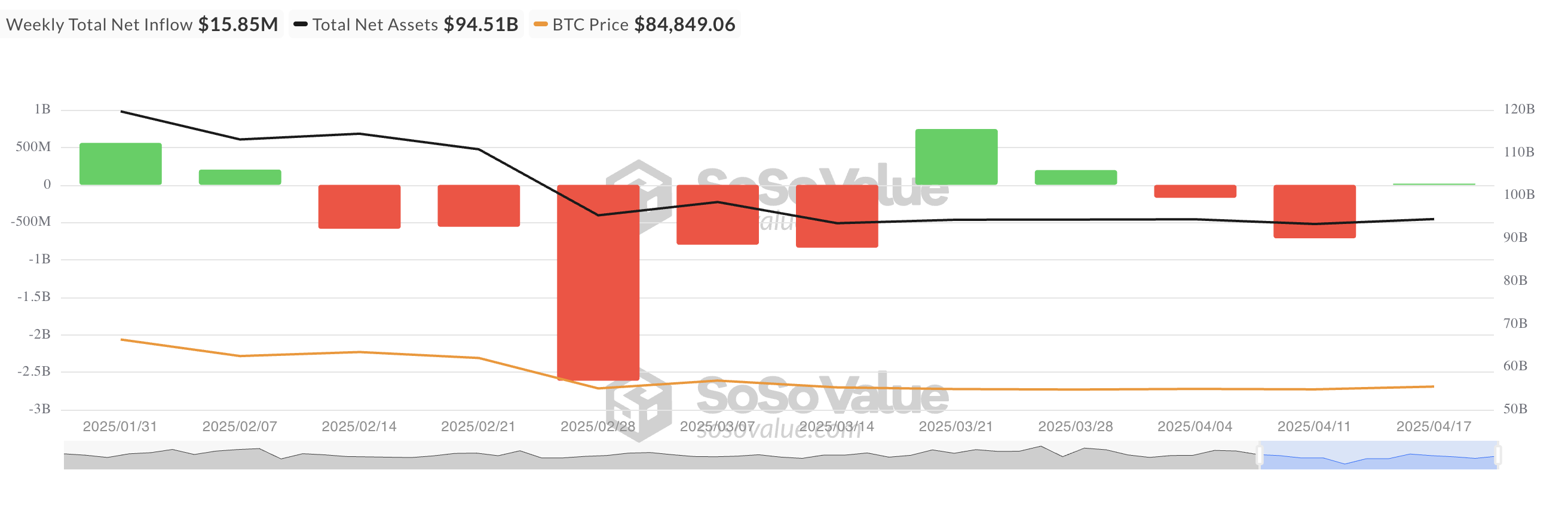

Bitcoin’s Bolsa -Bolsa Bolsa funds registered a modest net entry of US $ 15 million last week, marking a significant turnaround compared to the accentuated exits from the previous week, which exceeded US $ 713 million.

However, despite the positive change in capital flow, last week’s value represents the lowest weekly net entry recorded since the beginning of 2025.

Bitcoin ETF inputs fall to minimum of the year

Last week, from April 14 to 17, institutional investors added capital to BTC ETFs in sight, raising net entries to these products to $ 15.85 million.

Despite the positive movement, this latest funds influx has represented the lowest net entry for Bitcoin ETFs since the beginning of the year, further confirming the deceleration in optimistic feeling.

The deceleration occurs amid growing global commercial tensions, which introduced new uncertainty into the financial markets. As the main economies tighten trade policies and retaliatory measures increase, the feeling of institutional investors has become more cautious, leading them to adopt a waiting approach while relocating their capital.

