As the broader crypto market begins to recover from recent casualties, on-chain data reveals a growing behavioral division between long and short-term bitcoin holders.

Long -term holders (LTHS) have resumed liquid accumulation for the first time since the last local peak, while short -term holders (Sths) seem to be leaving the market.

BTC long -term holders return to accumulation while short -term those capitulating

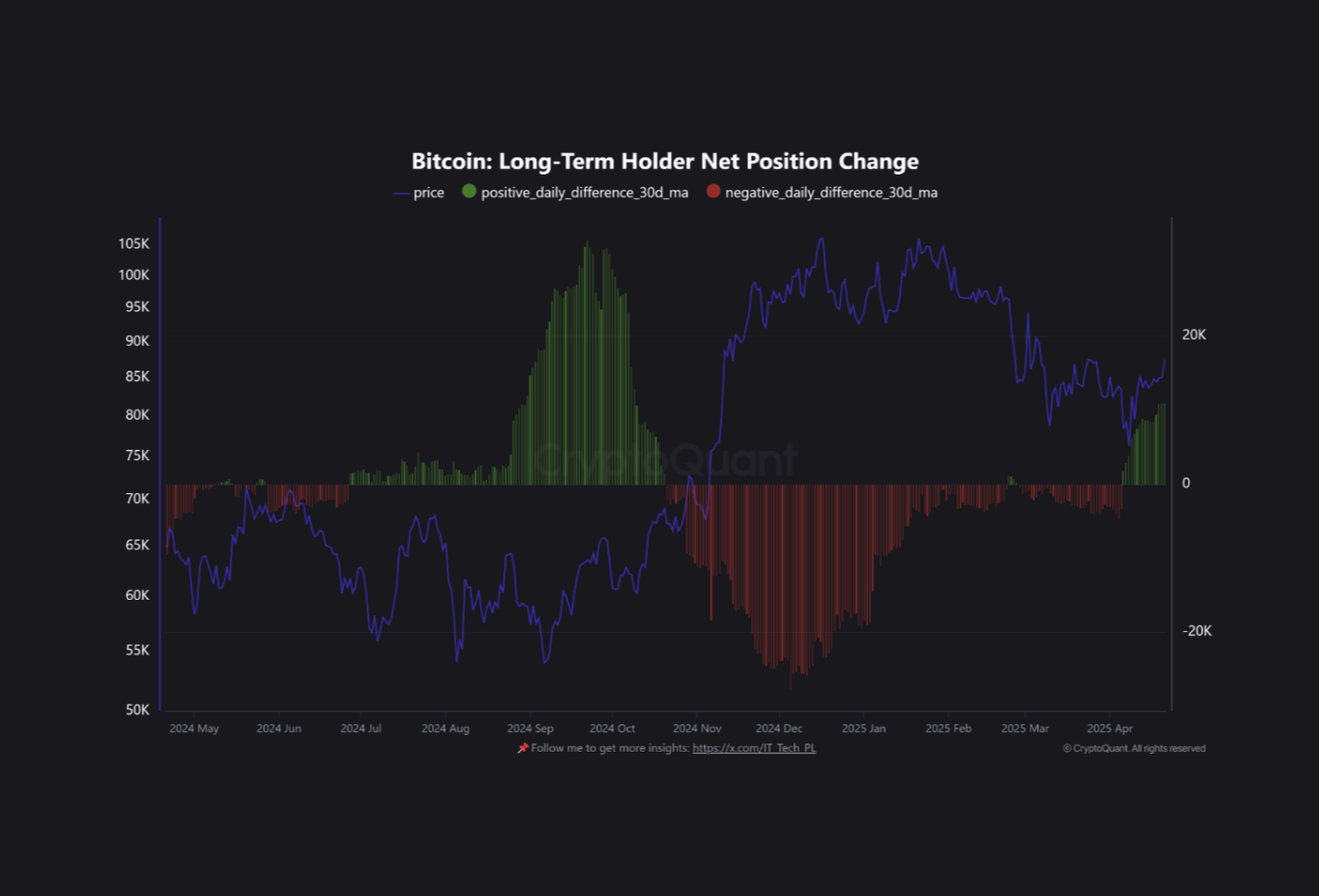

In a new reportCryptoquant’s pseudonym analyst It Tech stressed that a clear behavioral division emerged between BTC’s LTHs and Sths, suggesting the initial formation of a re-adiculating phase.

This is based on an assessment of the change of net position of BTC long -term holders (LTH), which, according to the analyst, has now become positive for the first time since the last local peak of the BTC.

This suggests that experienced and convinced participants are gradually returning to accumulation after several months of sustained distribution. Its activity often reflects a strategic repositioning of the cycle, not necessarily large -scale capital flows, the analyst commented.

