According to Data from TradingView, the Eth/BTC exchange rate recently dropped to 0.01791, marking its lowest level since 2020.

At the same time, the pressure to sell “whales”, that is, large investors, in the Ethereum (ETH) market continues to increase. A number of major transactions are performed by institutions such as Galaxy Digital, Paradigm and an address associated with the Ethereum Foundation.

Large Ethereum investors continue to sell

Data From Onchaindataned, at X, they reveal that the digital galaxy transferred 5,000 additional ETH, approximately $ 8.11 million to Binance on April 22. Previously, the beinchrypto reported that the digital galaxy had transferred nearly $ 100 million in ETH to Exchanges within a few days, generating speculation about a possible large -scale sale.

In addition to the digital galaxy, Paradigm is also suspected of selling ETH, transferring 5.5 thousand ethabout $ 8.65 million, for Anchorage Digital just 3 hours earlier, according to Embercn, in X. In addition, an address linked to the Ethereum Foundation deposited 1,000 ETH, approximately $ 1.57 million, at Exchange Kraken, as observed by Lookonchain.

These actions of large institutions exert significant pressure on the price of ETH, especially as the Eth/BTC ratio reaches its lowest point since 2020.

Fall of the Eth/BTC relationship: Market sentiment is impacted

The Eth/BTC ratio falling to 0.01791 is a worrying sign for Ethereum. Indicates that ETH is losing value compared to Bitcoin (BTC). This fall takes place in part of the price of the BTC approaching $ 90,000.

Meanwhile, ETH is being negotiated at $ 1,574, a 2.5% drop in the last 24 hours. This disparity can lead investors to turn to Bitcoin, further intensifying the sales pressure on ETH.

In addition to increasing the sales pressure of whales, the Ethereum Foundation has a history of selling Eths several times recently. This suggests that large institutions of institutions can significantly impact price volatility or make it difficult to growth to some extent.

In addition to whale pressure, Ethereum’s Staking proportion is currently only 28%, significantly lower than competitors such as Solana (65%), for example. This can also undermine investors’ confidence, especially because ETH offers less attractive Staking Income. In addition, the dominance of Bitcoin (BTC.D), reaching a 4 -year peak, indicates that capital is flowing away from ETH and other altcoins.

Ethereum forecast: correction or fall?

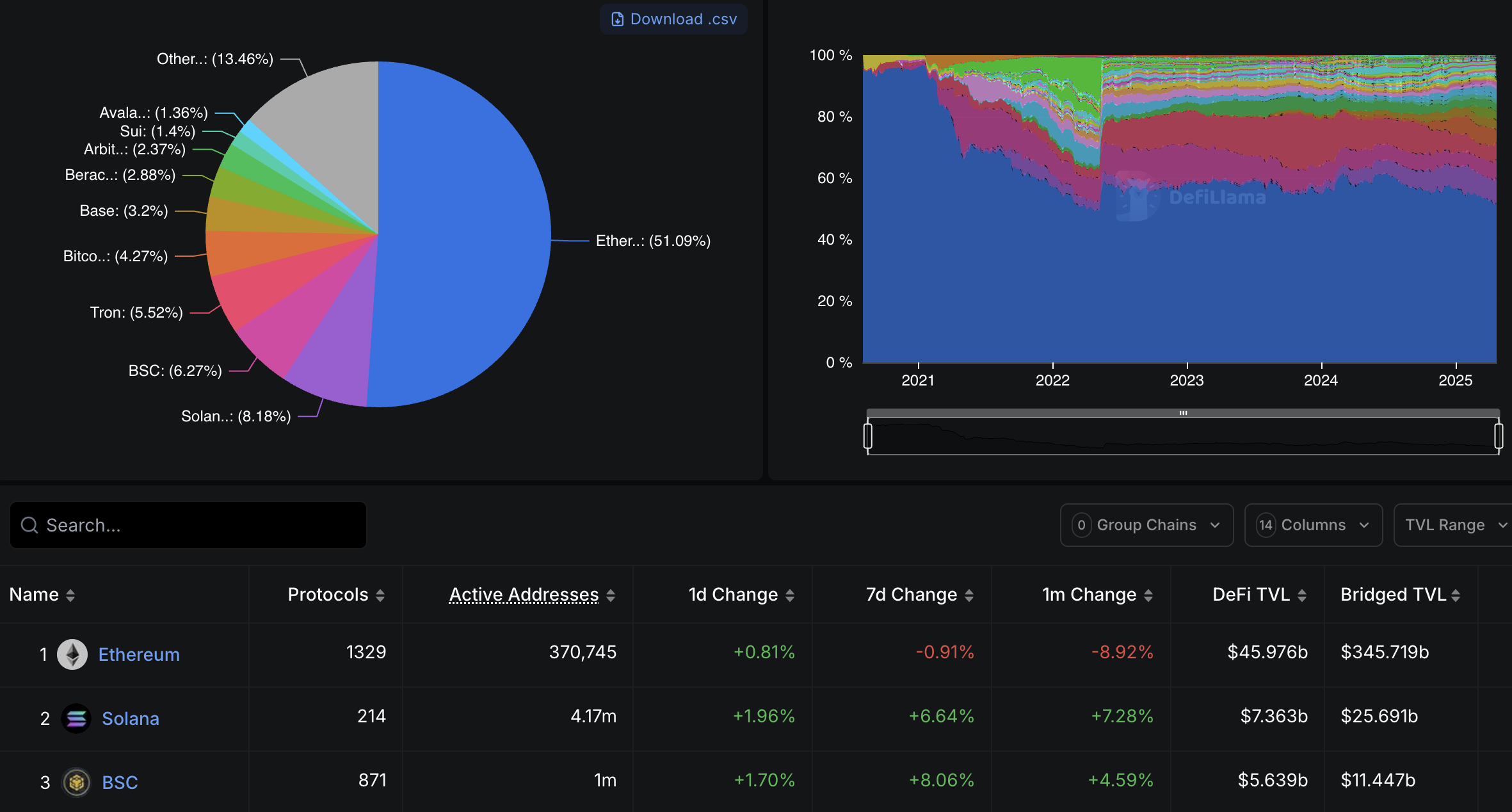

Although the current sales pressure is concerned, some experts remain optimistic about Ethereum’s long -term prospects. According to Defillama, the asset continues to lead as the main platform for Defi and NFT applications, with a total blocked value (TVL) over $ 45 billion in April 2025. In addition, updates such as Ethereum 2.0 and the full transition to Proof-of-Stake can improve Altcoin performance and attract investors in the future.

However, investors must be cautious in the short term. If the sales pressure of whales persist, Ethereum may face the risk of a more pronounced fall, especially since the ETH/BTC relationship shows no signs of recovery.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.