The total value of the cryptocurrency market (Totalcap) and Bitcoin (BTC) are undergoing a deceleration phase after recorded high high this week. Following these signs, the Deepbook Protocol (Deep) recorded a fall of almost 11%, emerging as the largest loser of the day.

In today’s news (24):

- The Ministry of Finance and the Central Bank of Russia are helping to launch a centralized cryptocurrency broker after efforts to expel foreign brokers. This initiative is part of a broader strategy in Russia to promote cryptocurrencies and dribble sanctions, including plans for a ruble -backed Stablecoin.

- The El Salvador National Digital Asset Commission (CNAD) and SEC’s cryptocurrency task force are collaborating in a transfronic regulatory sandbox for cryptocurrencies. The plan involves two pilot programs, with a cost of less than $ 10,000, with the objective of providing data on major regulatory priorities, with American brokerages in partnership with Salvadorenhas companies.

The cryptocurrency market is cooling

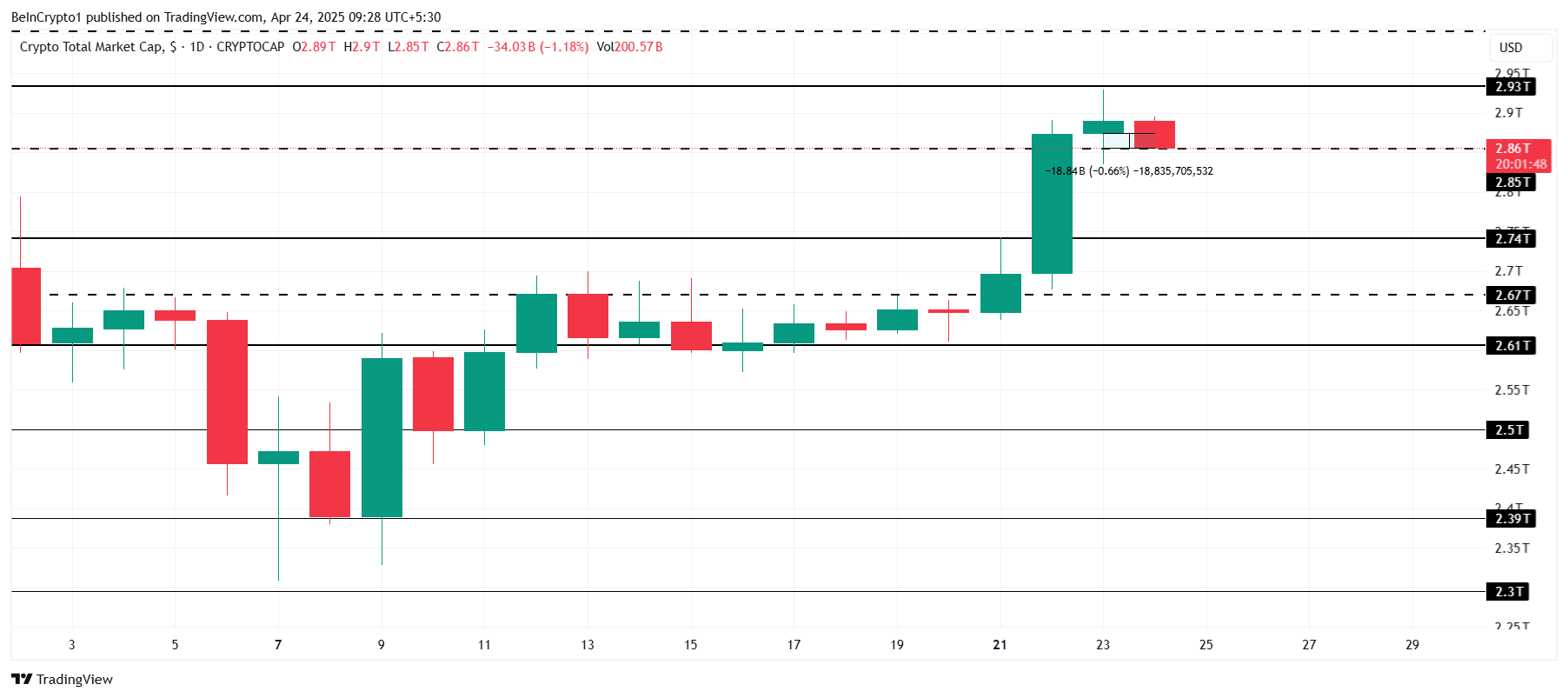

The total value of the cryptocurrency market has dropped $ 18 billion in the last 24 hours. This slight fall reflects a period of stability after a strong discharge, signaling a phase of consolidation rather than a complete reversal of the low trend. The market remains tense while seeking a direction.

Currently, at US $ 2.86 trillion, the total market amount remains above the US $ 2.85 trillion support. If this support level fails, a drop to $ 2.74 trillion may be on the horizon. This scenario would probably prolong the current consolidation of the market, potentially affecting investors’ feeling and market confidence.