Meanwhile, the BTC nths – those who kept BTC for less than 155 days – they are selling in the midst of weakness, with liquid exits remaining firmly in negative territory. This trend suggests capitulation as new investors reduce their exposure to currency in response to recent price problems.

It Tech stressed that this behavioral divergence “tends to signal the early stages of a re-adiculating phase.”

Suppose long -term participants continue to increase their positions while short -term offer is eliminated. This configuration can serve as a constructive basis for future price recovery, even if the short -term price action remains unstable, the analyst said.

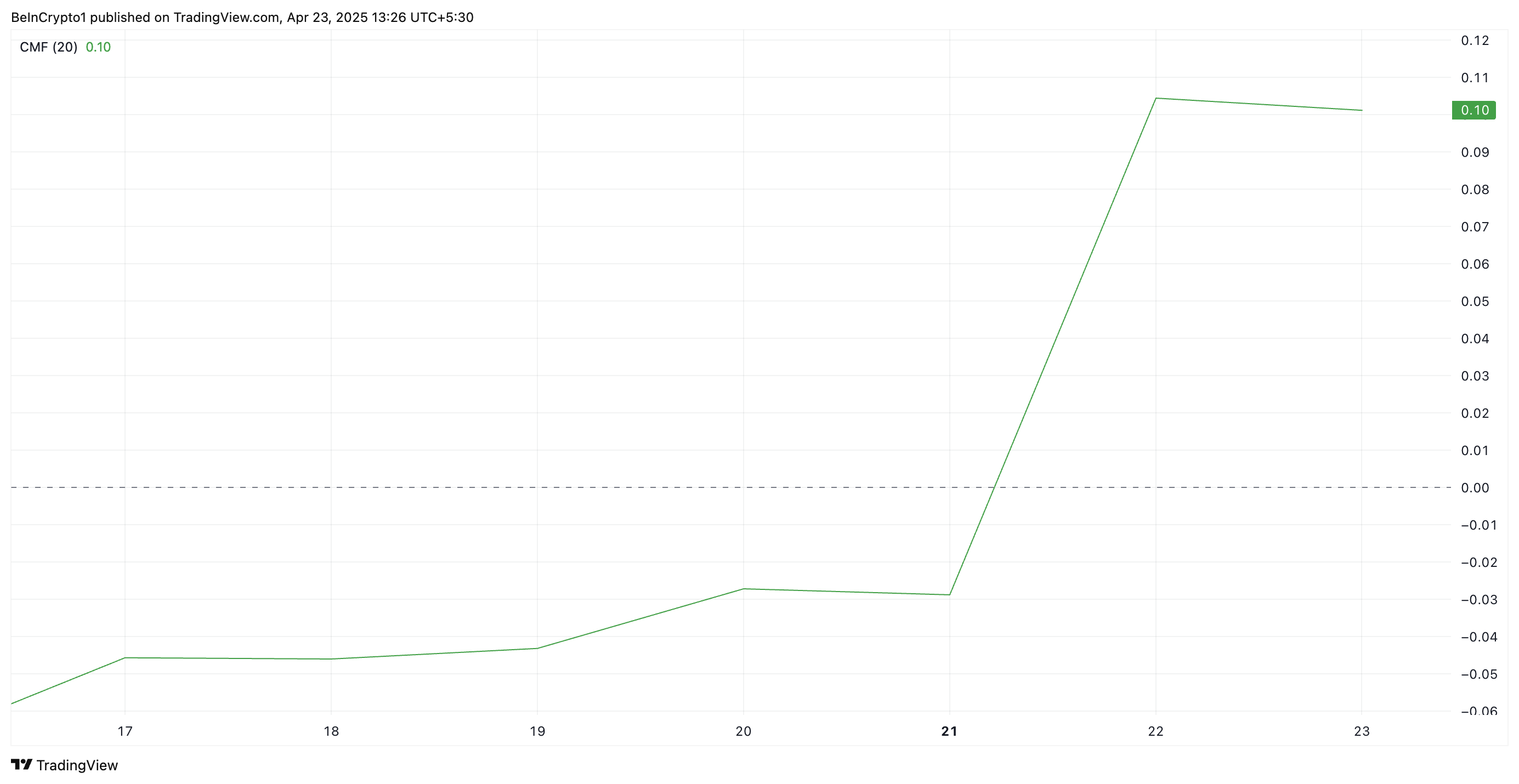

In the daily chart, BTC’s positive Chaikin Money Flow reflects increased investor demand and the positive cash flow impulse. This further reinforces the possibility of a discharge, as designed by the analyst.

At the time of publication, this moment indicator, which measures as money flows in and out of an asset, is 0.10. A positive reading of the CMF as it indicates that purchase pressure exceeds sales between market participants and suggests prolonged BTC price growth.

