The old financial market saying “Sell in May and Go away” has been a guiding principle for investors seeking to avoid the potential volatility of summer. However, some analyzes suggest that this saying may not apply to Bitcoin next month.

Several arguments indicate significant differences in the market scenario for 2025. These factors suggest that May can see price increases instead of falls.

4 reasons why selling in May can be a big mistake in 2025

Many analysts have recently highlighted a key reason: Bitcoin now aligns closely with the global monetary supply M2.

M2 measures the amount of money circulating in the economy. Includes money in kind, savings deposits and highly liquid assets. Historically, M2 showed a strong correlation with Bitcoin prices. When central banks such as the Fed, PCS or PBOC increase money offer, Bitcoin tends to rise.

Kaduna shared a chart that confirms that this trend will continue in 2025. According to this standard, May may be a month of prominence for Bitcoin. Although not all analysts agree with this view, investors are increasingly accepting it, creating a positive feeling in the market.

“Selling in May and leaving would be a big mistake,” Kaduna emphasized.

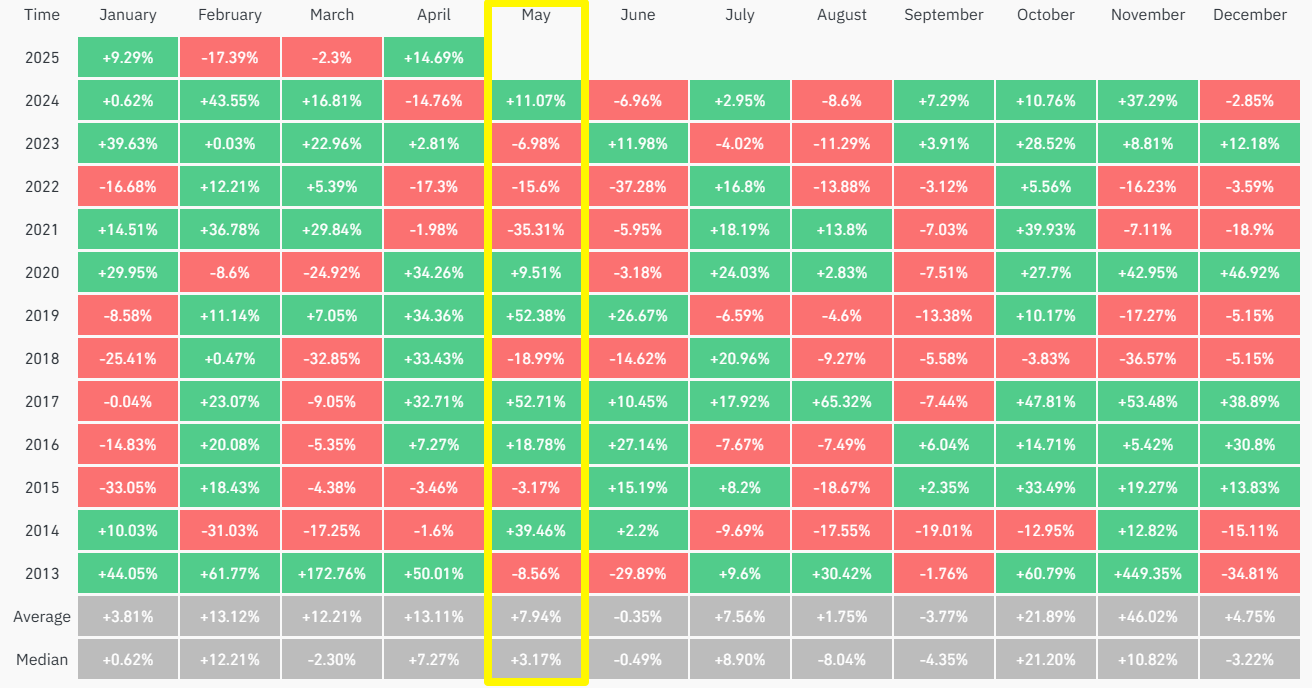

Secondly, historical data support Kaduna’s perspective. According to CoinglassBitcoin presented an average return of more than 7.9% in May in the last 12 years. Although financial markets often try turbulence in summer, Bitcoin does not always follow this pattern.

