Bitcoin’s price has remained below the $ 100,000 mark since the beginning of February. Currently negotiated at US $ 97,576, the main cryptocurrency registered a 7% drop in value last week.

However, recent macroeconomic developments suggest that this trend may soon reverse.

FEED RRP drop can raise Bitcoin prices to new levels

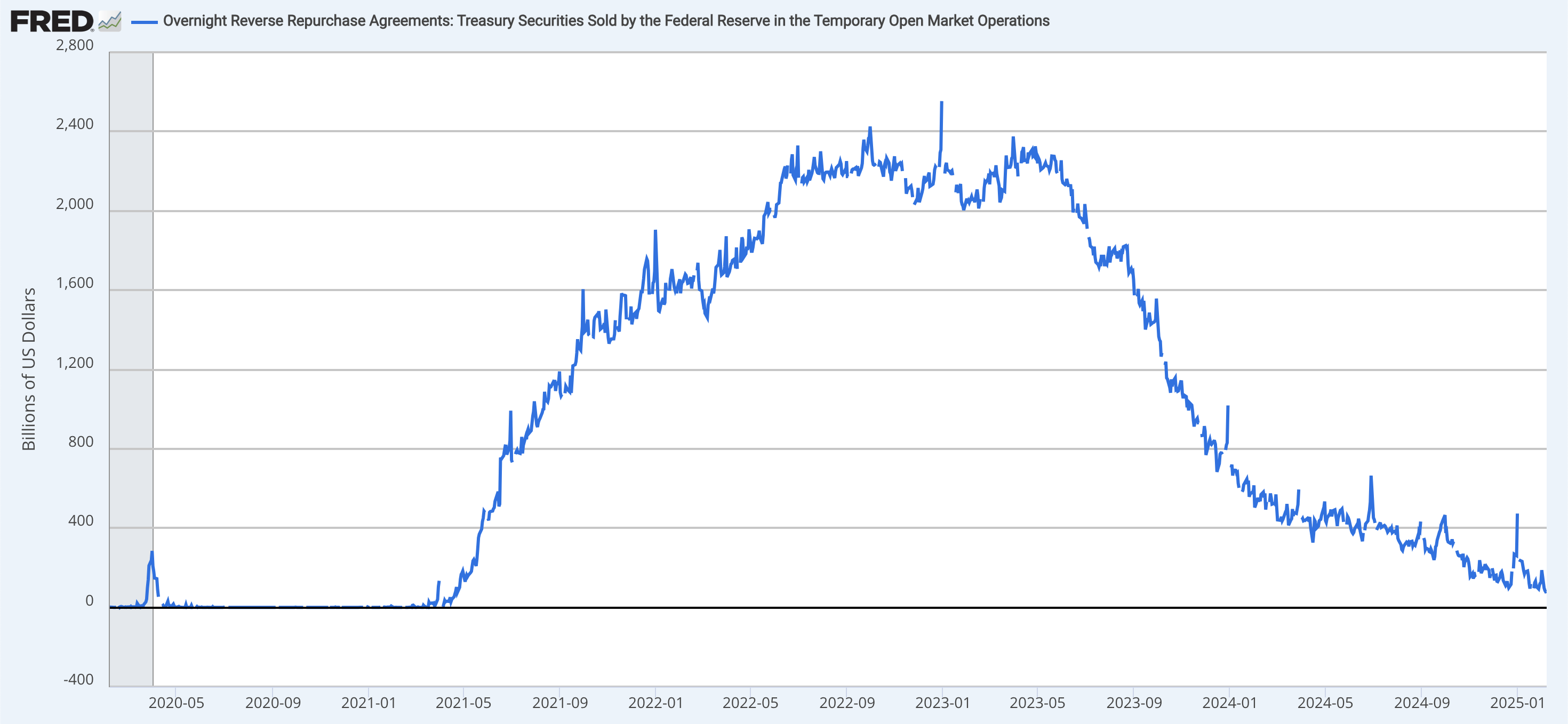

The ease of Reverse Agreement (RRP) of the Federal Reserve has reached its lowest level in 1,387 days, signaling a possible change in the direction of liquidity flow.

The federal reserve from the US uses RRP to manage short -term liquidity in the financial system. It allows financial institutions – as far as monetary market funds and banks – will be overcrowded at the Fed at night.

In return, the Fed provides these institutions of the Treasury titles. This helps the regulator to control short -term interest rates and manage circulating money in the financial system. The Fed created this method to absorb excess liquidity when there is a lot of money in the market.

When the RRP balance falls like this, traditional financial services providers are moving away from the use of the ease of the Fed for surplus liquidity storage. This means that they may be investing their money in other risky assets such as cryptocurrencies.

This can raise prices as the demand for cryptors increases due to the availability of more money in the system. With more liquidity flowing to the market, Bitcoin can benefit as institutional investors and traders seek value alternatives.