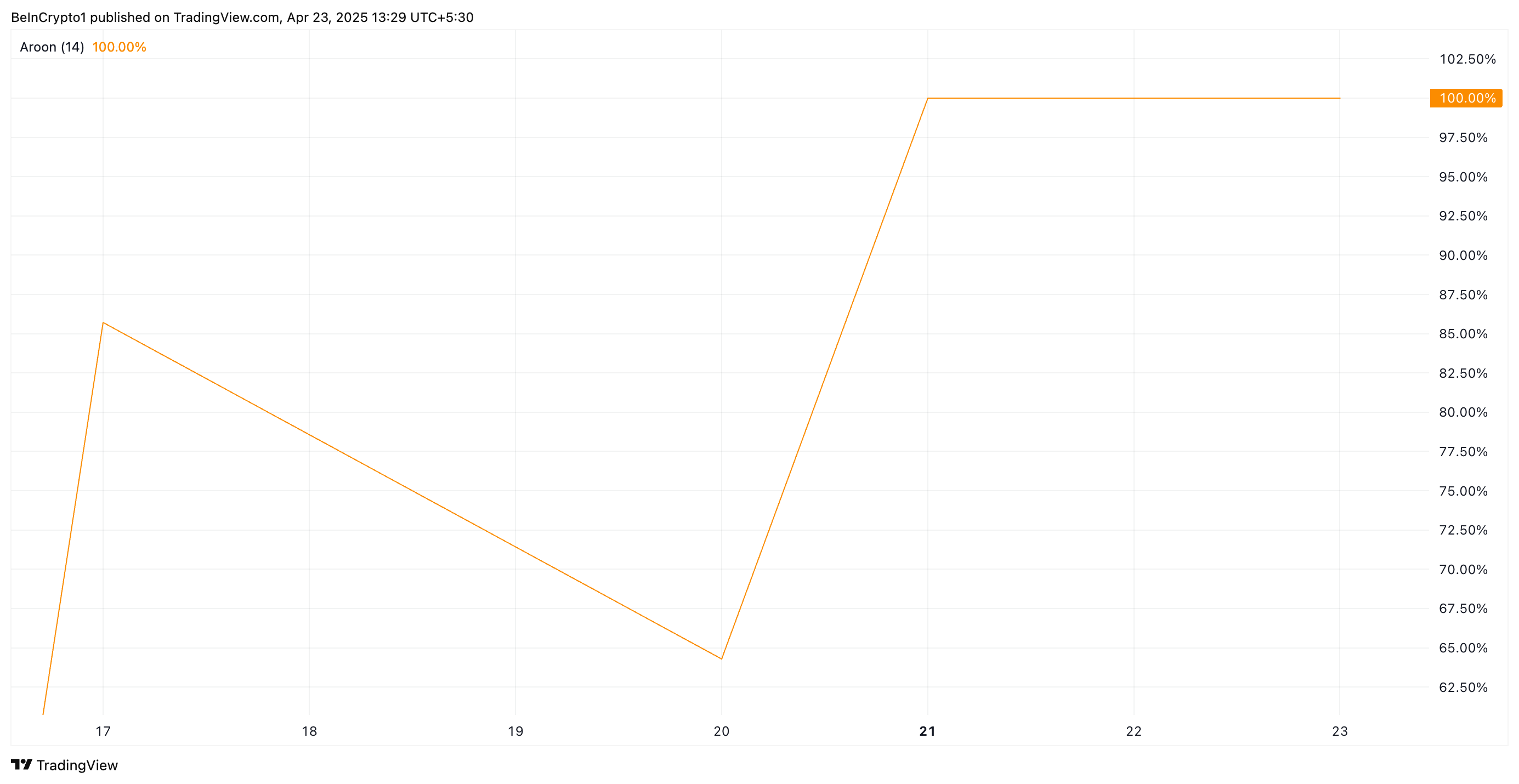

In addition, Aroon Up Line of the coin is currently 100%, reinforcing the strength of its ongoing high trend.

The Aroon indicator of an asset measures the strength and direction of a trend, tracking the time from the highest and lower prices in a given period. It is made up of two lines: Aroon Up, which measures the high impulse, and Aroon Down, which tracks the low pressure.

As with BTC, when the Aroon Up line is in 100, it signals a strong upward impulse and a dominant high trend. This suggests that the purchase pressure is high, and the price may continue to go up.

BTC Bulls Miram New Records

The BTC now negotiates firmly above the key support formed at $ 91,851. If the high pressure remains and the demand trigger, the main currency can continue its discharge to negotiate at $ 95,971.

However, if traders resume profits, this rise projection will be invalidated. In this scenario, the price of the BTC can retest the support at $ 91,851. If you can’t keep up, your price may fall to $ 87,730.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.