Bitcoin has faced significant difficulty in overcoming the $ 85,000 mark this week, and its price remains stagnant below this key resistance.

Thus, BTC enthusiasts are increasingly frustrated. This is because cryptocurrency struggles to maintain the upward impulse. Along with this price stagnation, there was a drop in open interest and ETF exits, reflecting the growing uncertainty in the market.

Are Bitcoin ETF flows in sight worrying?

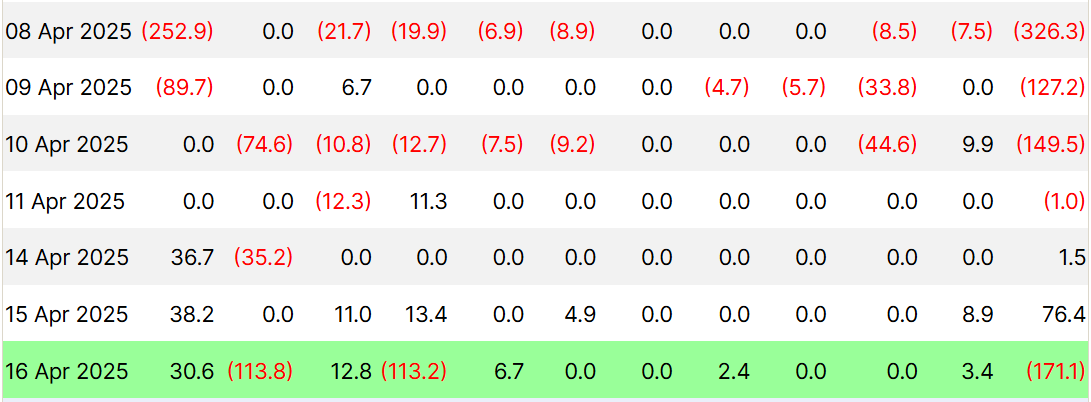

Bitcoin ETFs in sight have recently registered large exits, with US $ 171.1 million in registered exits on Wednesday, April 16, marking the highest value for this week. This change signals the decreasing confidence of investors in Bitcoin, as market conditions remain low. As investors remove their funds, this highlights a decreased confidence in the short -term prospects of Bitcoin.

Therefore, continuous outputs suggest that the widest market feeling is souring in relation to the BTC. The heavy movement of backgrounds away from Bitcoin’s ETFs shows that investors are becoming cautious, driven by the currency failure to firm over $ 85,000. This lack of growth in price led to uncertainty and hesitation between traders.

