Bitcoin -trading funds in the US registered massive tickets of more than $ 3 billion last week.

This performance marks one of the strongest weeks for Bitcoin ETFs in 2025, driven by the recovery of the price of the BTC and the renewed interest of institutional investors.

Bitcoin ETFs register a larger sequence of inputs in six days

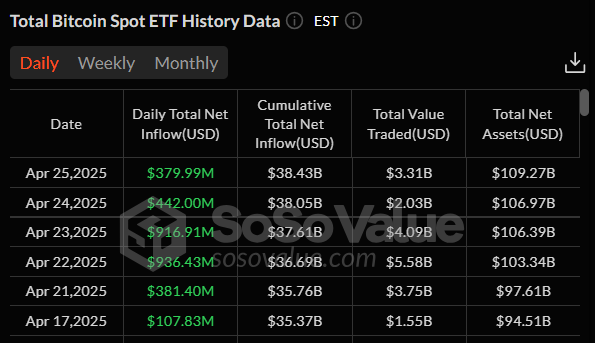

According to Sosvalue, the 11 Bitcoin ETFs in sight recorded a combined entry of approximately US $ 3.06 billion over six consecutive negotiation sessions.

This investment wave is classified as the second largest net input recorded for Bitcoin ETFs, highlighting the growing demand for crypto -focused financial products.

The biggest tickets were seen on April 22 and 23, when the daily figures reached $ 936 million and US $ 916 million, respectively. Analysts noted that these have been some of the best daily performances since Donald Trump returned to the White House earlier this year.

The investment wave raised the total assets under management (AM) to Bitcoin ETFs to $ 109 billion. Blackrock’s Ishares Bitcoin Trust (Ibit) continues to lead the market, now managing more than $ 56 billion. This represents about 3% of Bitcoin’s circulating supply.

Saylor predicts Ibit leadership and analysts highlight Bitcoin’s strength

Michael Saylor, presidente da Strategy (antiga MicroStrategy), teria planned that Ibit could become the largest ETF in the world in the next decade.

Meanwhile, analysts attribute the increase in ETF entrances to the recent Bitcoin decoupling of traditional risk assets such as US and gold actions. Increasing geopolitical tensions, especially global tariff battles, have increased bitcoin status as a safe investment.

In addition, analysts from The Kobeissi Letter suggest that macroeconomic asset bitcoin decoupling has supported its price recovery. Since falling below $ 75,000 on April 7, the price of BTC has risen more than 25% and is now being negotiated over $ 94,000.

“As the global impression of money continues, the valuation of the price of Bitcoin will also continue. The value of paper money is backed by nothing more than debt, and this debt has been out of control for some time. Bitcoin is the solution to our broken monetary system,” said Mark Wlosinski, a crypto analyst, stated.

Looking to the future, Ark Invest analyst David Puell remains highly optimistic about the main crypto.

Puell predicts that Bitcoin could reach up to $ 2.4 million by 2030, driven by growing institutional adoption and its increase as a strategic asset of corporations and even nations.

In more conservative scenarios, it projects that Bitcoin reaches between $ 500,000 and $ 1.2 million in the same period.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.