The cryptocurrency market is a significant change in investors’ feeling this month, driven by a consistent recovery in prices. The valuation of Bitcoin triggered a domino effect on demand, affecting from major institutional players to retail investors.

Since the minimums registered in early April, the asset has accumulated high of 25%. On-chain data, combined with projections revised by industry experts, help to assess the sustainability of this discharge movement.

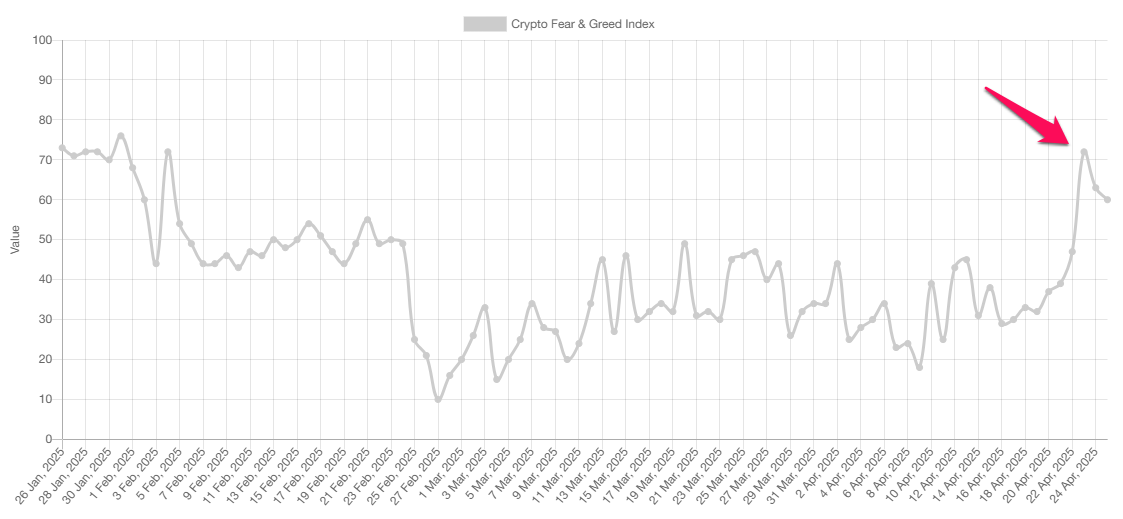

Market feeling changes fear to greed

According to data from alternative.me, the fear and greed rate rose from a low from 18 to a rise from 72 in April. This is the highest level since February and marks a clear change of fear for greed.

On the other hand, the coinmarketcap index version features a slightly distinct scenario. The index rose from 15 to 52 points, moving from a state of extreme fear to a neutral zone. Although there are differences between the two indicators, both show a significant change in investors’ feeling, which have overcome panic that usually drives mass sales.

This neutral or greedy mindset establishes the foundations for more optimism. If it continues, the market can reach an extreme greed state before any significant correction occurs. This change of feeling has led to five signs of divergence that support the potential continuation of recovery for both Bitcoin and Altcoins.

