Approximately US $ 3.12 billion in Bitcoin (BTC) and Ethereum (ETH) options today expire (07). With Bitcoin below $ 100,000 this week, will your value value of more than $ 1 billion in salaries boost the price up?

Market observers are particularly aware of this event due to their potential to influence short -term trends through the volume of contracts and their notional value. Examining PUT-TO-CALL reasons and maximum pain points can provide visions on traders expectations and possible market directions.

Visions on Bitcoin and Ethereum options that win today

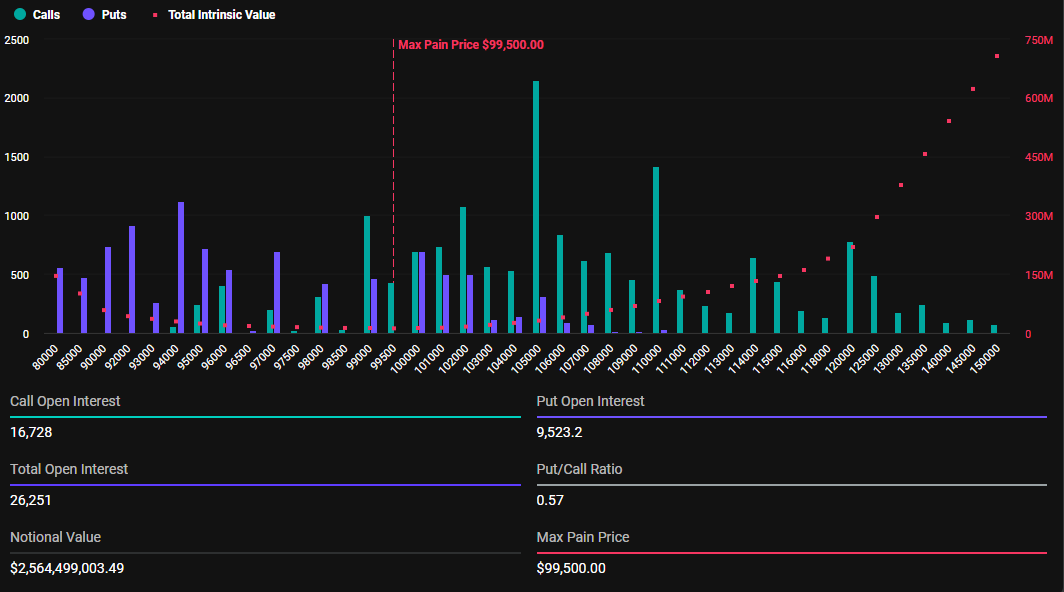

The notional value of the BTC options that expire today is $ 2.56 billion. Deribit data show that the 26,251 Bitcoin options that expire have a Put-to-Call ratio of 0.57. This reason suggests a prevalence of purchase options (Puts).

The data also reveal that the point of maximum pain for these options that expire is $ 99,500. The point of maximum pain is the price at which the asset will cause the largest number of financial losses to holders.

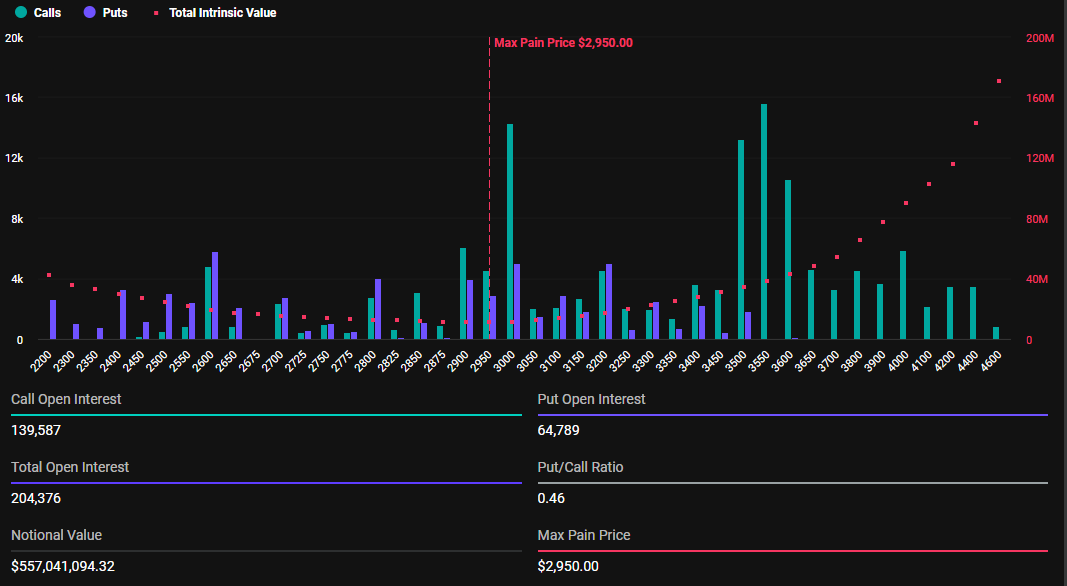

In addition to Bitcoin options, 204,376 Ethereum options contracts are scheduled to win today. These options that expire have a notional value of US $ 557.04 million, a put-to-Call ratio of 0.46 and a maximum pain point of $ 2,950.

The number of Bitcoin and Ethereum options that win today is significantly lower than last week. Beincrypto reported that the BTC options expired last week were 80,179 contracts compared to 603,426 for ETH.

This marginal difference comes from last week’s options, which represented the total of the month. Thus, the total number of options that expired exceeded $ 10 billion.

Prior to maturity, the Greeks.Live Option Trading Tool provider shared her perceptions about the market. He highlighted the predominant weak feeling this week and explained why the maximum pain levels for BTC and ETH were below $ 100,000 and $ 3,000, respectively.

Market sentiment was weaker this week, with the ETH Pain Maximus point falling below $ 3,000 again, with the currency falling to $ 2,100 at one point during the session, a new minimum since 2024, and The BTC effectively falling below the $ 100,000 mark, around which the market has been oscillated on a wide range since it exceeded $ 95,000 in late November, these a Greeks.live.

Trump effect on options

In this context, the options negotiating tool indicates the role of US President Donald Trump’s fares of influencing the feeling. Commercial policies were a key market engine this week, causing the largest settlement event on a single day in history. Traders remain cautious with potential commercial wars that can further exacerbate the feeling.

Therefore, Greeks analysts.Live attribute the current volatility to these concerns, citing expectations of more market adjustments.

The market continues to digest the effects of three months of Trump Trade, with deliveries representing 10% of the total positions this week, with purchase options falling significantly and block puts growing as a percentage of volume, analysts added.

Today’s market engines: An increase in unemployment in the United States can increase interest in Bitcoin as protection against economic instability. A fall can make investors prefer traditional markets. Strong payroll numbers can signal economic health, potentially reducing Bitcoin’s appeal as a safe haven. Weak numbers can increase the attractiveness of bitcoin as an investment in times of economic uncertainty, noted Crypto analyst Mark Cullen.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.