The crypto market is about to see $ 2.58 billion in Bitcoin and Ethereum options expire today (4), a development that can trigger short -term volatility and impact traders profitability.

Of this total, Bitcoin (BTC) options represent US $ 2.18 billion, while Ethereum (ETH) options total US $ 396.16 million.

Bitcoin and Ethereum holders prepare for volatility

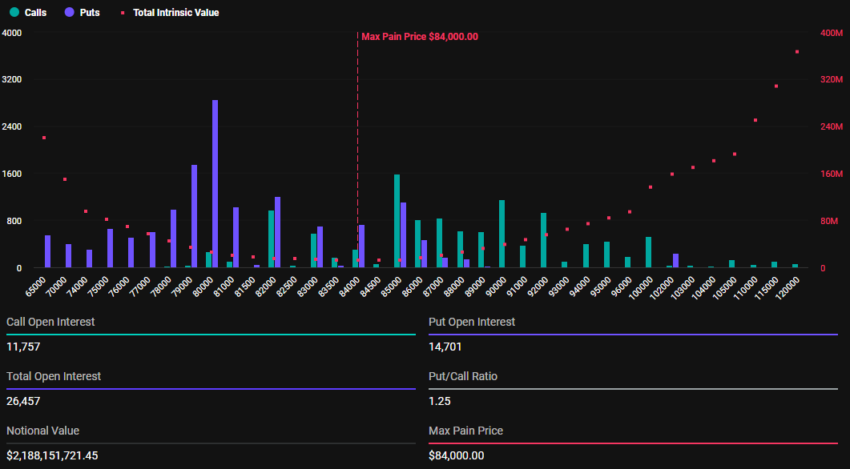

According to Deribit data, 26,457 Bitcoin options will expire today, significantly less than in the closing of the first quarter (Q1), when 139,260 BTC contracts were closed. Option contracts that win today have a PUT-TO-CALL ratio of 1.25 and a maximum pain point of $ 84,000.

Put-to-Call ratio indicates a larger volume of PUTS (sales) compared to calls, signaling a feeling of low. More traders or investors are betting or protecting themselves against a possible drop in the market.

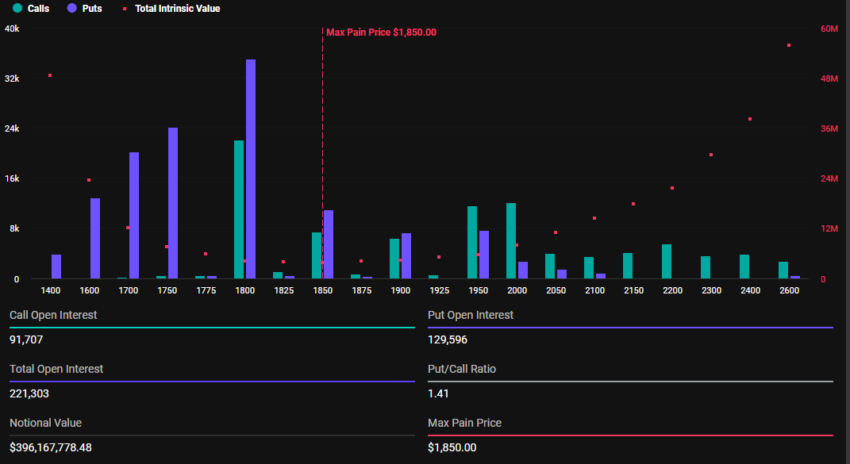

On the other hand, 221,303 Ethereum options will also expire today, a drop compared to 1,068,519 on the last Friday of March. With a PUT-TO-CALL ratio of 1.41 and a maximum pain point of $ 1,850, expirations can influence the ethi short-term price movement.

According to Beincrypto data, the BTC was being negotiated at $ 82,895 until the publication of this text, while the ETH was being exchanged for $ 1,790.

This suggests that prices can rise as intelligent money seeks to move them toward the “maximum pain” level. Based on Max Pain theory, options prices tend to go towards exercise prices where the largest number of contracts, both calls and puts, expire worthless.

Greeks.live analysts explain the current feeling of the market, highlighting a low perspective. This reinforces the reason why more traders are betting or protecting themselves against a possible drop in the market.

FEELING OF LOW DOMINATES MARKETS

In an X (former Twitter) post, Greeks.Live reported a predominantly low feeling in the options market. This follows the announcement of US President Donald Trump’s rates.

Beincrypto reported that the new rates were an overall rate of 10% and 25% on cars. Although this has been short of market expectations, it was still perceived as a negative development, generating widespread concern among traders.

According to analysts, the flow of options reflected this pessimism, with the heavy purchase of puts dominating the negotiations.

Trump fares are seen as a serious commercial interruption… The positive initial reaction of the market with a price peak to $ 88 was seen as a short bet/coverage, followed by a sharp reversal as the reality of economic impacts has been established. The flow of options remains strongly low, with traders watching a significant purchase of puts, including 700 puts of 79,000 to the end of April, wrote Greeks.live analysts.

Traders acquiring 700 puts of $ 79,000 to the end of April signal expectations of a sustained fall. According to analysts, the consensus among traders points to continuous volatility, with a possible “bad closure” below $ 83,000 today (4). Such action would erase the previous increase completely.

Meanwhile, many traders are adopting low strategies, favoring short calls or puts calendars. Calls’s discovered sale is considered the most effective approach in the current climate.

Therefore, while the initial reaction of the market to Trump’s fares was a mixture of hope and reality, reversal reflects the broader economic impact of the US President’s policies. As traders are preparing for unstable conditions, the outlook for low in options negotiations paints a cautious picture for the next few days.

Global supply chain interruptions and economic uncertainty remain at the forefront of market concerns.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.