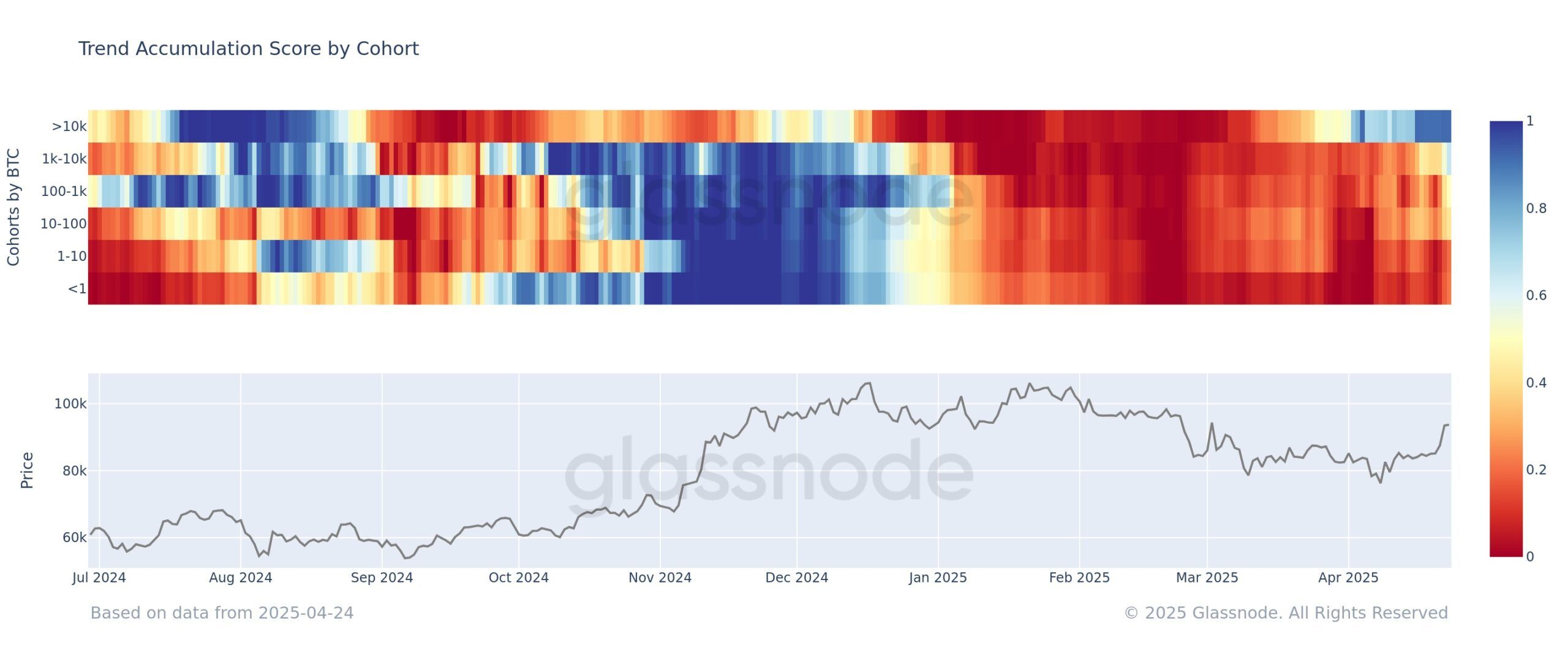

Bitcoin accumulation spreads from large to smaller wallets, indicating a positive perspective

On-chain data show that whale accumulation helped Bitcoin stay over $ 93,000 in the last week of April.

A Glassnode chart reveals a clear transition from a distribution phase (marked in red) to an accumulation phase (marked in green) during April. This moment coincides with the recovery of Bitcoin from its monthly low.

Specifically, the so -called bitcoin whales – wallets that have over 10,000 BTC – have shown an almost ideal accumulation. Your trend accumulation score is currently around 0.9.

Following the behavior of whales, wallets with 1,000 to 10,000 BTC also gradually increased their accumulation score in the second half of April, reaching 0.7, which is visible by the color change from the yellow to Azul chart. Other portfolio segments also indicate signs of accumulation, reflecting a change in feeling among smaller investors.

So far, big players have bought in this rally, Glassnode explained.

In addition, a recent benchrypto report points out that Bitcoin ETFs recorded $ 2.68 billion in tickets last week. These ETFs had five consecutive days of positive entries. These metrics confirm that demand is returning and establishing the base for continuous price gains.

