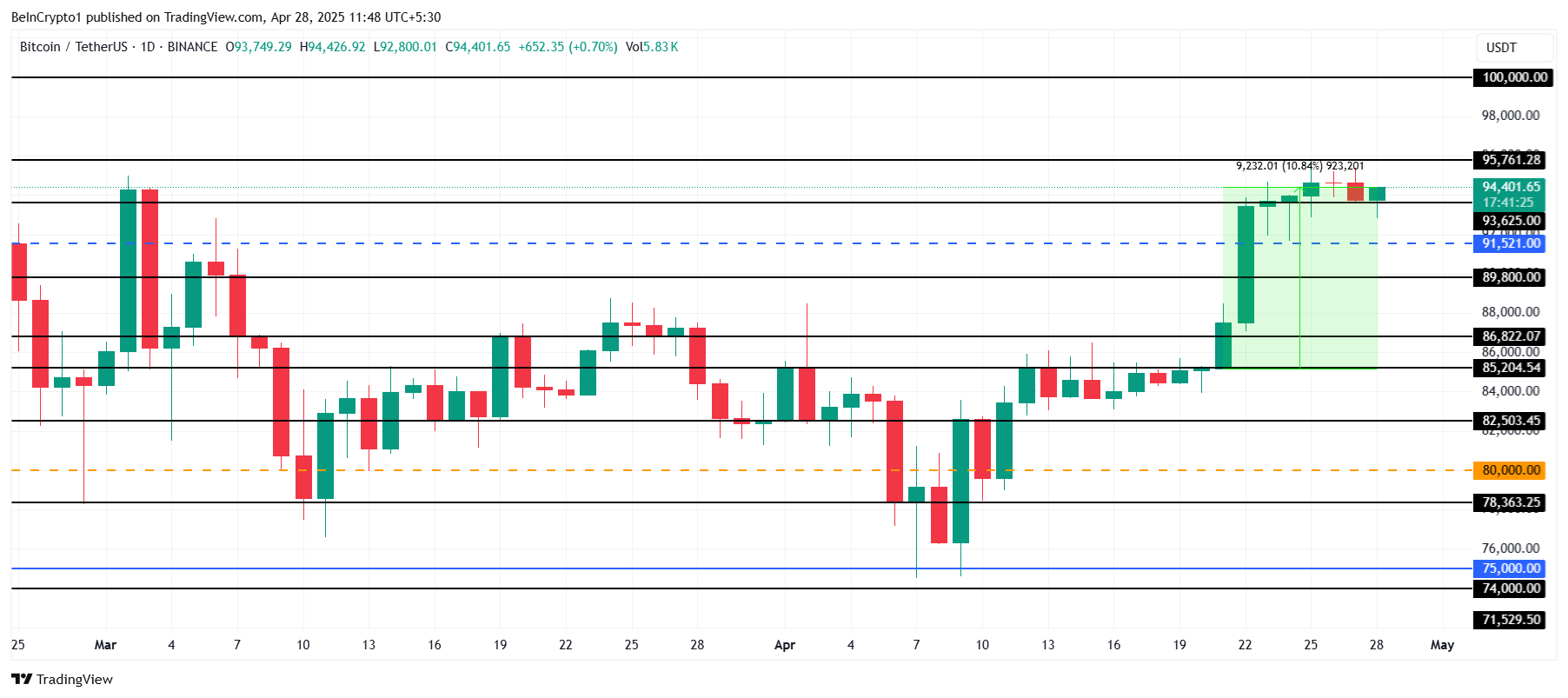

Bitcoin recently experienced a recovery, raising the price again over $ 90,000 after more than five weeks of stagnation. Currency is currently being negotiated close to $ 94,401, just below the critical resistance of $ 95,761.

This suggests that the asset has not yet reached its saturation point, with more upward boost if key barriers are overcome.