Bitcoin traders remain resolved

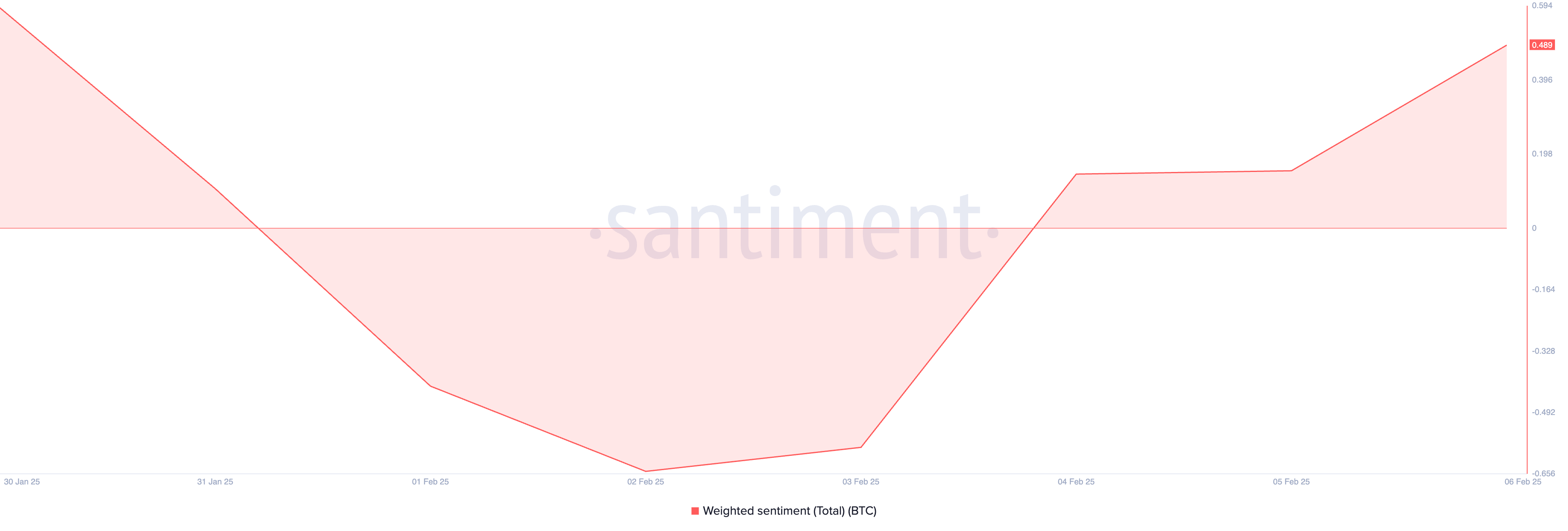

Bitcoin traders were firmly firm in their optimistic bias in relation to currency despite recent obstacles. For example, BTC’s thoughtful feeling is positive at the time of publication, signaling that the market remains optimistic about short -term price recovery.

The thoughtful feeling of an asset measures its positive or negative general bias, considering both the volume of mentions in social media and the feeling expressed in these mentions. When it is positive, it is a signal as investors are increasingly optimistic about the short -term perspective of the asset.

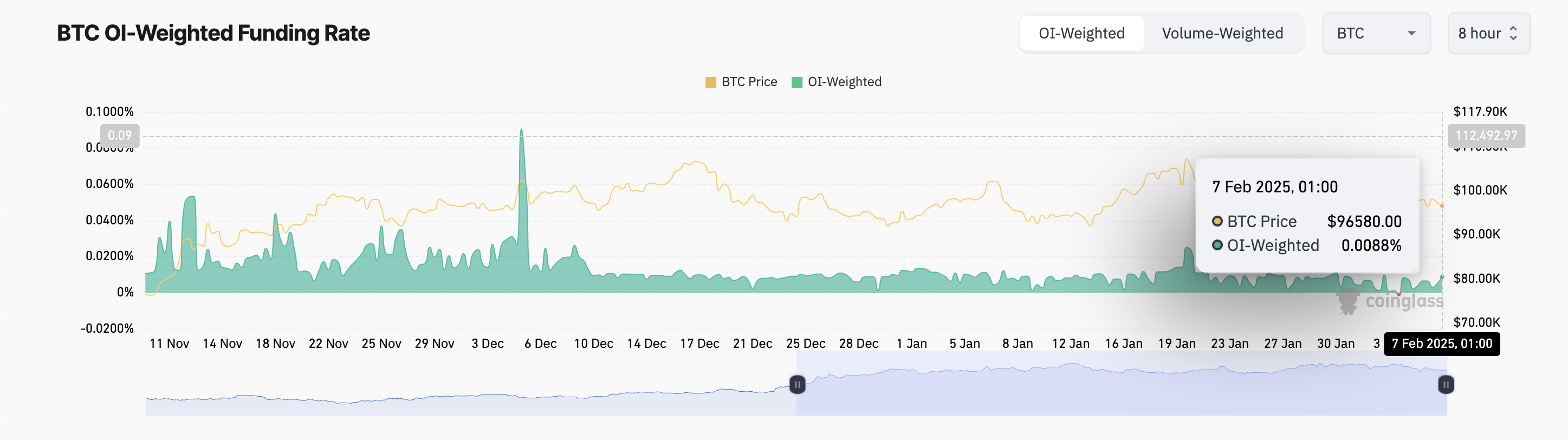

In addition, the BTC financing rate in its derivative markets is also positive, supporting this optimistic perspective. At the time of publication, it is 0.0088%.

The financing rate is a periodic payment made between traders in future markets, specifically for perpetual contracts, to ensure that the contract price is aligned with the price of the underlying asset. When it is positive, traders in long positions (purchase) pay those in short positions (sale). This indicates more demand for long positions and suggests an optimistic market feeling.

BTC price forecast: Break over $ 100,000 can trigger next high

A potential increase in liquidity flow for the crypto market would mean more capital for traders and investors to increase their participation in BTC.

If the currency sees a resurgence in demand because of this, its price may exceed the crucial resistance of $ 100,000 and try to revisit its historical record of $ 109,356.

On the other hand, if the purchase activity weakens even more, the price of Bitcoin can extend its fall and fall to $ 92,325.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.