Open Interest needs an impulse

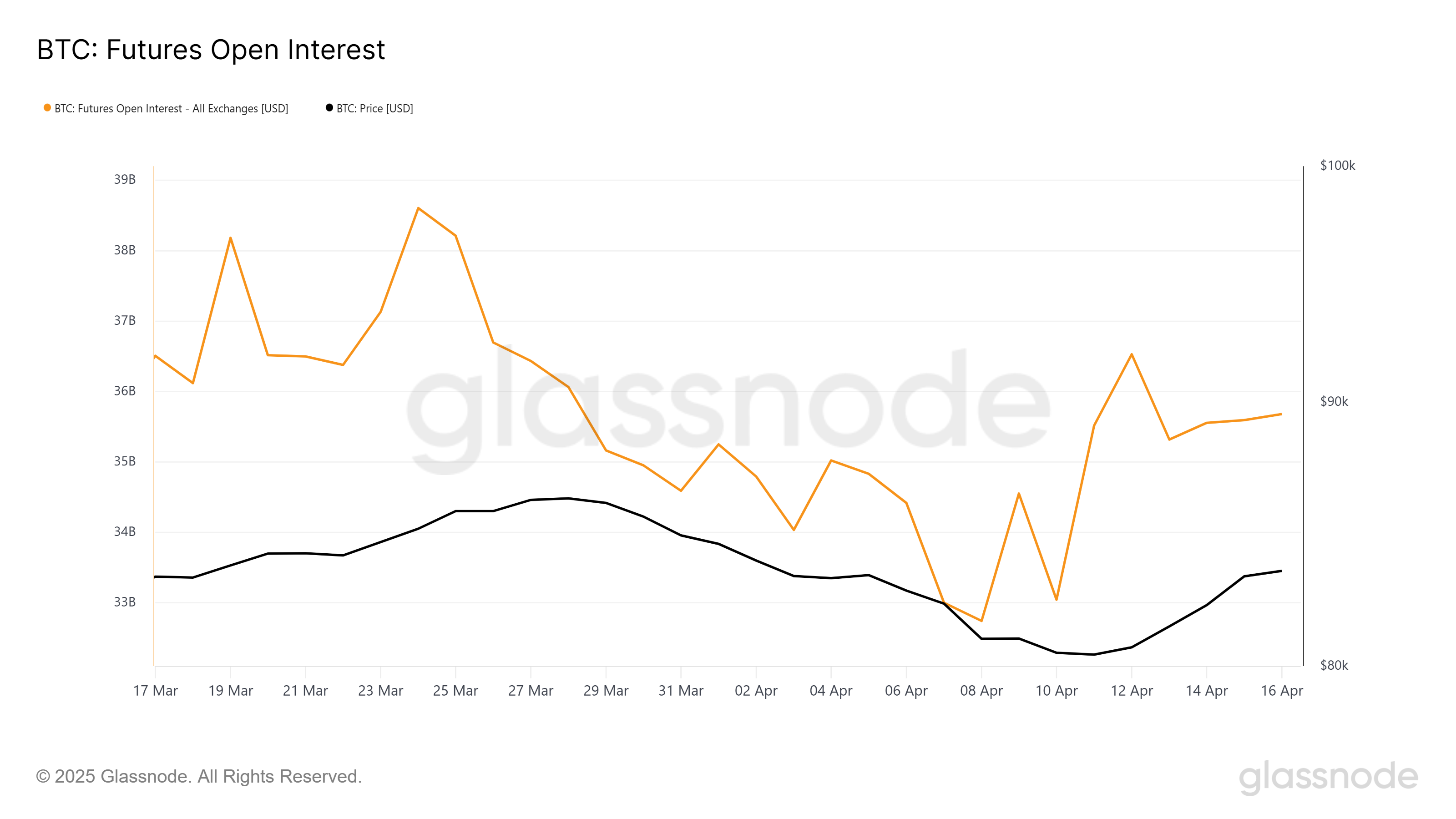

Open interest in Bitcoin remains below $ 36 billion, a sign that traders are skeptical about Bitcoin’s immediate future. Despite some optimism earlier this year, the lack of recovery or significant price movement maintained the stagnant open interest.

Thus, stability in open interest indicates that Bitcoin faces a period of indecision in the market. Therefore, traders seem hesitant to make aggressive bets in any direction, given the stagnant price and market conditions. Without an increase in open interest, Bitcoin may have difficulty leaving its current track.

Financing rate recovers

Despite skepticism, Bitcoin’s funding rate has seen a recent change. After being negative for a while, she has become positive in recent hours, reflecting a slight increase in market optimism.

Although the positive financing rate indicates renewed optimism, it is still early to determine whether this feeling will result in a upward -sustained price action. A sustained positive funding rate could suggest that bitcoin can see a more significant recovery if the broader market conditions improve.

Calls vs. Puts

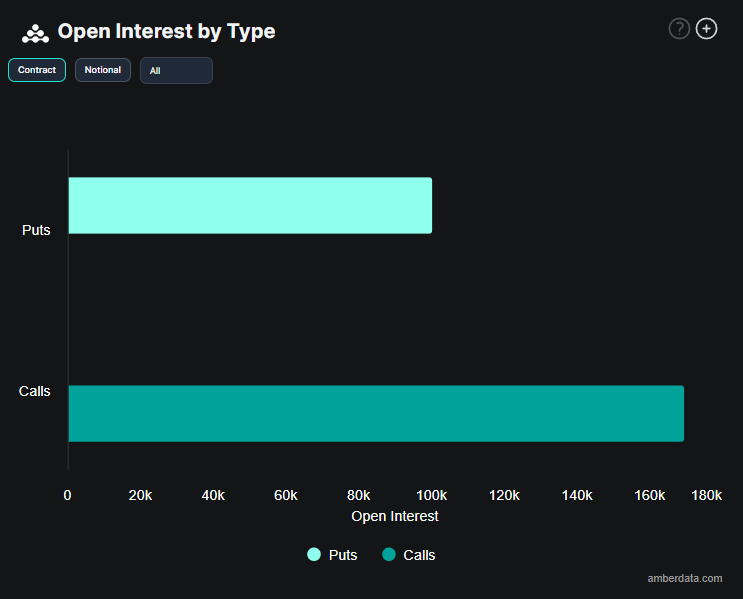

Data of open interest further support this optimistic change, as purchase options now dominate the market, with over 169,760 purchase contracts placed.

Thus, the predominance of purchase options on sales suggests that market participants expect a rise movement. This despite the recent lack of progress in the price of Bitcoin. If this optimism will be realized depends on the broader market trends and Bitcoin’s ability to overcome the $ 85,000 barrier.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.