Today (29), the focus is on Bitcoin ETFs, which continue to attract strong institutional interest and gaining space as an alternative to gold in times of uncertainty. Take a coffee and check out the analyzes of what this movement can mean for the future of the BTC.

Take a coffee to see expert opinions about what the future reserves for Bitcoin (BTC) amid the renewed institutional interest. Meanwhile, its market pair, gold, is no longer the only investment sought in times of uncertainty.

Bitcoin at $ 120,000: Standard Chartered predicts next discharge from BTC

As indicated in a recent US Crypto News publication, the price of Bitcoin remains on the way to the purpose of the descendant wedge pattern.

After surpassing the resistance at $ 94,000, the BTC is facing immediate resistance at $ 95,765. A decisive closure of Candlestick above this obstacle can pave the way to the highest, with the price of Bitcoin potentially completing the expected rise from 20% to $ 102,239.

This optimism emerges while Bitcoin emerges as a potential beneficiary in the midst of global commercial tensions. US tariffs are causing capital escape and market volatility.

In this context, analysts are already predicting a major Bitcoin reassessment. They cite increased liquidity and global conditions, elements that suggest a change away from dollar dependent assets.

Beincrypto has contacted Standard Chartered to get insight into the current Bitcoin market perspective. Interestingly, the bank predicted a bitcoin breakage rally mirroring its US post-election increase, with a price of $ 120,000 in the second quarter now in view.

According to Geoff Kendrick, Standard Chartered digital asset research, the price of Bitcoin is prepared for a rally similar to its dramatic ascension after the US presidential election in November 2024.

The pioneer crypto reached a historical record of $ 103,713 the following month.

Bitcoin attracts more than gold and can break record soon

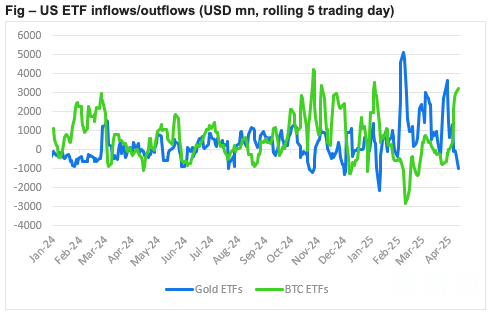

Kendrick pointed to the increase in Bitcoin ETF influx in sight in the US, especially compared to the fall of golden ETPs influxes.

“The last time the difference between Bitcoin and Gold’s ETF flows was so great was during the US election week,” Kendrick told the beinchrypto.

According to Kendrick, Bitcoin is approaching gold, with the King of Crypts already serving as a better protection amid strategic reallings of active away from the US.

This is aligned with another recent US Crypto News publication that highlighted Bitcoin such as Traditional Finance Protection (Tradfi) and US Treasury Risk.

With this, the Standard Chartered executive maintains an optimistic goal for the second quarter for the largest digital asset by market capitalization.

“I hope a new historical record of $ 120,000 in the second quarter, then for my $ 200,000 forecast at the end of the year,” Kendrick added.

In fact, Standard Chartered recently predicted that Bitcoin would reach a new historical record, predicting $ 200,000 by 2025 and $ 500,000 by 2028.

Graph of the day

This graph compares investment flows in two financial instruments, Bitcoin ETFs and gold ETPs. It shows greater interest in investors and volatility in the first compared to the second.

Quick Crypto, Alpha DIRECT TO POINT

- More than 85% of Bitcoin’s circulating supply is currently in profit, signaling strong confidence from investors and discharge trends.

- Billionaire Ray Dalio warns that the global monetary order is approaching the collapse, driven by tariffs and disgusting trends.

- Tether’s first trimester’s 2025 report reveals that its tokenized gold product, Xaut, is backed by over 7.7 tons of physical gold. With the growing global economic uncertainty, Shaut’s market value rose to US $ 853.7 million, becoming the largest tokenized gold product.

- Bitcoin ETFs had seven consecutive days of positive entries, with more than $ 500 million in new capital added. Despite the strong demand for ETFs, the Bitcoin futures market shows caution, with a growing preference for low options.

- BNB Chain optimizes for speed, reducing block times to 1.5 seconds to BSC and 0.5 seconds to OPBNB. Meanwhile, Ethereum’s Fusaka faces a disagreement between developers.

- Experts warn that Stablecoins transaction volumes may be inflated by bots, Wash Trades and Flash Loans that distort the actual use.

- Virtual Virtual Protocol’s native token rose 161% in a week, reaching a two -month increase as AI agent activity increases.

Pre-market view of crypto actions

| Enterprise | At the closing of April 28 | Pre-market view |

| Strategy (MSTR) | US$ 369,25 | US$ 370,47 (+0,33%) |

| Coinbase Global (COIN) | US$ 205,27 | US$ 206,79 (+0,74%) |

| Galaxy Digital Holdings (GLXY.TO) | US$ 21,21 | US$ 21,81 (+2,81%) |

| MARA Holdings (MARA) | US$ 14,01 | US$ 14,04 (+0,21%) |

| Riot Platforms (RIOT) | US$ 7,63 | US$ 7,66 (+0,39%) |

| Core Scientific (CORZ) | US$ 8,24 | US$ 8,34 (+1,21%) |

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.