Bitcoin advances, but traders come out of positions

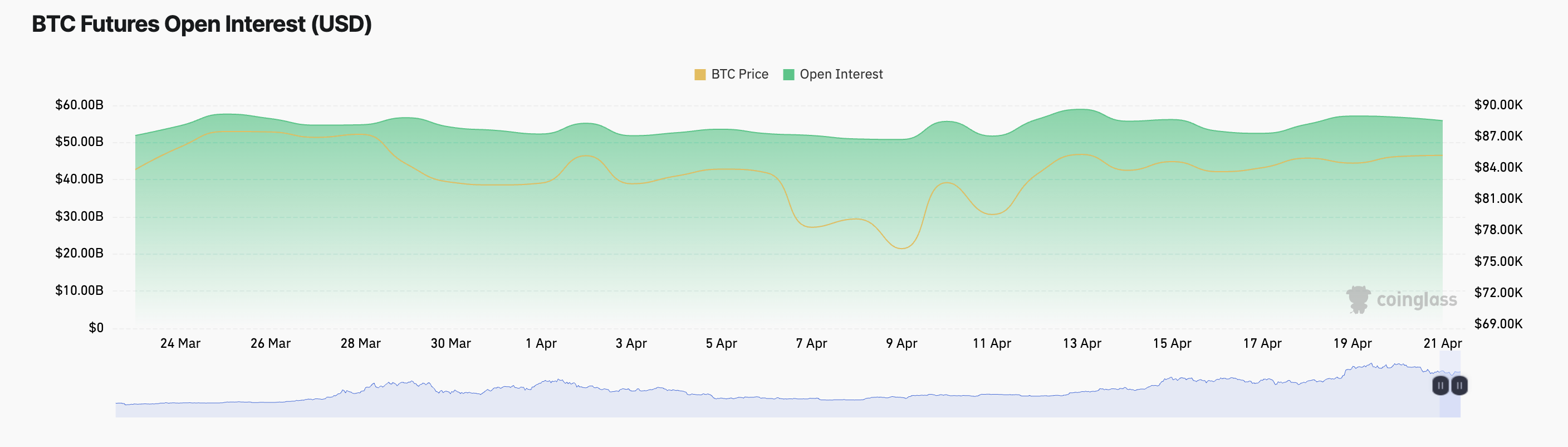

Bitcoin is being negotiated at $ 87,000 at the time of publication, having won 3% in value in the last 24 hours. However, the open interest of currency futures fell by 2%.

The open interest of an asset refers to the total number of future contracts or open options that have not been settled or closed. When it falls during a high price, it suggests that traders are closing their positions instead of opening new ones, indicating a lack of strong conviction for a sustained price of price.

This feeling extends to the currency options market, reflected by today’s high demand for sales contracts.

When there are more puts than calls like this, it indicates a pessimistic market feeling, as traders are positioning themselves for a possible fall or seeking protection against price declines.

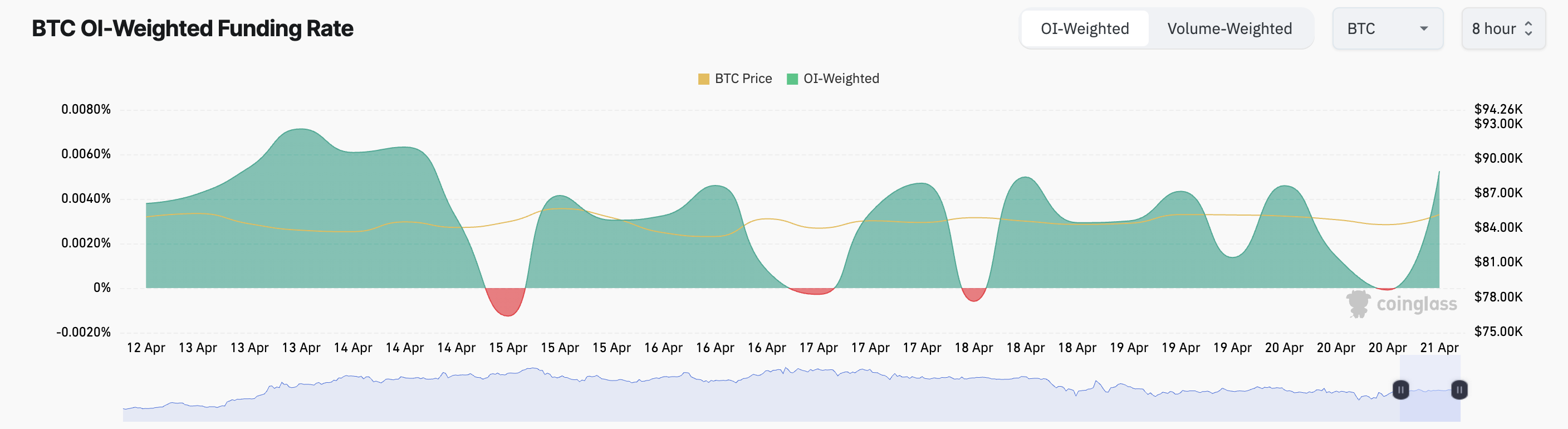

Meanwhile, combined with BTC’s falling interest, points to a market that is still acting with caution amid broader uncertainties, the positive currency financing rate offers relief. At the time of publication, according to Coinglass, it is 0.0052%.

When the financing rate is positive, long traders are paying the short, indicating that optimistic feeling dominates and the demand for long positions is higher.

These factors suggest that despite the cautious tone in the derivatives and Bitcoin ETF flows, some traders remain confident and anticipate higher.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.