However, if the market value of cryptocurrencies exceeds US $ 2.85 trillion support, it could exceed US $ 2.93 trillion in the coming days. A successful high above this level can mean a touched touched impulse, encouraging greater market growth.

Bitcoin cannot break the resistance

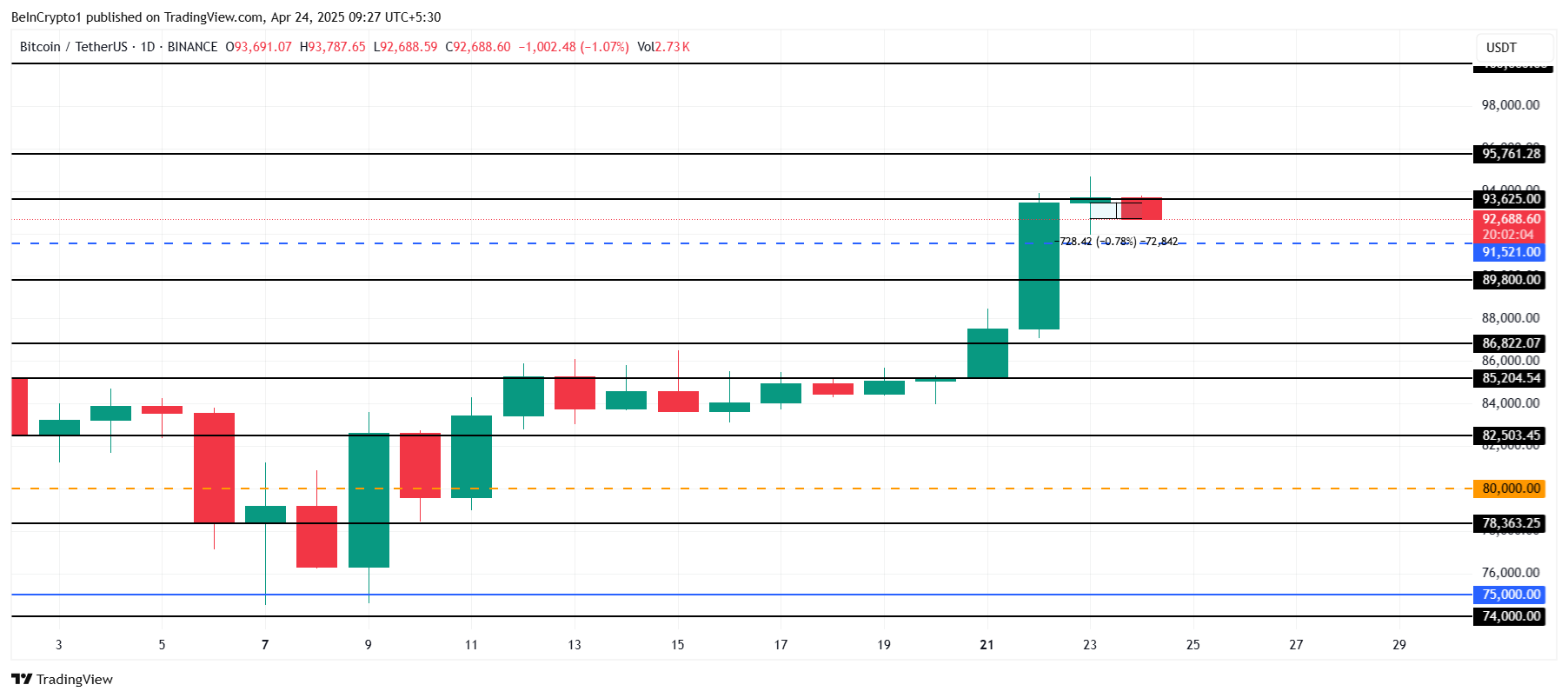

The price of Bitcoin is $ 92,688, with difficulties to break the resistance of $ 93,625 in the last 24 hours. Although it has fallen, there are no clear signs of low yet. The market remains cautious, waiting for Momentum to strengthen or break.

If Bitcoin cannot keep support at $ 91,521, the price may fall to $ 89,800. This would eliminate more than half of the gains obtained earlier this week, signaling potential weakness.

On the other hand, if Bitcoin remains over $ 91,521, it may rise and exceed the resistance of $ 93,625. The movement would probably boost the asset toward $ 95,761, strengthening its discharge perspective. A successful breach of this level would invalidate the current feeling of low and increase investor confidence.

Deepbook protocol falls on the daily chart

The price of Deep has fallen 10.5% in the last 24 hours, making Altcoin perform worse performance of the day in the category. Negotiated at $ 0.15, the token failed to maintain a support of $ 0.17. The fall raises concerns about the capacity of the recovery currency in the short term.

If the falling trend continues, Deep could fall even more to $ 0.12, eliminating much of the recent gains. Investors should be aware of signs of stabilization at this level, as new falls may suggest a prolonged phase, affecting investors’ confidence.

However, if market conditions become favorable, Deep can recover $ 0.17 as a support. A successful recovery can push the price to $ 0.23, invalidating the current perspective of low and boosting market optimism.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.