Bitcoin’s recent rally has confirmed a high standard, providing more optimism for the currency price trajectory.

Large investors are actively accumulating, and the demand for Bitcoin -negotiated index funds has increased, boosting the discharge of assets. With significant ETF market entrances, the token is about to reach new levels soon.

Bitcoin whales accumulate intensely

The activity of large investors remains a driving force behind the high price of Bitcoin. According to the trend accumulation rate, investors with over 10,000 BTC are showing an almost perfect accumulation rate of 0.9, signaling strong optimism among large investors.

This accumulation suggests that large investors expect a continuous high impulse and are positioning themselves for additional gains.

In addition, investors with between 1,000 and 10,000 BTC are also actively participating, with a slightly less than 0.7 accumulation rate. This indicates that smaller but still significant players are following the example of large investors, contributing to the positive feeling around Bitcoin.

The confidence shown by these large investors suggests that demand for Bitcoin will continue to increase, potentially raising prices.

Strong ETF flow reinforces optimism and can boost Bitcoin discharge

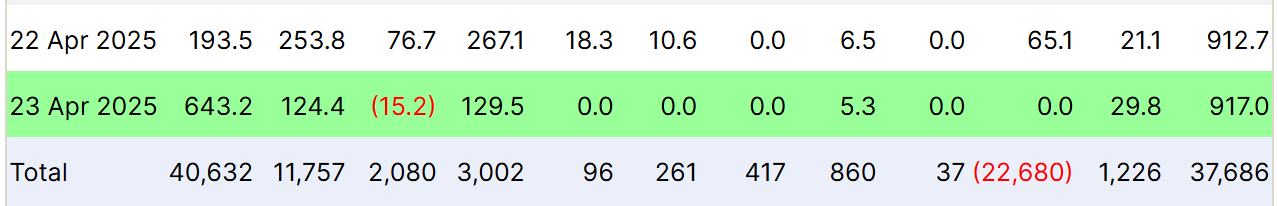

The macro time for the token is increasingly favorable, especially due to recent ETF flows in sight. In the last two days, the asset has seen $ 1.8 billion. On April 22, US $ 912 million were directed to Bitcoin ETFs, followed for US $ 917 million on April 23, marking the largest daily tickets in more than five months.

Substantial entries are a clear indication of the growing demand and reflect investors’ confidence in the long -term potential of the currency.

These large entrances to institutional investors and retail signal a broader change in the BTC market feeling. As the demand for Bitcoin ETFs grows, it also increases the high potential in the price of the asset. The growing investment in Bitcoin ETFs is creating a positive feedback cycle, probably raising the price in the short term.

BTC price targets US $ 95 thousand

Currently, Bitcoin is being negotiated at $ 92,347, just below the resistance of $ 93,625. Despite recent attempts, the asset has not yet exceeded this key level. However, with the recent breakup and favorable market conditions, the asset is on the way to break this resistance soon.

In addition, cryptocurrency validated a double background pattern earlier this week, rising 10% in just two days. This break reinforces the discharge perspective, and the combination of accumulation by large investors and ETF inputs can help Token exceed $ 93,625 resistance.

A successful rupture can push the asset to the $ 95,000 range and potentially for resistance of $ 95,761.

However, if Bitcoin cannot maintain its upward impulse and fall below the $ 89,800 support, this may trigger a low reversal.

A fall below this level of support would invalidate the discharge perspective, potentially leading the price of Bitcoin to $ 86,822, erasing recent gains.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.