Experts question Bitcoin status (BTC) as inflation protection and economic uncertainty as institutional influence grows.

The recent purchase of 6,556 BTC by Strategy, former Microstrategy, worth US $ 555.8 million, raised the company’s accumulated yield to 12.1% by 2025.

MSTR acquired 6,556 BTC for US $ 555.8 million at $ 84,785 per bitcoin and reached an yield of 12.1% YTD 2025. On the 20th, Strategy holds 538,200 BTC acquired for ~ $ 36.47 billion a ~ $ 67,766 per Bitcoin, Michael Saylor, CEO, Strategy, shared.

The company uses Bitcoin YTD performance to measure the increase in BTC participation per action. This model has been central to the company’s financial strategy since its first purchase in August 2020.

The acquisition is aligned with the optimistic feeling of the market, with Bitcoin approaching the landmark of $ 90,000, as pointed out by US Crypto News.

Despite a slight recovery in Bitcoin Beasta Week prices, up more than 3% in the last 24 hours, it is noteworthy that Bitcoin is highly sensitive to economic indicators.

Similarly, the global market is highly sensitive to monetary policies defined by large economies, particularly the US. In an interview with Paybis founder and CEO InnoKenty Isers revealed that macroeconomic policy can influence BTC’s volatility.

Given the strong concentration of investors in technology actions, changes in trade policies and government interventions that influence key rates such as NASDAQ Composite creates chain effects on financial markets, the executive said.

According to Isers, since the US presidential inauguration, Bitcoin’s perspective has changed from reliable protection against inflation to a riskier asset.

With their relatively high volatility, risk -averse investors may prefer alternative inflation protections rather than bitcoin, he added.

He still expressed awareness of the long duration of the trade war and the potential inflation that will emerge. Based on this, he noted that capital allocation for Bitcoin as protection against economic instability can be reduced.

Strategy Action Award decreases

Meanwhile, Strategy has seen a change in the dynamics of assessing its actions last year. Michael Saylor recently revealed that, in the first quarter of 2025, more than 13,000 institutions and 814,000 retail accounts had MSTR directly.

It is estimated that 55 million beneficiaries have indirect exposure through ETFs, mutual funds, pensions and insurance wallets, he commented.

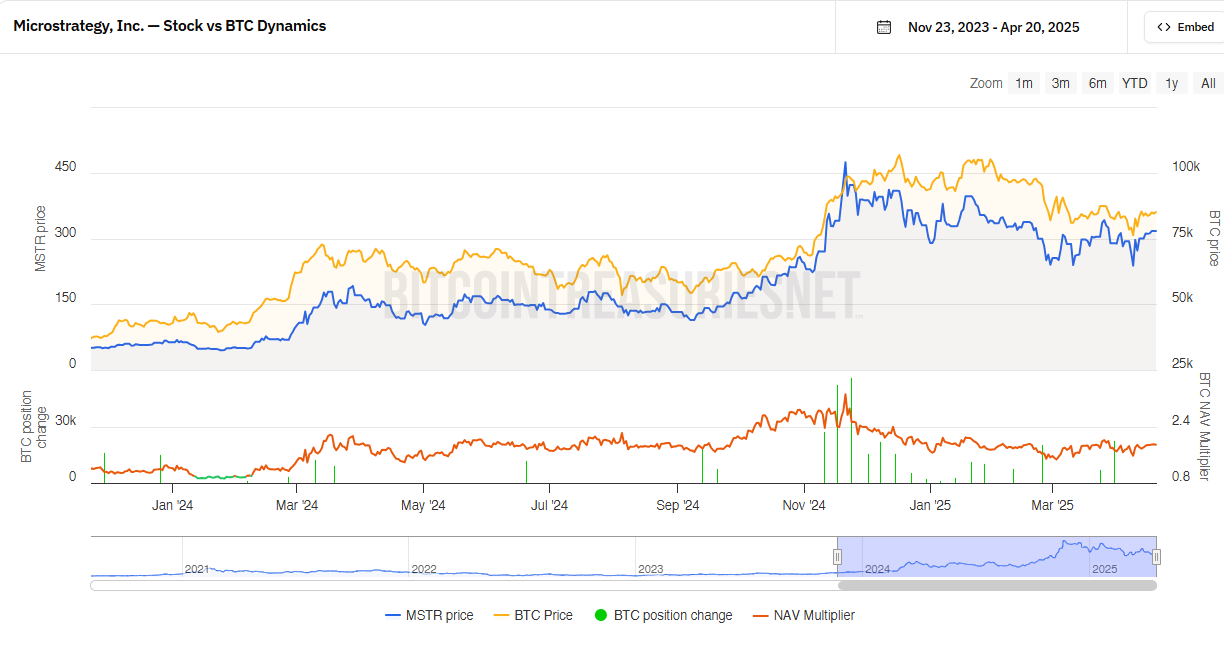

According to data From Bitcointreasuries, the award that investors paid for the exposure to their participation in Bitcoin decreased expressively.

Specifically, the NAV multiplier, a measure of how much the action is negotiated above the value of Strategy’s bitcoin assets, decreased compared to last year. This indicates that MSTR is now being negotiated closer to the real value of its Bitcoin reserves.

In 2024, investors were willing to pay a substantial prize for MSTR actions, driven by Bitcoin Hype and the aggressive Microstrategy accumulation strategy.

I don’t know if buying Strategy’s actions is a good idea for the government. The action would only inflate, and is probably being negotiated with a NAV prize with a higher risk profile. In addition, I believe the government will have difficulty finding institutions willing to sell its BTC in large quantities, commented an analyst.

Nav multiplier shrinking suggests a more cautious market feeling. Analysts believe this reflects a change towards Microstrategy based on its foundations rather than the speculative enthusiasm for Bitcoin.

This suggests a more mature market approach to the company’s unique investment strategy.

Graph of the day

This graph shows how Strategy’s (blue) stock price moves with the price of bitcoin (orange). When Bitcoin rises, microstrategy usually follows, but oscillates even more.

However, the NAV multiplier has decreased compared to last year, which means Microstrategy’s shares are now being negotiated closer to the real value of their participation in Bitcoin.

Last year, investors paid a larger prize to have MSTR exposure, but this difference decreased. This suggests a more cautious feeling or a change towards valuing the company based on fundamentals rather than just the Bitcoin hype.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.