Bitcoin investors are greedy

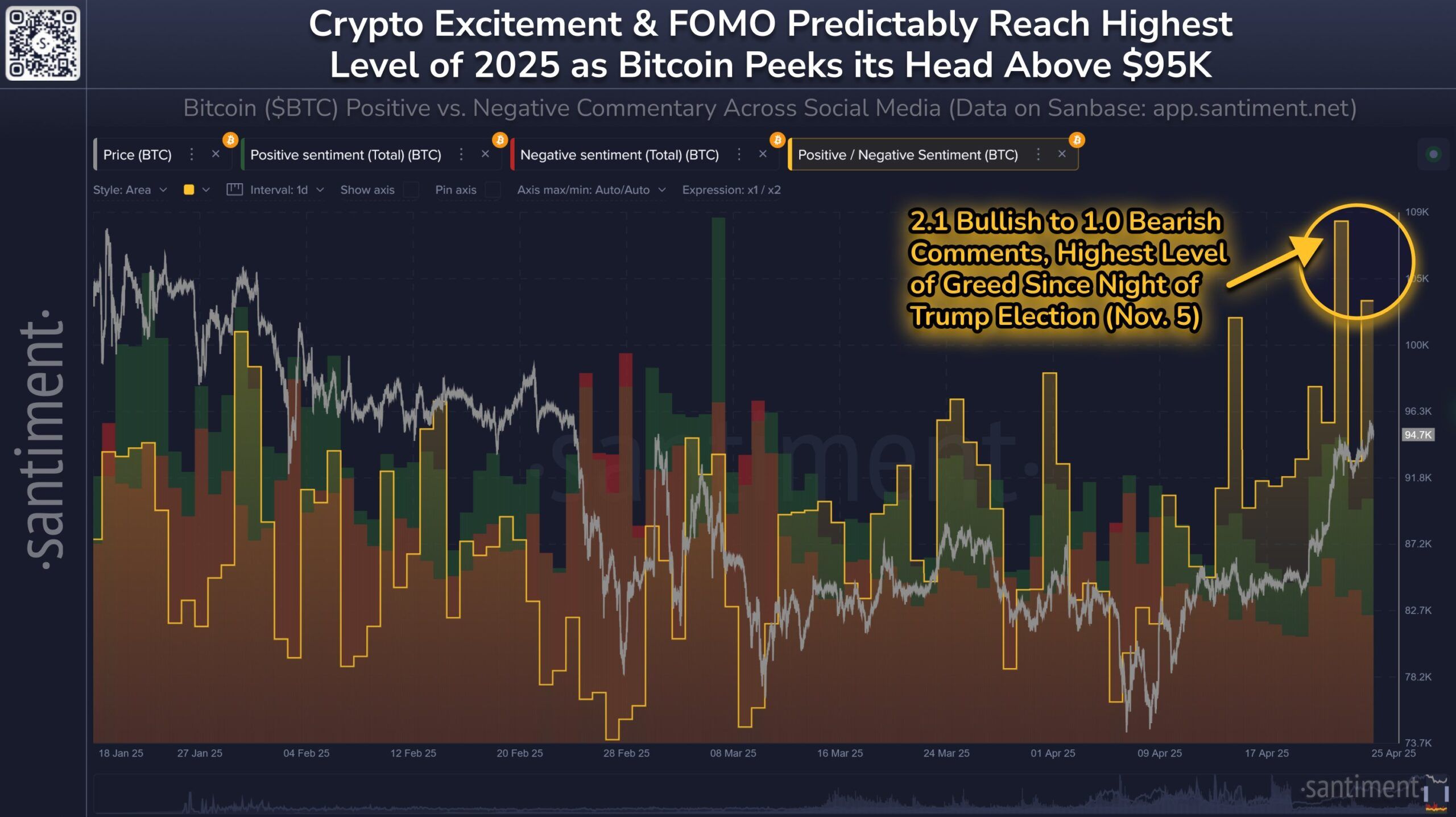

Market feeling about Bitcoin remains extremely positive, with investors demonstrating high levels of optimism for new price gains. Posts on social networks indicate a sharp increase in optimistic feeling, with the number of optimistic posts (compared to pessimists) reaching levels not seen since Donald Trump’s election night on November 5, 2024. This increase in positivity suggests that many investors are ready to capitalize the growth potential of Bitcoin, further feeding their recovery.

However, the extreme level of greed in the market raises questions about the sustainability of this ascending movement. As investors’ feeling becomes increasingly optimistic, there is a risk that this can lead to a local top if many traders become excessively greedy.

