Jeff Park, Bitwise Asset Management’s chief of strategy, said a prolonged tariff war could have a substantial positive impact on Bitcoin over time.

Over the weekend, President Donald Trump imposed tariffs on Canada, Mexico and China.

Tariff War: Good for Bitcoin?

President Trump imposed A 25% rate on imports from Canada and Mexico. In addition, a 10% rate on Chinese products and a 10% rate on Canadian energy resources have been implemented. According to BBCCanada and Mexico also announced plans to impose retaliatory tariffs.

In a recent X -post, Park explained Triffin’s dilemma and President Trump’s personal objectives to justify Bitcoin’s long -term rise.

Tariffs can just be a temporary tool, but the permanent conclusion is that Bitcoin is not just rising, but rising faster, park he wrote.

Park has elaborated that Tiffin’s dilemma appears from the US dollar status as a world reserve currency, granting him an “exorbitant privilege.” This privilege results in three structural effects: an overvalued dollar, a persistent commercial deficit and lower loan costs for the US government.

While the US benefits from cheaper loans, they seek to correct the imbalances of an overvalued dollar and continuous commercial deficits. Therefore, Park suggests that tariffs are being used as a negotiation tactic to press for a new international agreement. This, he argues, is similar to the 1985 Plaza agreement, which aimed to weaken the dollar.

In addition, Park argues that Trump has a personal interest in this strategy. Given its great exposure to the real estate sector, its main objective is to reduce the 10 -year treasure performance.

In a weaker dollar scenario and a drop in US interest rates, US risk assets could trigger while foreign economies face increasing inflation and coin devaluation. Faced with financial instability, Park provides for global investors to seek alternative assets.

The asset to possess, therefore, is Bitcoin, noted Park.

He emphasized that as economic tensions increase, Bitcoin’s rise will accelerate.

President Trump’s fares cause collapse in the crypto market

Meanwhile, the threat of a trade war made the crypto market plummeted. In recent hours, Bitcoin has dropped briefly to a minimum of $ 91,281, while Ethereum fell to $ 2,143. This resulted in billions being eliminated from the market.

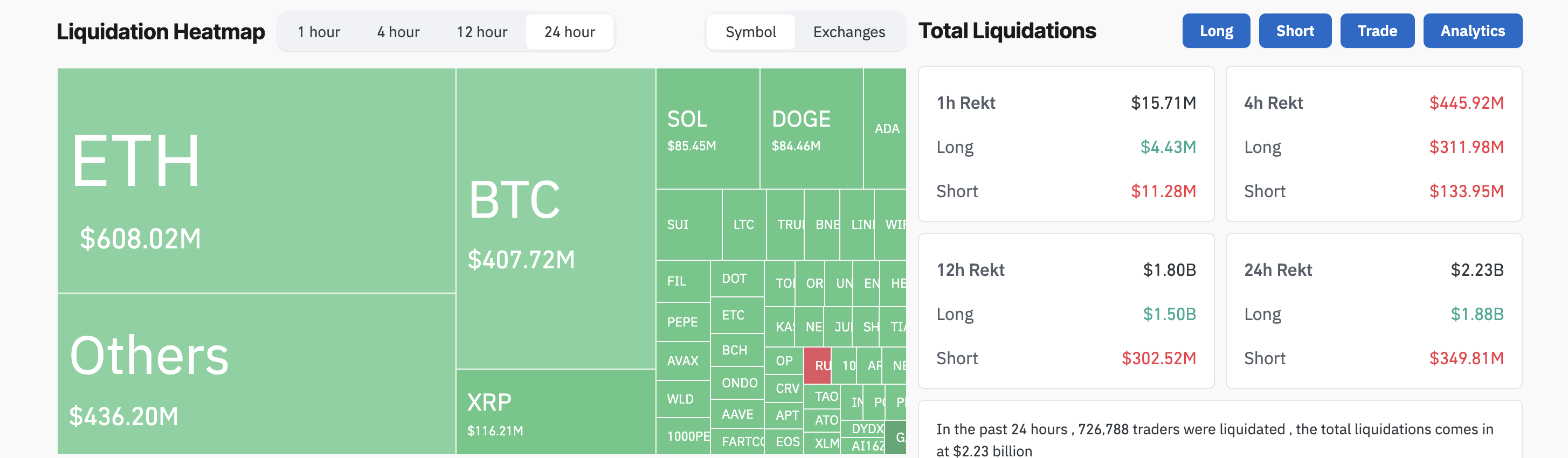

According to Coinglass, total settlements have exceeded $ 2.23 billion in the last 24 hours.

Worst History Settlement event in a single day, Crypto Analyst Miles Deutscher posted No X (former Twitter).

Deutscher added that it was worse than Luna and FTX collapses, which resulted at $ 1.6 billion in settlements.

Of total settlements, $ 1.88 billion came from long positions and $ 349.81 million short positions. In total, 726,788 traders were settled.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.