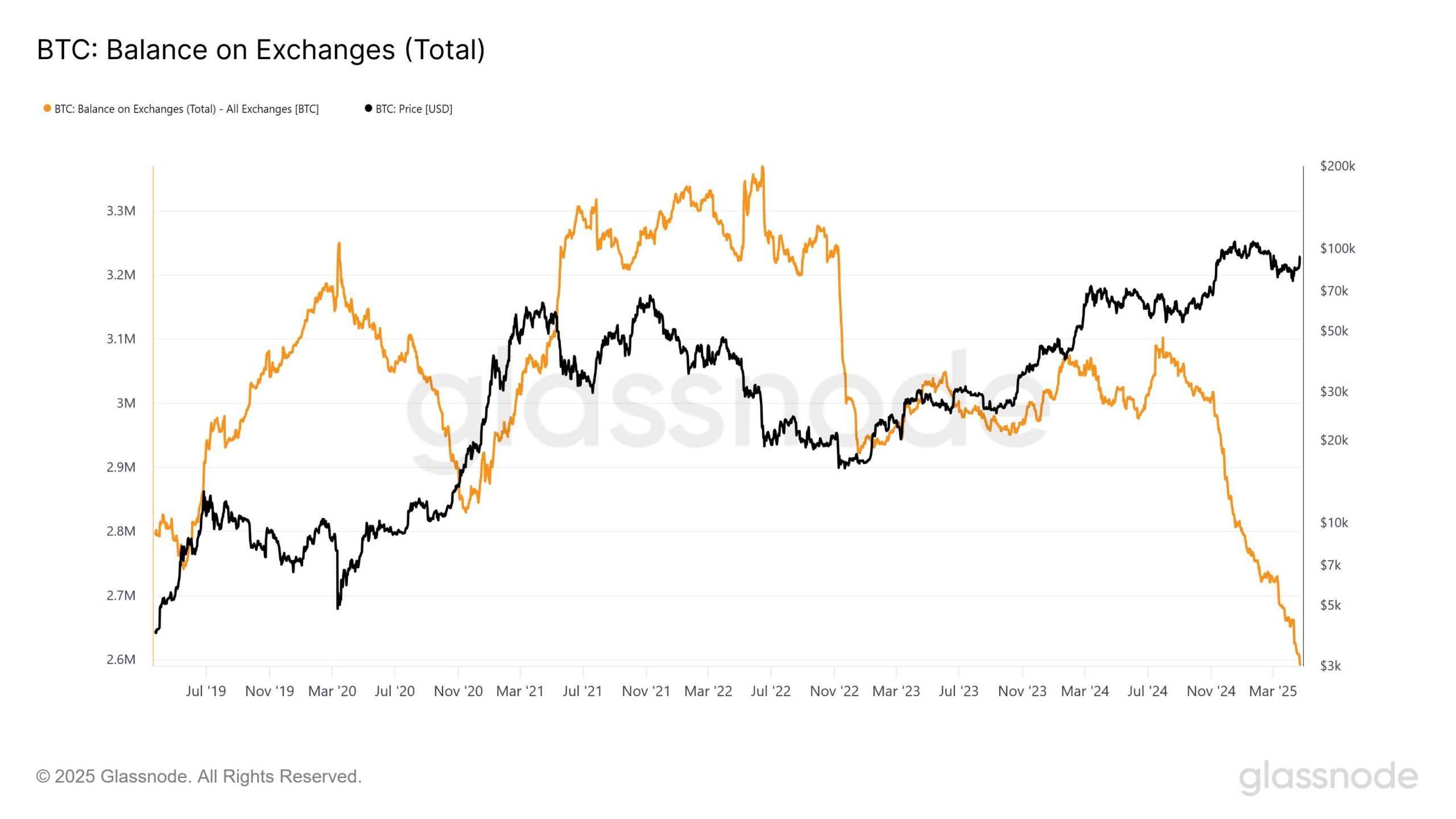

Fidelity updates forecast for bitcoin

The Fidelity Digital Assets, a division of the Investments Fidelity, reported that the supply of Bitcoin in Exchanges has fallen to its lowest level since 2018, with only about 2.6 million BTC remaining.

Fidelity also pointed out that more than 425,000 BTC have been removed from Exchanges since November 2024. In addition, public companies have added nearly 350,000 BTC since the US elections, with an average acquisition of over 30,000 BTC per month in 2025. The asset manager projects that this trend of accumulation persists in the near future.

We have seen the supply of bitcoin in exchanges fall due to purchases of public companies – that we anticipate accelerate in the near future, Fidelity Digital Assets stated.

As fund managers like Fidelity have a positive perspective for April, some retail investors begin to express caution. The idea of “selling in May” is beginning to emerge, reflecting concern in the midst of unpredictable macroeconomic factors, such as rates and changes in interest rates, which can strongly impact the market in the near future.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.