The total value of the cryptocurrency market (Totalcap) and Bitcoin (BTC) is remaining stable around key price levels, while volatility remains low. Stacks (STX) is capitalizing this moment, rising 15% in the last 24 hours.

In today’s news (25):

- A recent study by the Citi Institute provides that the global Stablecoins market could reach $ 3.7 trillion by 2030, with a base scenario of $ 1.5 trillion. The report remains optimistic, despite the risks that can lead to a low -$ 0.5 trillion scenario, highlighting the potential impact on global markets.

- Polymarket’s betting market for the next Pope moved $ 6.4 million after a viral scam falsely claims that the Catholic Church would excommunicate gamblers. The fake publication, shared by a popular account in X, condemned platforms like Polymarket for turning the papal election into financial speculation.

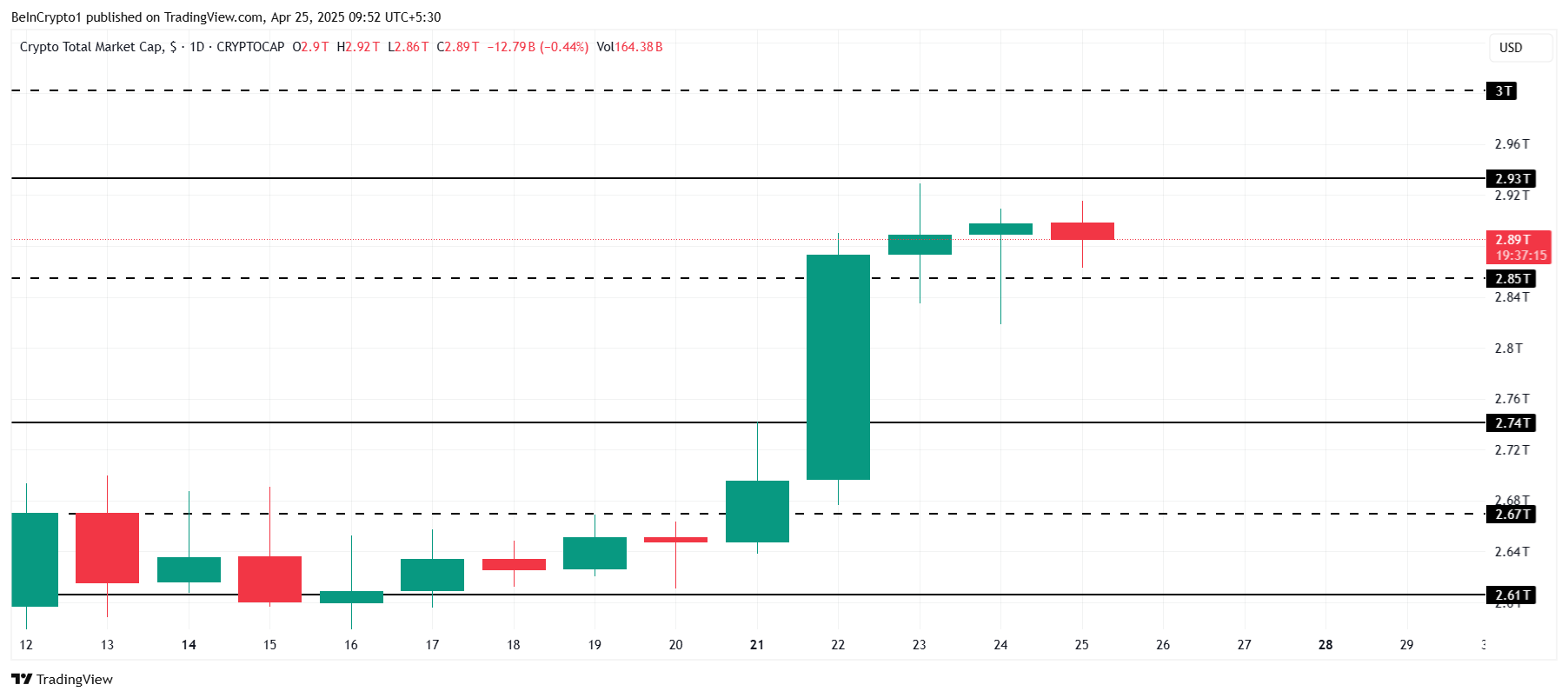

The cryptocurrency market approaches $ 3 trillion

The total value of the cryptocurrency market has remained stable in the last 24 hours, above the US $ 2.85 Tri support level. Currently negotiated at $ 2.89 TRI, the market seems to be finding stability despite small fluctuations. This stability arises as investors await a possible breakup.

Totalcap is approaching the mark of $ 3.00 tri, facing resistance at $ 2.93 trillion. If the market can turn this barrier into support, there may be a new boost, leading to even stronger growth.

However, a drop below the $ 2.85 trillion support may result in a decline in the total value of the cryptocurrency market. This can push the market down, testing levels as low as $ 2.80 trillion or possibly up to $ 2.74 trillion, invalidating the current optimistic perspective.