Instead, May often shows positive performance. It is not the strongest month, but it surpasses June and September. An investor in X noted Which since 2010, Bitcoin had nine positive and six negatives.

The original proverb comes from the stock market, where historical data shows that works Better for stocks, not necessarily for crypto, so the “sell in May” may not work.

Bitcoin can contradict the classic saying and climb in May, analysts say

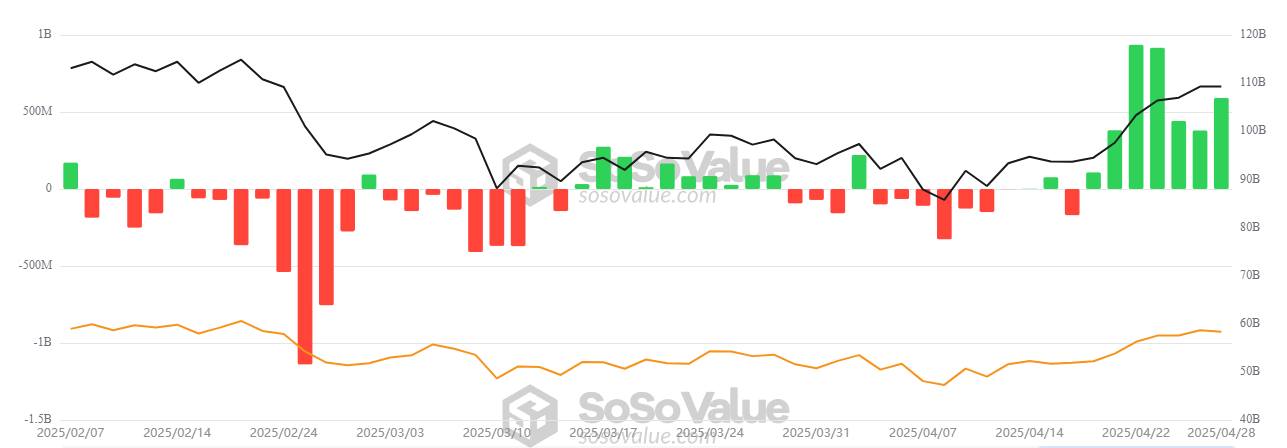

Another important point that supports Kaduna’s thesis is the increase in Bitcoin ETFs. The beinchrypto recently reported that Bitcoin ETFs in sight attracted new demand from investors on Monday. They registered net inputs of $ 591.29 million and extended their sequence of victories to seven consecutive days.

In fact, Blackrock’s Ishares Bitcoin Trust (Ibit) led the way. It registered the largest entry among its peers, attracting $ 970.93 million in one day, raising its total accumulated net inputs to $ 42.17 billion.

This increase reflects investors’ growing confidence and long -term optimism for Bitcoin in 2025. This feeling may well extend to May, giving more uptake for the price of Bitcoin.

Finally, Bitcoin is clearly detaching itself from S&P 500, which historically signaled large price increases.

Investor Arndxt noted this divergence. The benchrypto also reported a growing disconnection between Bitcoin and the Nasdaq index. Optimistic analysts interpret this as a sign that Bitcoin behaves more as an independent asset, less linked to traditional markets.

“The old mantra ‘sale in May and leaves’ does not apply the same way for crypto, liquidity pressures are decreasing, and this time, May can mark the beginning of an acceleration, not a break.” – ARNDXT PREVENTED.

Strong support for M2 correlation, positive performance in May in Bitcoin’s history, major ETFs entrances, and traditional rates detachment suggest that selling Bitcoin in May 2025 may be a serious mistake.

However, investors should remain cautious. Important Fed data, such as CPI, interest rates, and updates on commercial tensions, can still introduce uncertainty from May’s perspective.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.