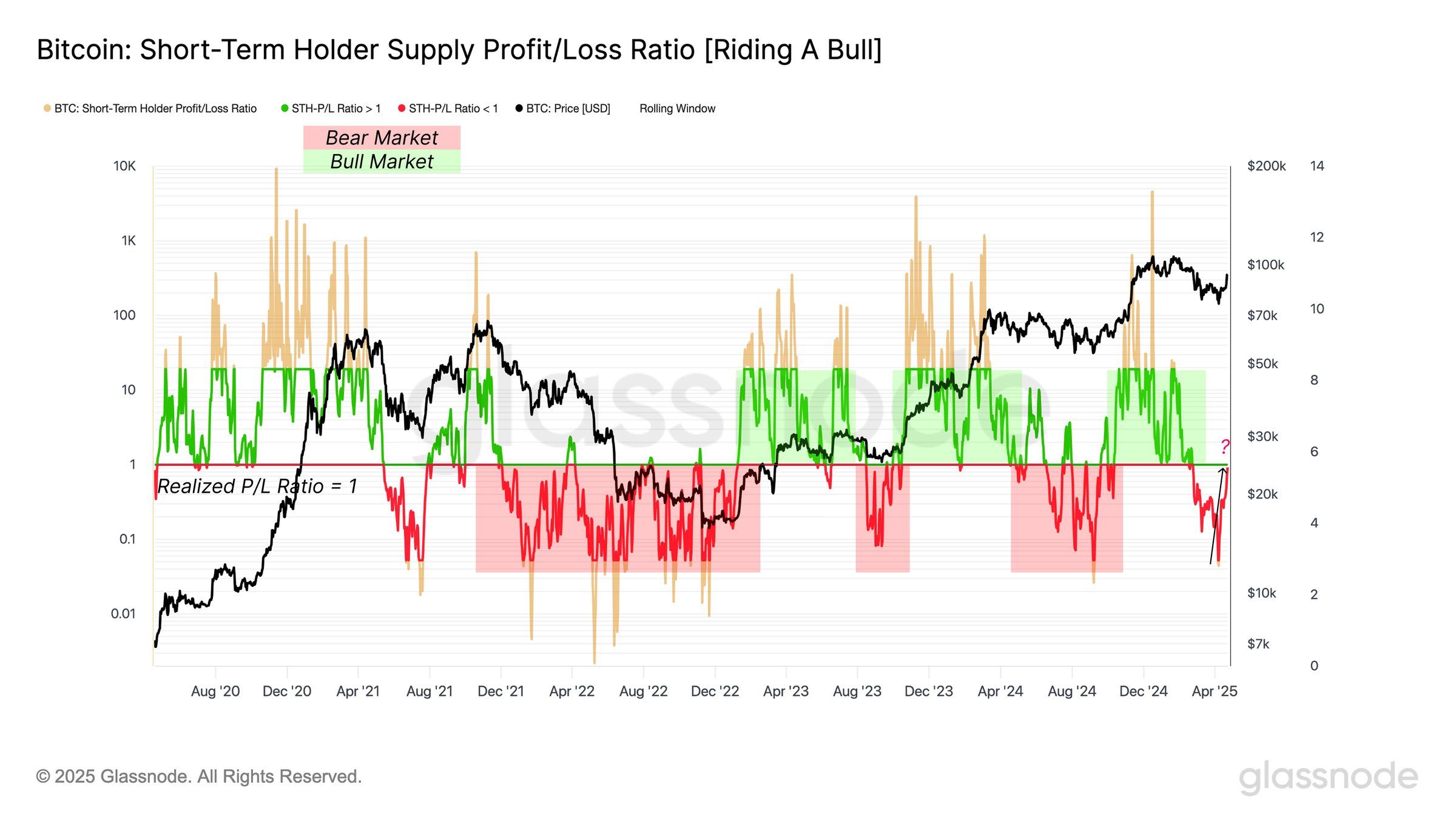

The broader macro impulse for bitcoin is signaling a recovery, particularly in the profit/loss ratio (p/l), which is approaching a neutral level of 1.0. This change indicates a balance between profit coins and those in loss. Historically, the 1.0 threshold acted as resistance during low phases, but a sustained movement above this level can signal a stronger recovery and a continuous upward impulse to the asset.

Although the change to a neutral P/L relationship suggests potential strength, it also opens the possibility of sales pressure as investors seek to make profits. Therefore, Bitcoin’s ability to keep the impulse will depend on how investors react to price movements and decide to sell or maintain their positions.

BTC price needs an impulse

Bitcoin’s recent price action shows a 10% increase in the last seven days, being negotiated at $ 94,401. The asset is now just below the significant level of resistance of $ 95,761, which has been stable for some time. A break above that level would put the asset on the way to reach new levels, with $ 100,000 as the next big milestone.

If the asset exceeds US $ 95,761, the growing greed in the market will likely encourage investors to keep their positions instead of selling. This will probably feed the optimistic boost of the coin, pushing Bitcoin even more toward $ 100,000 as demand remains strong among traders eager to capitalize potential gains.

However, if Bitcoin cannot keep its position above $ 93,625, the price may fall towards the $ 91,521 support. A deeper drop to $ 89,800 can put the optimistic impulse at risk, delaying any immediate recovery and increasing the chances of a consolidation phase.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.