The main currency, Bitcoin, had recently turbulent weeks, with price problems taking many short -term investors – often called “paper hands” – leaving the market.

However, amid price volatility, long -term holders (LTHS) remain firm and show no signs of retreat as they try to push the BTC back above $ 85,000. How fast can they achieve this?

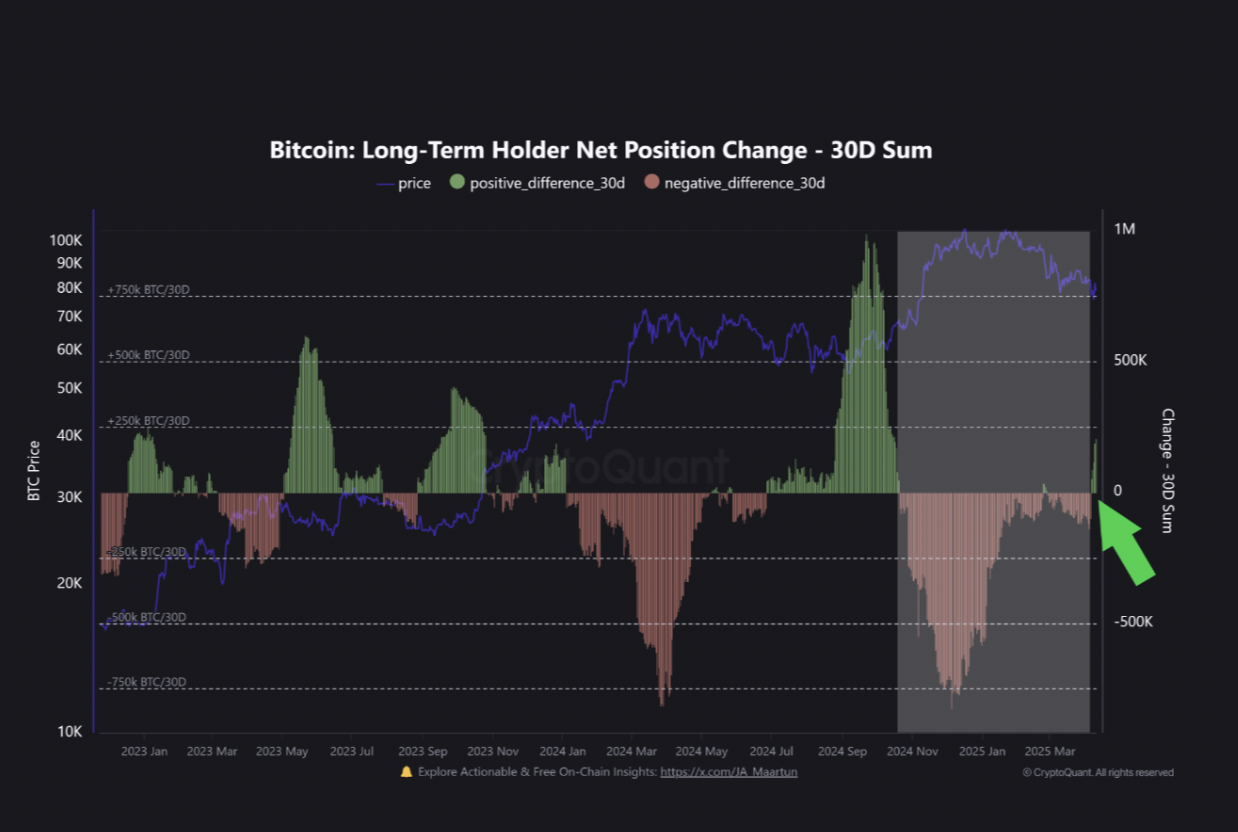

Bitcoin long -term holders change sales for accumulation

In one report Recent, Cryptoquant analyst Burak Kesmeci has evaluated the change in the net position of the long -term holders of the BTC (30 -day sum) and found that since April 6, the indicator has become positive, showing a clear upward impulse. As a result, Kesmeci wrote, the BTC rose approximately 12%.

The change in the net position of the BTC long -term holders track the purchase and sale behavior of LTHs (those who keep their assets for at least 155 days) to measure the change in the number of coins maintained by these investors over a specific period.

When its value is positive, it indicates that LTHs are not selling and remain optimistic about the future performance of the price of the BTC. On the other hand, when it becomes negative, it suggests that these holders are selling or distributing their coins, often in response to market pressures, which is a low signal.

According to Kesmeci, the change in the net position of the long -term holders of the BTC (sum of 30 days) becoming positive is remarkable. This indicator had remained below zero since the last week of October, signaling that the LTHs were consistently selling their BTCs.

Sales reached its lowest point on December 5, causing a 32% drop in the price of BTC and marking the peak of a period of 6 months of distribution by LTHs.

However, this trend has changed since April 6. The indicator is now above zero and in a tall trend. Talking about what that means, Kemesci added:

“Although it is early to say definitely, the growing positive impulse in this indicator may be a sign that long -term conviction is returning to the market.”

In addition, the BTC financing rate remained positive amid their price problems, confirming the optimistic perspective above. At the time of publication, it is 0.0037%.

The financing rate is the periodic payment exchanged between long and short traders in the perpetual future markets. It is designed to maintain the price of futures near the cash price of the underlying asset.

When it is positive, the long traders are paying to the short traders. This indicates an optimistic feeling of market, as more traders are betting on the climb of the price of the BTC.

Long -term holders prepare the $ 87,000 race scenario

The increase in BTC LTHS accumulation pushed the price of currency above the key resistance at $ 81,863. At the time of publication, the main currency is being negotiated at $ 83,665.

As the market responds to these lths -sustained purchase pressures, the price of currency may be prepared for a significant rally soon.

If retails of retail follow the example and increase your Demand for coins, the BTC may exceed $ 85,000 to $ 87,730.

However, if the accumulation tendency is over and these LTHs start selling for gains, the BTC can resume their fall, fall below $ 81,863 and get down to $ 74,389.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.