Bitcoin fell below the $ 100,000 limit while the widest crypto market faces increasing volatility.

This fall coincides with a significant decline in the Bitcoin network transaction activity, bringing the volume of the Memory Pool (MEMPOOL) to its lowest level since March 2024.

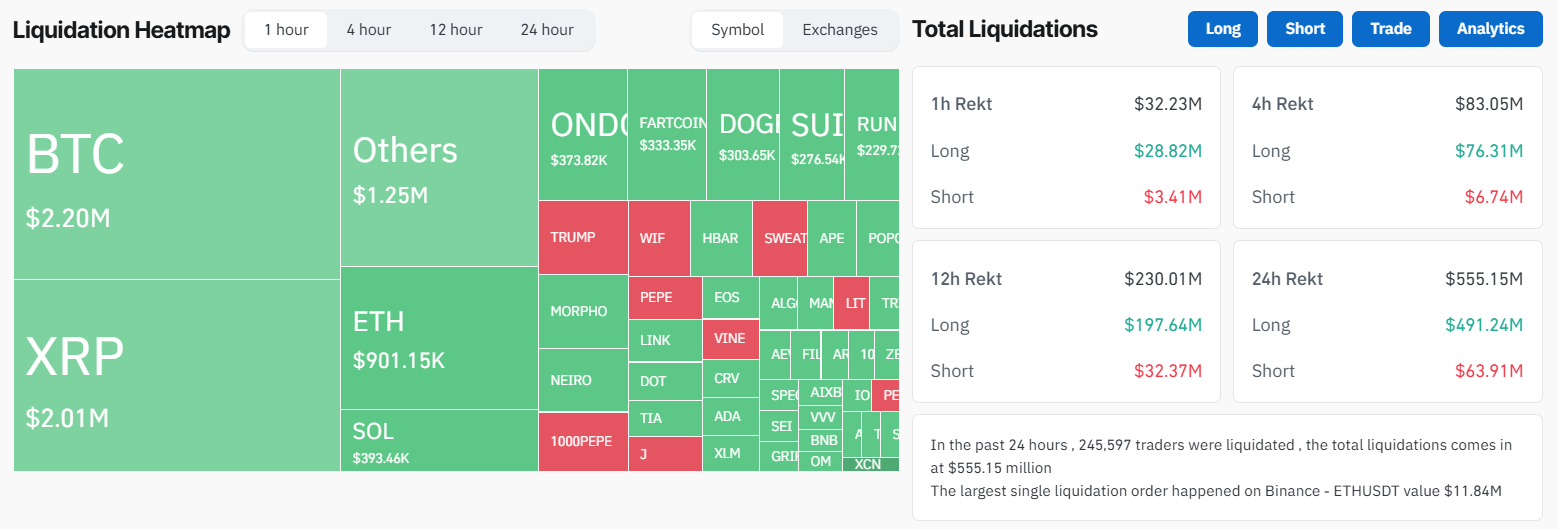

Market fall eliminates more than $ 500 million in settlements

In the last 24 hours, Bitcoin has fallen below $ 100,000, losing more than 4% of its value and briefly playing $ 98,000. Bursing data indicates that active initially reached $ 102,000 before succumbing to sales pressure.

The fall follows the instability of the broader market, with the total value of the crypto market losing 5% of its value. However, other major cryptocurrencies also faced sharp declines. Ethereum, Solana and BNB recorded losses more than 7%.

Thus, increased volatility triggered a wave of settlement, eliminating more than $ 555 million in leveraged positions, according to Coinglass. More than 239,000 traders faced forced liquidations, with long traders – those betting on price increases – sagging the highest losses, totaling $ 491 million.

Short traders, anticipating price falls, lost approximately $ 63 million.

Turbulence follows the decision of US President Donald Trump, from impose rigorous tariffs to large business partners, including Canada.

Administration states that the measure aims to contain the flow of undocumented immigrants and illicit substances to the US. However, rates have generated concerns about inflationary pressure on US consumers.

In response, Canadian Prime Minister Justin Trudeau announced retaliatory measures, imposing 25% rates on $ 106 billion on US imports.

Thus, the first round of tariffs, aiming at $ 30 billion in goods, will immediately come into force, with another $ 125 billion in scheduled rates for the coming weeks.

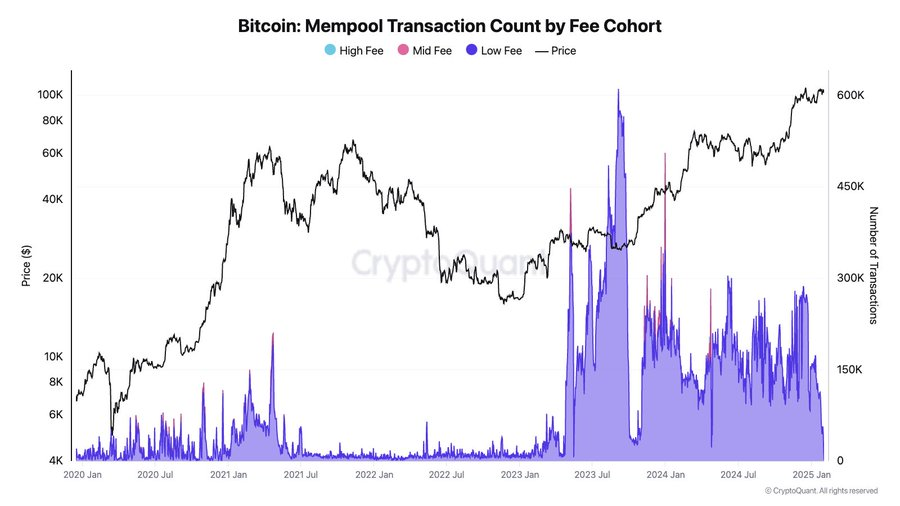

Bitcoin Network sees a sharp drop in transactions

In addition to market turbulence, Bitcoin network activity has decreased significantly, with Mempool – the waiting area for unconfirmed transactions – giving a remarkable reduction in volume.

On February 1, Cryptoquant data show that Mempool is almost empty, indicating a sharp drop in transactions. The data also reflect that Bitcoin's transaction rates fell to 1 SAT/VB, signaling a reduced block space demand.

This marks the lowest level of transaction activity since March 2024.

This trend raises concerns about using bitcoin as a means of exchange, with some analysts suggesting that the growing BTC perception as digital gold can discourage transactional use.

Bart Mol, host of Satoshi Radio Podcast, criticized the change in the narrative, stating that celebrating an empty mepool ignores the potential risks to the fundamental role of Bitcoin. He compared this to “wood rot” in the founding of a house, warning that the lack of transaction activity can undermine Bitcoin's central functionality.

Bitcoiners celebrating that Mempool has been cleaned is one of the most retarded things I saw in a while. The Digital Gold Narrative is slowly destroying the foundation of Bitcoin, as a wooden rot in the foundation of a house, mol he wrote.

In fact, Mol's comment is aligned with the growing adoption of bitcoin as a reserve asset. Several corporations and governments began to consider Bitcoin for their treasures. These narratives reinforce the token position as a long -term value reserve instead of a transactional currency.

However, continuous decline in on-chain activity raises questions about Bitcoin's long-term utility and is a digital gold reserve.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.