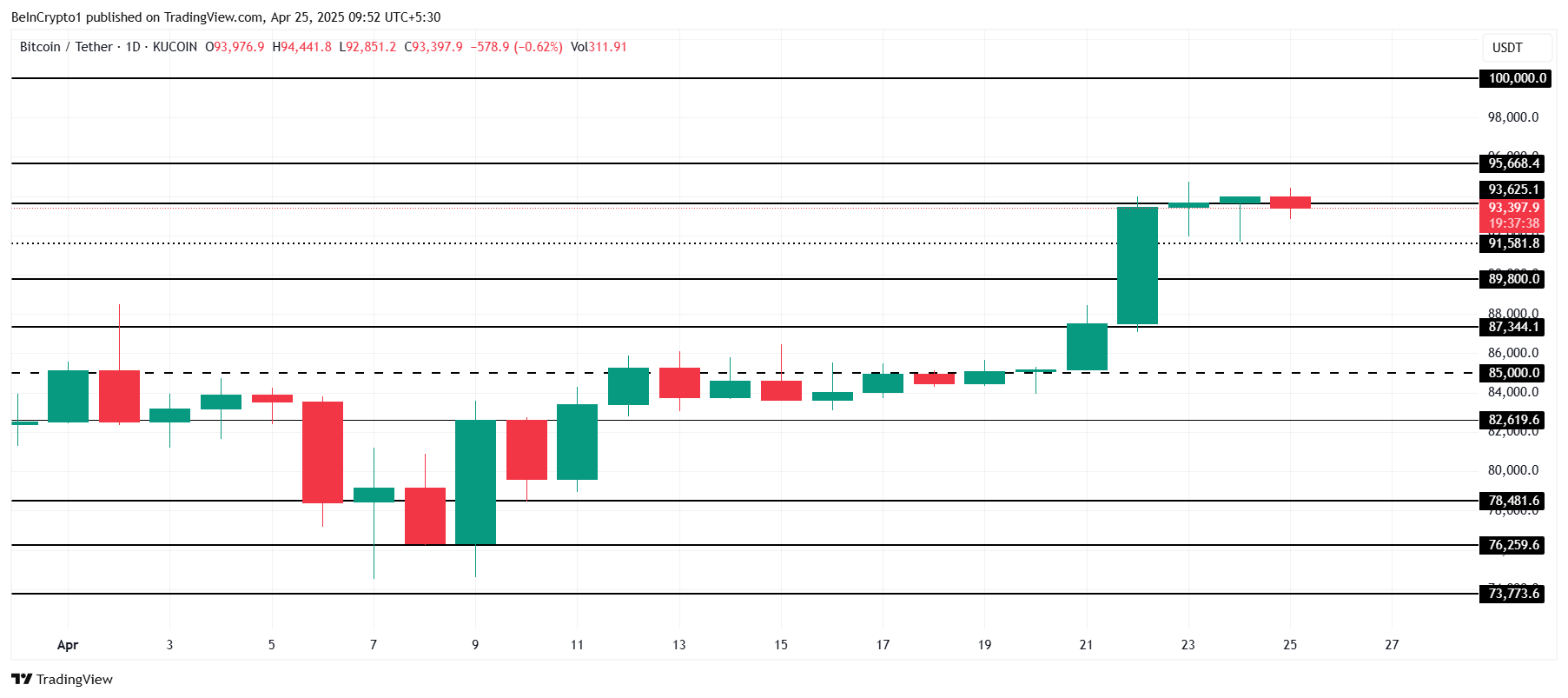

Bitcoin needs an impulse

The price of Bitcoin presented minimum movement, being negotiated at US $ 93,397 at the time of writing this text. Despite the low volatility in the last 24 hours, the BTC has struggled to secure US $ 93,625 as a support. This lack of decisive price action makes the asset vulnerable to short -term fluctuations.

If the currency can guarantee US $ 93,625 as a support in the coming days, it may potentially advance to $ 95,668. This level represents the final resistance before reaching $ 100,000. A successful break can generate even more high boost, boosting Bitcoin towards new price levels and encouraging investors’ confidence.

However, if the value does not remain above $ 93,625 and under sale, it may fall below the main support levels. A drop below $ 91,581 and $ 89,800 would invalidate the optimistic perspective, prolonging the current weakness of the price.

Stacks reaches the highest level in 2 months

STX emerged as Altcoin with the best performance of the day, rising 15.5% and being negotiated at $ 0.902. Altcoin successfully surpassed the $ 0.870 mark, indicating a strong high impulse. This significant price variation highlights investors’ confidence and suggests the possibility of additional growth if market conditions remain favorable to STX.

With STX reaching a maximum of almost two months, it seems ready to continue its upward trajectory towards the $ 1.00 mark. Achieving this level would allow STX by targeting its next resistance at $ 1.088, signaling potential for more gains. A successful breach of over $ 1.00 could reinforce the optimistic STX perspective in the short term.

However, if Altcoin experiences short -term profit, price reversal is possible. In this scenario, Altcoin can fall below the support level of $ 0.870 and reach a drop to $ 0.778, potentially reaching $ 0.729.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.