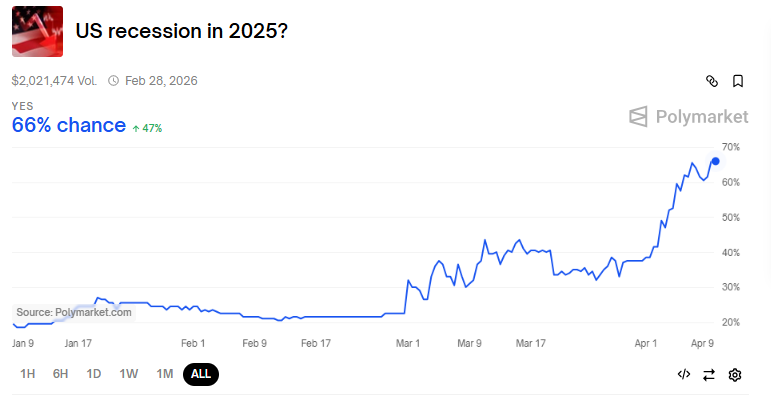

Amid increasing commercial tensions, Polymarket gamblers see almost 70% chance of recession in the US after liberation day tariffs.

Goldman Sachs increases participating in Bitcoin ETF

Despite the dark perspective for the economy, Goldman Sachs remains strongly invested in the crypto space, particularly Bitcoin (BTC). On February 12, the bank held a substantial $ 1.5 billion in Bitcoin. This exhibition comes through investments in Bitcoin ETFs from Blackrock and Fidelity.

In addition, recent files They reveal that Goldman Sachs has significantly increased their participation in Bitcoin ETFs. Compared to previous files, it increased its position on Ishares Bitcoin Trust (Ibit) in 88% and Franklin Bitcoin Trust (FBTC) by 105%.

This position reflects the growing interest of Goldman Sachs in digital assets as a value reserve alternative amid the instability of the traditional market.

This increase occurs while Bitcoin has shown resilience in recent months, surpassing many other asset classes in performance. Recently, Bank CEO David Solomon highlighted the potential of Blockchain technology to optimize Traditional Finance (Tradfi). Beincrypto reported Solomon saying that Bitcoin was not a threat to the US dollar.

In addition to Goldman Sachs, JPMorgan also predicted a recession in the US. Beincrypto reported that it was Wall Street’s first big bank to predict a US recession after former President Trump’s fares.

Of course! Here is a shorter version of the subtitle:

Fed can cut interest rates and rekindle debate on impact on bitcoin

Their forecast warned of the broader economic consequences of commercial wars, providing for the Federal Reserve (Fed) might need to cut the fees earlier than expected.

The possibility of a cut in rates, which many see as a response to a weakened economy, increases concerns about stagflation – a simultaneous increase in inflation and stagnation in economic growth.

This economic uncertainty also increases the chances of quantitative loosening (QE) in the US financial system. This outcome may have significant implications for the crypto market.

If the Fed chooses a discreet QE, it can inject market liquidity and provide short -term relief for risk assets such as bitcoin.

However, such actions can also intensify inflationary pressures, requiring a difficult balance for policy formulators.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.